// Major shopping centres dominate areas of high taxation costs outside London despite falling values

// Average rateable values for business rates at shopping centres can be as high as £3500 per square metre

Major shopping centres dominate areas of high taxation costs outside London despite falling values, new research as found.

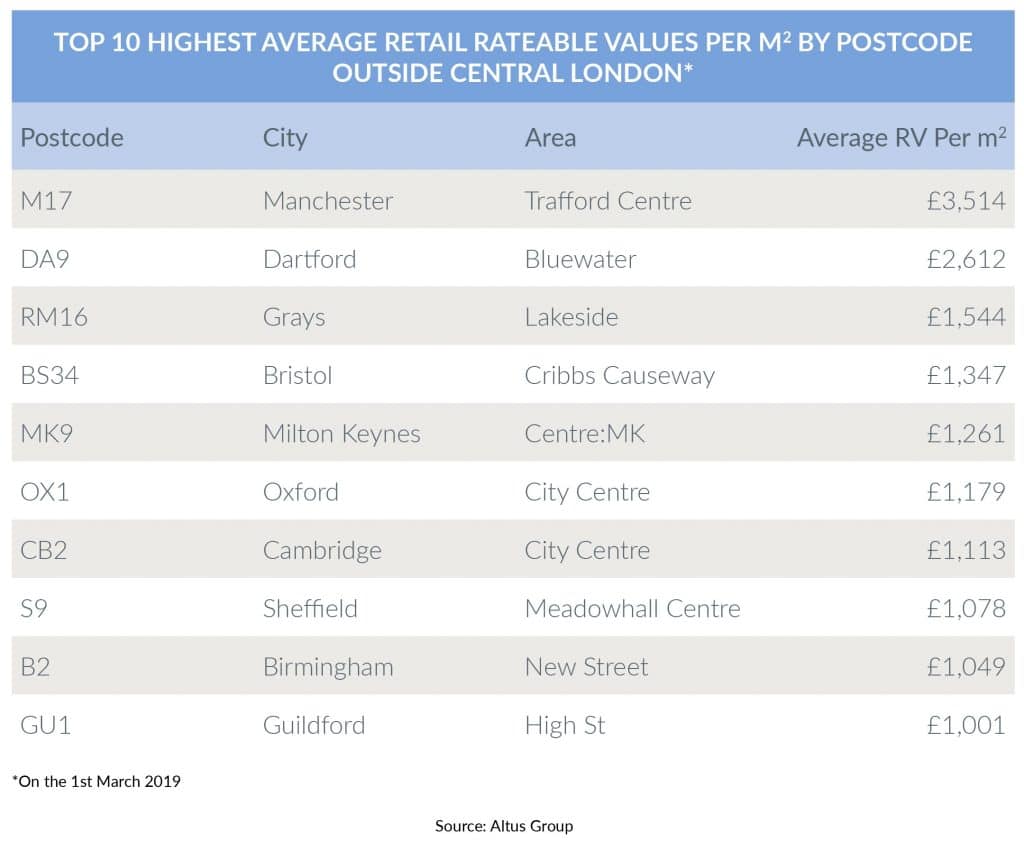

According to real estate advisory firm Altus Group’s annual business rates review, despite a fall in shopping centre values thanks to an increasing number of CVAs, the average rateable values for business rates at shopping centres can be as high as £3500 per square metre.

READ MORE:

CVAs have become popular with retailers to not only close unprofitable stores hit by increasing cost pressures but to also seek rent reductions.

Just this week, Landsec revealed it had written down the value of its UK shopping centres by 11.7 per cent last year as rental income declined.

