Two separate grocery market share data have shown that British supermarkets continued to record soaring sales, spurred on by festivities such as Valentine’s Day and Chinese New Year.

According to the latest figures from Kantar Worldpanel, published today for the 12 weeks to February 25, grocery sales increased in value by 3.2 per cent compared to the same time last year – marking the 12th consecutive period that total sales exceeded three per cent.

READ MORE:

“The grocery market remains in good health, spurred on by February festivities such as Valentine’s Day and Chinese New Year, which lend themselves to a focus on ready meals,” Kantar Worldpanel head of retail Fraser McKevitt said.

“Over the month, sales of chilled ready meals which form part of a meal deal jumped by 26 per cent as retailers offered customers the opportunity to wine and dine at home without the fuss, while Chinese ready meals also rose by more than a quarter.”

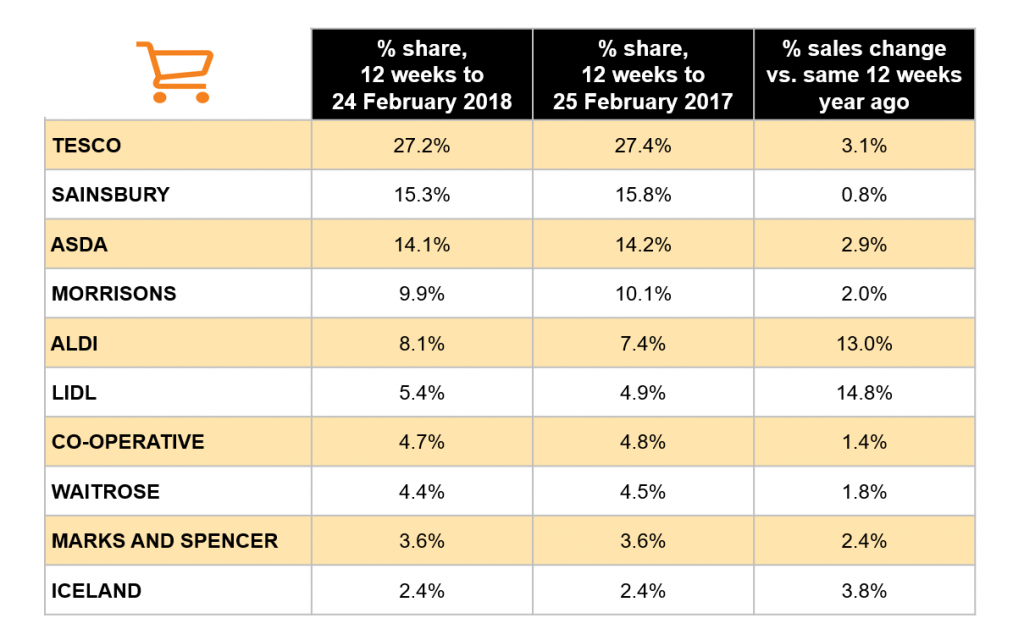

While each of the Big 4 retailers enjoyed positive growth, Tesco and Morrisons were jointly the fastest growing of the group – both clocking in sales growth of 2.7 per cent.

Morrisons’ market share remained steady year-on-year at 10.6 per cent but Tesco’s market share dipped slightly by 0.1 percentage points to 27.9 per cent.

However, Tesco’s dominance of the UK grocery industry was still well and truly alive as its nearest rival, Sainsbury’s, recorded a 0.3 percentage points drop in its market share to 16.2 per cent.

Meanwhile, Asda had a 0.1 percentage point drop in its market share to 15.6 per cent.

Aldi and Lidl once again battled to be crowned the UK’s fastest-growing supermarket, with the former pipping the latter to the post this month as sales grew by 13.9 per cent and 13.3 per cent respectively.

With both discounters working hard to expand their store portfolio, Aldi and Lidl also benefited from increased shopper numbers as well as growth in basket size.

Aldi’s market share now stands at seven per cent, up from 6.4 per cent the same time last year, while Lidl’s market share grew from 4.6 per cent to 5.1 per cent.

Co-op returned to growth for the first time since July 2017 with sales up 0.4 per cent, after a period of decline following the retailer’s sale of nearly 300 stores to McColl’s.

However, its market share dropped slightly year-on-year from six per cent to 5.8 per cent.

Iceland held share steady at 2.2 per cent compared to this time last year, but increased sales by 1.3 per cent.

There were no signs of a slowdown for Waitrose, which has enjoyed uninterrupted sales growth since March 2009.

Latest figures showed sales growth of 2.3 per cent while its market share dipped from 5.3 per cent to 5.2 per cent.

Finally, online grocer Ocado increased market share by 0.1 percentage points to 1.2 per cent, while its sales surged 10.7 per cent.

Meanwhile, according to Nielsen retail data also released today, the volume of groceries sold at the UK’s leading supermarkets rose by its highest year-on-year rate for 18 months.

Shoppers bought eight per cent more groceries during the four weeks ending February 24 compared to the same period last year.

The last time year-on-year volumes rose by more – excluding seasonality-affected periods – was 1.4 per cent in August 2016.

Year-on-year sales increased at the supermarkets by 1.8 per cent, or 2.9 per cent including the discounters.

The corresponding figures in the previous four-week period were 2.7 per cent and 4.2 per cent respectively.

“In contrast to non-food retailers, which are seeing weaker consumer demand than a year ago, grocery retailing continues to look positive,” Nielsen UK head of retailer insight Mike Watkins said.

“Much of the credit goes to the grocery retailers who’ve displayed a great balancing act at not passing on too much of the increased supply chain costs to the end shopper.

“As a result, consumers in general don’t feel the need to hold back on grocery shopping.”

Over the 12 weeks ending February 24, Tesco had the most improved year-on-year performance among the Big 4, with sales up 3.1 per cent, followed by Asda with 2.9 per cent growth.

Overall, Iceland, which recorded 3.8 per cent growth, had the best growth figures outside of the discounters.

“Good news continues for the ‘Big 4’: Tesco and Asda are still attracting more shoppers, Morrisons growth was good – even against a good performance last year – and whilst Sainsbury has the lowest growth, visits and spend per visit are increasing.”

Click here to sign up to Retail Gazette‘s free daily email newsletter