Separate market share figures released today indicate that Tesco’s longstanding dominance in the UK grocery sector could come to an end if the proposed Sainsbury’s-Asda merger were to be approved.

According to Kantar Worldpanel’s data covering the 12 weeks to April 22, Sainsbury’s and Asda have a market share stands at 15.9 per cent and 15.5 per cent respectively, giving the proposed combined entity a potential share of 31.4 per cent and outstripping Tesco’s current market share of 27.6 per cent.

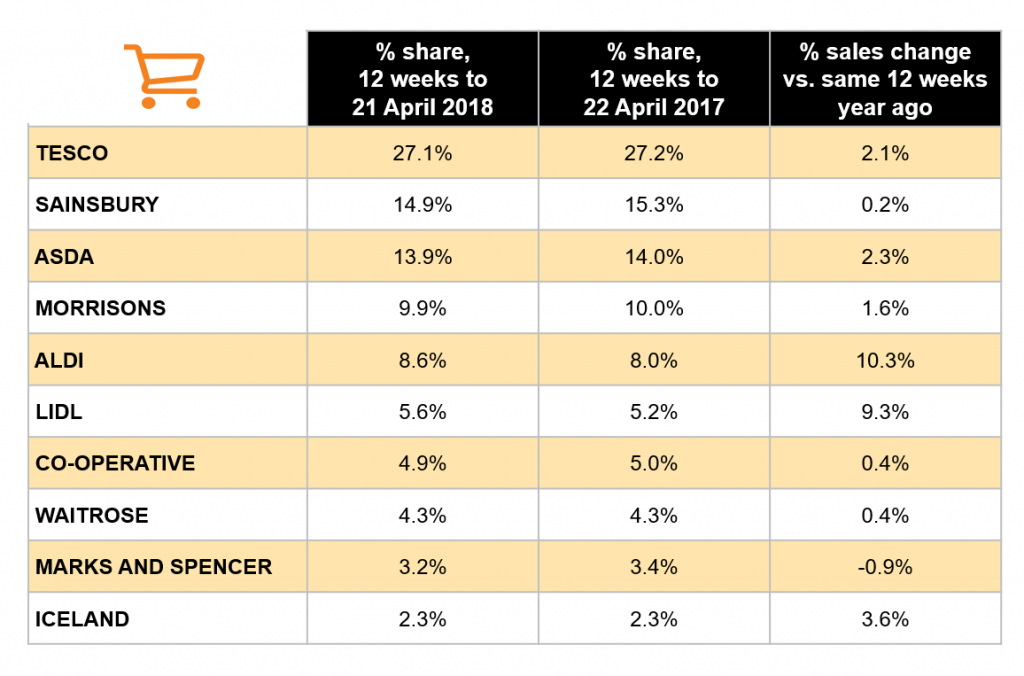

Meanwhile, Nielsen’s data for the 12 week period ending April 21 shows that Sainsbury’s and Asda have a market share of 14.9 per cent and 13.9 per cent respectively.

This means the new combined business entity would have a potential share of 28.8 per cent, overtaking Tesco’s current market share of 27.1 per cent.

Kantar’s figures indicate that Sainsbury’s sales have grown by 0.2 per cent while Asda’s sales rose by 1.4 per cent.

However, Sainsbury’s and Asda both dropped market share compared to this time last year – down 0.3 percentage points and 0.1 percentage points respectively.

READ MORE:

Head of retail and consumer insight Fraser McKevitt said the proposed merger was a “pivotal moment” for the British grocer sector, especially when Sainsbury’s and Asda’s different customer bases are taken into account.

“A merger between Sainsbury’s and Asda would transform the traditional landscape placing nearly a third of market share in the hands of the joint supermarket giant, though the march of the discounters – and any enforced store closures – could impact this figure,” he said.

Neilsen UK’s head of retailer insight Mike Watkins added: “Both retailers have over half of all households as shoppers every 12 weeks, while over three-quarters also visit Tesco.

“This illustrates how competitive the retail landscape is, which is why we’re seeing further consolidation within the industry.”

Overall, Kantar Worldpanel’s figures showed that British grocery sales grew two per cent due to lower price rises, but this is slowest rate of growth since March 2017.

Like-for-like inflation stood at 2.1 per cent and it is expected to fall further in the coming months.

Of the Big 4 grocers, Kantar found Morrisons to be the fastest-growing, with sales growth of 2.1 per cent and holding market share at 10.5 per cent.

Meanwhile, for the 12th consecutive period Tesco grew by more than two per cent – the first time the retailer has achieved this since March 2011.

However, with sales surging by 9.1 per cent Lidl was still the UK’s fastest-growing bricks-and-mortar supermarket. It also upped its market share by 0.4 percentage points year-on-year to 5.4 per cent.

Aldi also continued to experience strong sales growth – up 7.7 per cent – increasing its market share by 0.4 percentage points year-on-year to 7.3 per cent.

Sales at both Iceland and Waitrose rose by 0.2 per cent. Iceland continues to hold market share at 2.1 per cent, while Waitrose dropped share by 0.1 percentage points on last year to 5.1 per cent.

With the disposal of 300 McColl’s stores still impacting headline performance, Co-op saw sales fall by 0.4 per cent as its market share fell by 0.1 percentage points to six per cent.

Finally, online-only grocer Ocado recorded a 12.7 per cent jump in sales, helping it increase market share by 0.1 percentage points to 1.2 per cent.

Mirroring Kantar’s data, Nielsen also found that in the four weeks ending April 21, sales in the UK grocery sector rose by 1.2 per cent year-on-year – the lowest rise since January 2017.

It attributed the stalled performance to unpredictable weather disrupting grocery spend.

“A significant change in the weather can give supermarket sales as big a boost as an important event such as Easter, which is what happened in the week ending 21 April this year,” Nielsen UK’s head of retailer insight Mike Watkins said.

“The three days of hot weather helped sales jump 11 per cent year-on-year.

“However, this wasn’t enough to offset the previous three weeks of poor weather.”

Nielsen also found that Asda’s sales momentum continued during the 12-week period ending April 21.

It said it had the most improved year-on-year performance of the Big 4 grocers, with sales up 2.3 per cent.

Meanwhile, Sainsbury’s sales grew 0.2 per cent year-on-year, while Tesco’s grew 2.1 per cent.

Overall, Iceland had the best growth figures outside of discounters, growing up 3.6 per cent, and Aldi’s year-on-year growth of 10.3 per cent again edged ahead of Lidl’s increase of 9.3 per cent.

Click here to sign up to Retail Gazette‘s free daily email newsletter