// December online retail sales slows down to 3.6% growth

// Marks lowest-ever monthly growth rate

// Second half sales also slowed down to 8.4% growth compared to 16% in first half

// 2018 online sales grew 11.8%, compared to 12.1% in 2017 but still above 9% forecast

A tough Christmas saw the UK online retail sector record the lowest-ever monthly sales growth in December, capping off what was a turbulent year.

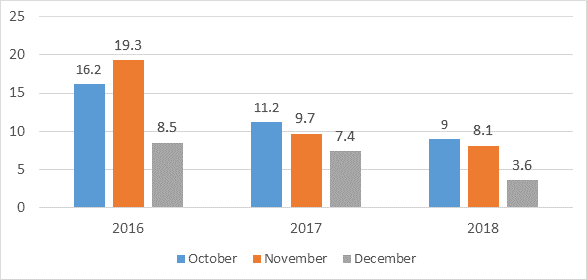

According to the latest eRetail Sales Index from Capgemini and IMRG, online retail sales growth hit an all-time low of just 3.6 per cent year-on-year (YoY) in December, as a tough Christmas trading period ended challenging second half of the year.

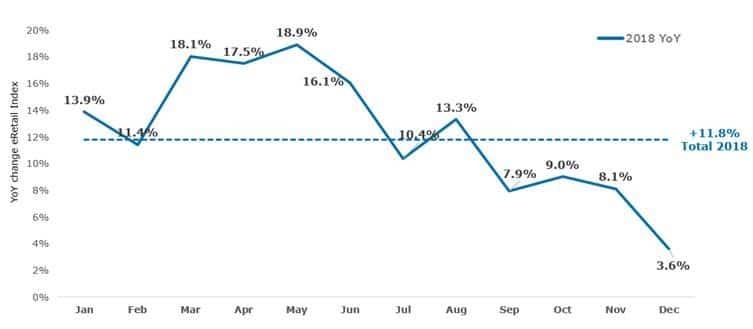

After online retail defied the downturn on the high street to record 16 per cent year-on-year growth in the first six months of the year – boosted by external factors such as the Beast from the East, the World Cup and the Royal wedding – the second half saw a dramatic slowdown, with 8.4 per cent year-on-year growth for that period.

Factoring in the contrasting performances in each half, UK online retail sales grew 11.8 per cent on a full-year basis.

Although the annual sales growth is a slight slowdown on 2017’s annual growth of 12.1 per cent, it is still well above the eRetail Sales Index’s start-of-the-year forecast of nine per cent.

However, IMRG and Capgemini said the poor performance across the second half of 2018 – especially during December – was evidence of low consumer confidence in the current economic climate.

Additionally, December’s growth rate of 3.6 per cent fell below the final quarter’s growth of 6.8 per cent and below the second half and full-year growth rates, and contributed to a declining quarterly trend.

December’s all-time low growth rate also follows the worst growth since 2011 for the month of November, when online retail sales grew 8.1 per cent year-on-year, thanks to an “underwhelming” Black Friday and extended discounting periods that did nothing to rejuvenate consumer spending.

On a month-on-month basis, December online sales plunged 15 per cent compared to November.

This marked a bigger decrease than the 11 per cent month-on-month decrease witnessed last year.

READ MORE:

- December retail sales up 3.7% despite month-on-month dip (ONS)

- Footfall dwindles for 13th straight month in December (BRC-Springboard)

- Retail endures worst Christmas trading since 2008 (BRC-KPMG)

- December consumer confidence slips to 5-year low (GfK)

- December high street sales fail to impress (BDO)

- Last-minute shopping brings Christmas cheer for UK retailers (Ipsos)

- December inflation drops to lowest level in two years (ONS)

- December shop prices rise despite festive discounting (BRC-Nielsen)

- Grocers rake in record £29.3bn Christmas sales

Product category results also echoed this poor performance, with gifts experiencing a 31.1 per cent year-on-year decrease compared to last year, and electricals down by 21.7 per cent year-o-year – a record low for this category.

As a reflection of the continuing uncertainty, Capgemini and IMRG have forecast that online retail growth will fall to nine per cent year-on-year for 2019 as a whole.

“The first half of 2018 was actually very strong for online retailers – it resisted and arguably benefitted from the tough climate that impacted trade for store retail,” IMRG insight director Andy Mulcahy said.

“It is only the second half of the year where the suppressed confidence and spend, evident in so many other sectors, has spread to online retail.

The macro-economic situation must be exerting pressure here, particularly with Brexit now entering its crunch period in Q1 2019.”

He added: “If there had not been so much uncertainty and shopper confidence had not been so negatively impacted toward the end of the year, it seems a reasonable bet that online retail sales growth could have been much stronger than 11.8 per cent for 2018.

“If Brexit can be resolved so that a course, whatever that may be, is agreed and pursued, it may help to build shopper confidence again with online likely to be the main beneficiary from a retail perspective.

“However, if 2019 proves to be a year of continuing uncertainty, with repeated delays and political instability causing market disruption, it may prove to be a tough year for many businesses to navigate – as we found out in late 2018, online is not immune from that.”

Capgemini principal consultant Bhavesh Unadkat said there was “a clear correlation” between consumer confidence and online retail sales throughout the year.

“Conversion rates were actually high in December despite the poor performance, however the lower order value indicates that consumers were tightening the purse strings by taking advantage of promotions rather than purchasing more,” he said.

“This allowed discounters to take the share in the final month of the year.

“Retailers will need to think carefully on how to manage pricing strategies to protect share of the wallet in potentially quite uncertain times, and the evolution of the peak events will undoubtably be a focus of next year.”

The eRetail Sales Index tracks online sales that IMRG and Capgemini defines as “transactions completed fully, including payment, via interactive channels” from any location, including in-store.

Click here to sign up to Retail Gazette‘s free daily email newsletter