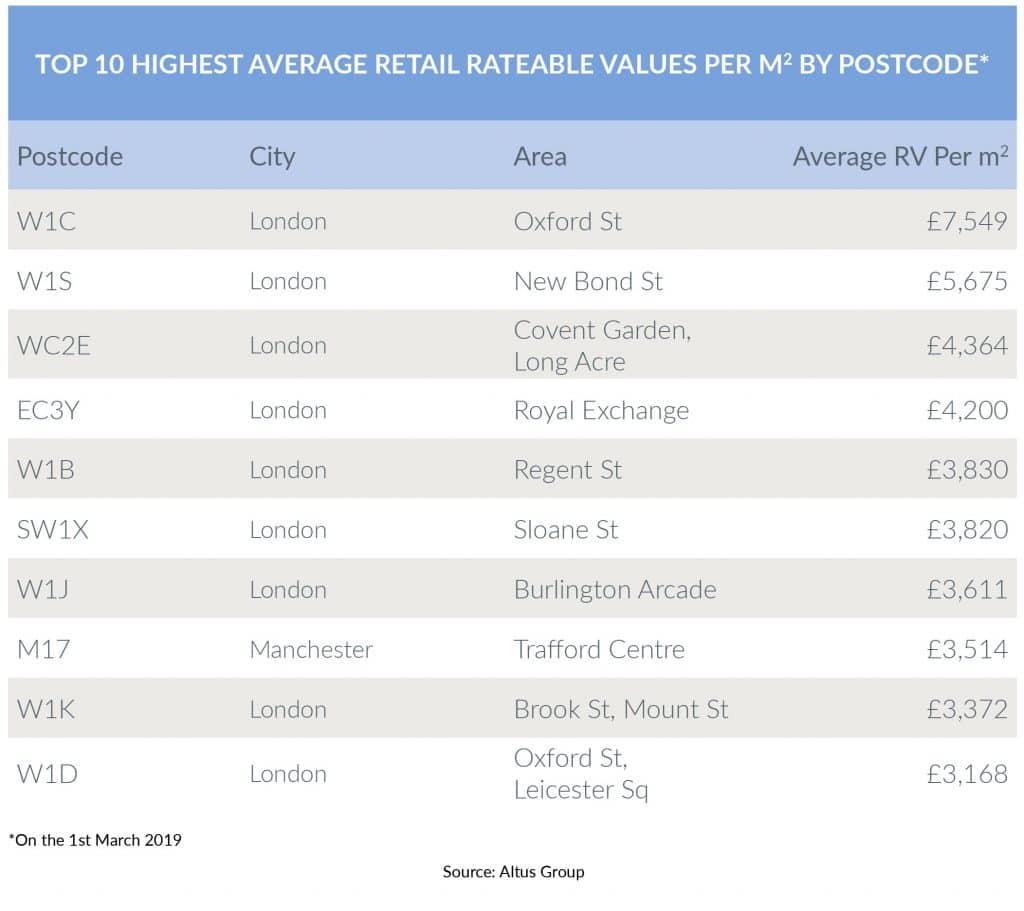

The average business rates bill in England and Wales is based upon an average rateable value of £269 per square metre, with that cost being 28 times higher on London’s Oxford Street, according to Altus Group.

Altus Group added that the average annual rental value per square metre for a shop on the open market on April 1 forms the basis of business rate tax liabilities until March 31, 2021.

The firm highlighted that nine out of the 10 most expensive retail post codes by rateable value are located in London.

The highest average rateable value of £7549 per square metre is the W1C postcode area which incorporates Oxford Street, with the second highest of £5675 per square metre for the W1S postcode, which includes New Bond Street.

At a rate of £3514 per square metre, the area is home to the Trafford Centre.

Outside Central London, higher costs per square metre are dominated by postcodes which house other major shopping centres.

The DA9 postcode includes Bluewater, RM16 has Lakeside, BS34 has Cribbs Causeway and MK9 is the home of Centre:MK.

They will be based upon an estimate by the Valuation Office Agency of the property’s open market rental value on 1st April 2019, the antecedent valuation date.

Altus Group head of business rates Robert Hayton said landlords were having to share a “disproportionate burden of the high street pain”.

He added: “Commensurate tax reductions by virtue of what is happening in the retail rents market generally will only come into effect in two years time at the next revaluation and even then such reductions are likely to be gradually phased in without a change in approach by government.”

Click here to sign up to Retail Gazette‘s free daily email newsletter