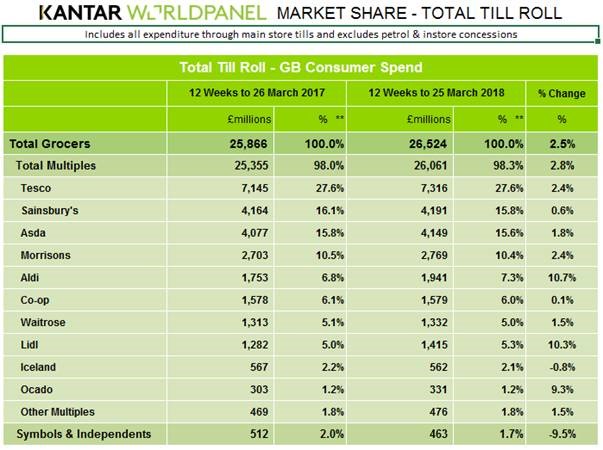

New figures have shown that Lidl has now overtaken Waitrose to become the UK’s seventh-biggest grocer in terms of market share, amid an overall increase in grocery sales despite adverse weather conditions.

According to Kantar Worldpanel’s grocery market share figures from for the 12 weeks to March 25, Lidl clocked in year-on-year sales growth of 10.3 per cent.

This allowed the German discounter to reach a 5.3 per cent share of the sector – compared to five per cent this time last year.

READ MORE:

Waitrose also experienced sales growth – up 1.5 per cent year-on-year – but its market share fell by 0.1 percentage points to five per cent, hence its drop in the grocery market share rankings.

Of the Big 4 retailers, Tesco experienced a sales increase of 2.4 per cent to hold market share steady at 27.6 per cent – the first time it has held share since December 2016.

Morrisons also saw sales increase by 2.4 per cent with a resulting market share of 10.4 per cent.

Meanwhile, Asda’s market share fell back by 0.2 percentage points to 15.6 per cent despite sales growth of 1.8 per cent and Sainsbury’s market share fell 0.3 percentage points to 15.8 per cent despite sales growth of 0.6 per cent.

Growing sales by 10.7 per cent, Aldi increased market share by 0.5 percentage points to reach a 7.3 per cent share of the market to retain its crown as the 5th biggest grocer in the UK.

Co-op saw sales increase by 0.1 per cent, with its market share dropping 0.1 percentage point to six per cent.

After two years of continuous growth, Iceland saw sales fall by 0.8 per cent and dropped market share to 2.1 per cent.

Finally, Ocado outperformed the overall online grocery market with sales growth of 9.3 per cent, to hold market share at 1.2 per cent.

Kantar’s figures also show that grocery sales increased in value by 2.5 per cent compared to this time last year despite heavy snow across the country in the early part of the month.

“The Beast from the East played havoc with consumers’ usual shopping plans,” Kantar Worldpanel head of retail insight Fraser McKevitt said.

“In the run up to and during the cold snap, shoppers stockpiled groceries buying four per cent more items than normal, increasing the average value of a trip from £14.99 to £15.80.

“However, they simultaneously visited stores five per cent less often as they stayed wrapped up at home, meaning overall lost sales from the storm were minimised to £22 million.

“Warming foods and drinks were the go-to items for customers after braving the snowy weather – sales of hot beverages and tinned soup grew by 8.4 per cent and 27.5 per cent respectively over the past month.”

An earlier-than-usual Easter this year also motivated shoppers into starting their Easter weekend shopping during the month of March.

“Despite average prices jumping by 35p to £1.83, Easter eggs were rolling off the shelf in March with sales up 69 per cent compared to this time last year,” McKevitt said.

“Almost 15 million shoppers picked up Easter eggs last month while the average household, tempted by promotional offers, was swayed into buying at least two Easter eggs to meet their seasonal chocolate fix.

“Hot cross buns also saw a steep rise, with sales up £7.7 million compared to this time last year.”

