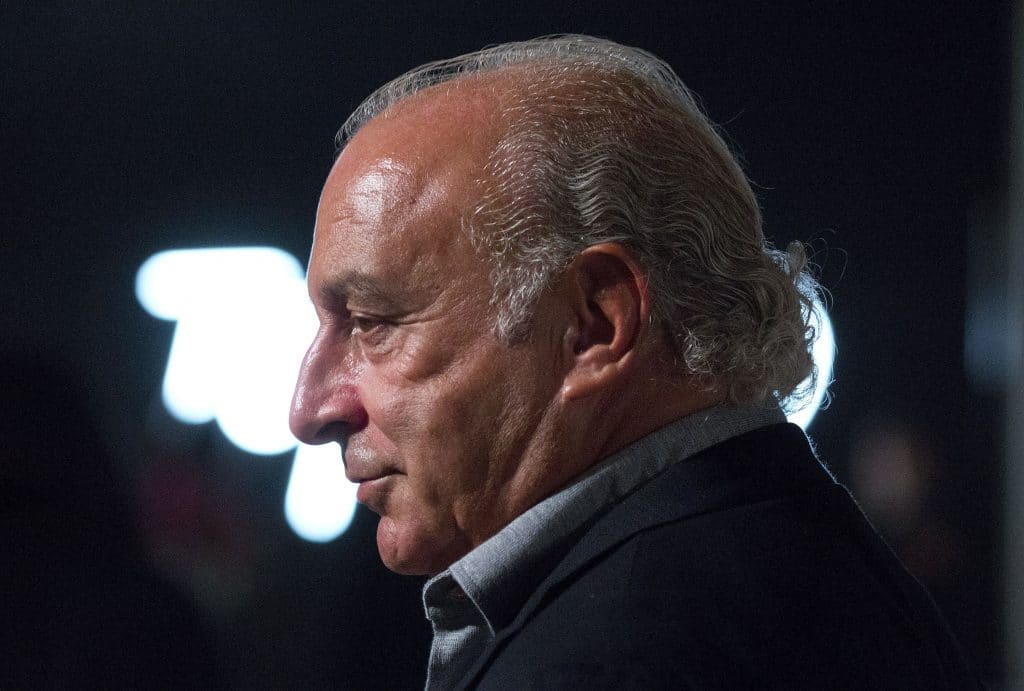

// Sir Philip Green charged with misdemeanour assault for “touching pilates teacher” in the US

// The Arcadia Group tycoon “strenuously denies” the four charges brought against him

// Charges come just days before Arcadia is due to meet creditors to vote on a CVA proposal

Arcadia Group owner Sir Philip Green has been charged with four counts of misdemeanour assault in the US over the weekend.

The charges followed allegations from a fitness instructor in Arizona who said Green repeatedly touched her inappropriately, according to BBC News.

READ MORE:

- Pensions Regulator demands contribution top up from Sir Philip Green

- Sir Philip Green reveals £135m revamp plans for Arcadia

- Sir Philip Green offers additional £185m to plug Arcadia pension deficit

- 520 jobs at risk as Arcadia confirms 23 store closures in CVA

- Sir Philip Green faces calls for police inquiry & having knighthood stripped

The incidents allegedly occurred at the Canyon Ranch resort in Tucson in 2016 and 2018.

Green has “strenuously” denied the accusations.

Pima County Attorney’s Office said each count carries a potential sentence of up to 30 days in jail and Green could be fined up to $500 (£400) as well as face year of probation on each count.

In a statement, Arcadia said: “Sir Philip strenuously denies these allegations and is disappointed that the charges have been filed in his absence and they are minor categories of misdemeanour in the US.

“Contrary to previous suggestions in the media there is no allegation of any sexual assault or misconduct made by the prosecution.”

A court hearing has been set for June 19.

Arcadia said Green would be represented by his lawyer in court as he was not required to attend personally.

The news comes just days before Arcadia is due to meet creditors for a crunch vote on CVA proposals.

The CVA includes plans to shut 23 stores, resulting in 520 job cuts, as well as rent reductions on 194 additional stores across Arcadia’s UK and Irish operations.

The firm’s 11 Topman and Topshop stores in the US are also set to either close down or be sold off.

Another 25 stores under the Evans and Miss Selfridge fascias will shut down as part of separate insolvency proceedings, including the flagship Miss Selfridge store on Oxford Street.

Arcadia directors will meet creditors – which includes The Pensions Regulator, the Pension Protection Fund and landlords – on June 5 to seek approval for its CVA proposals.

The CVA will only go ahead if at least 75 per cent of creditors vote in favour of it.

The CVA has already been met with obstacles from landlords, The Pensions Regulator and Pension Protection Fund.

Click here to sign up to Retail Gazette‘s free daily email newsletter