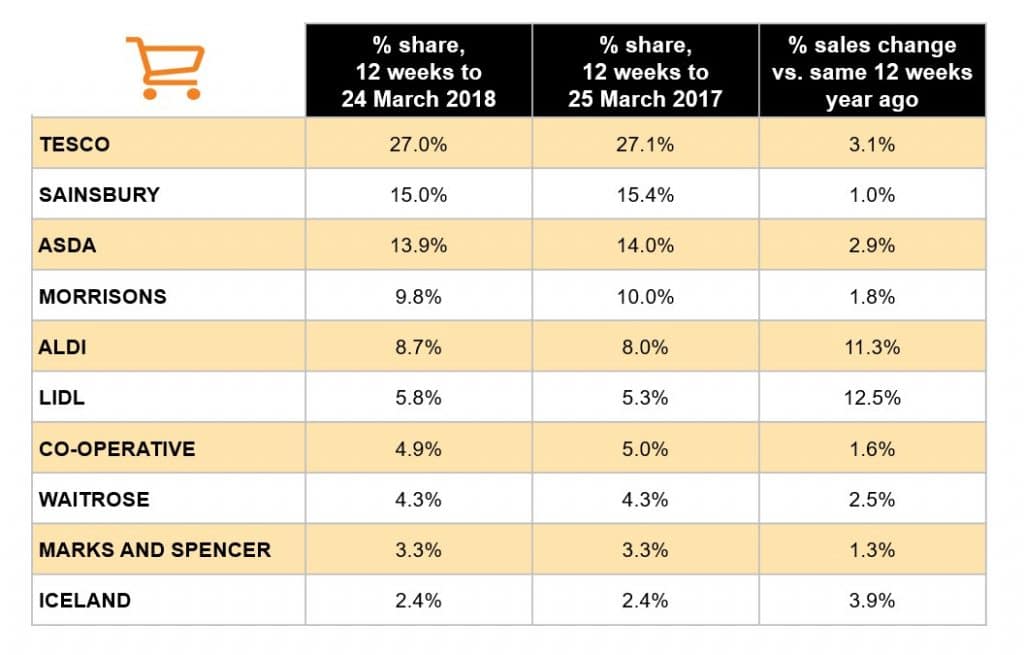

Separate grocery sales data from Nielsen, also released today and covering the four week period ending March 24, also showed that slowing price inflation and the adverse weather failed to derail the strong growth rates seen across the UK’s leading supermarkets.

Even though the bad weather meant the number of visits to grocery stores fell during the four week period, the amount of items shoppers bought rose by 0.4 per cent year-on-year – the second highest rise since 2016.

As a result, and combined with inflation, shoppers spent 3.3 per cent more on groceries compared to the same period last year.

“The winter weather in late February and early March certainly disrupted shopping patterns but not enough to knock food retail out of its stride because its underlying health remains strong,” Nielsen UK head of retailer insight Mike Watkins said.

“This is built on the big four supermarkets having adapted well to changing market conditions and consumer behaviour, and the sector has effectively seen 13 straight months of growth above two per cent.

“This is in stark contrast to non-food retail who are still adapting to their changing marketplace.”

Watkins added that even though grocery sales in the week of the storms fell one per cent, “they rallied by a massive 12 per cent the week after – helped by Mother’s Day – as shoppers returned to the high street.”

Meanwhile, Nielsen’s grocery market share data for the 12 week period ending March 24 showed that Tesco had the most improved year-on-year performance among the Big 4 grocers, with sales up 3.1 per cent.

This marked its fifth consecutive period of growth above three per cent.

In contrast to Kantar’s data, Nielsen found that Iceland had the best growth figures outside of the discounters, growing 3.9 per cent.

On the other hand, M&S sales slowed down to 1.3 per cent growth due to fewer store openings than a year ago.

Click here to sign up to Retail Gazette‘s free daily email newsletter