// Treasury to publish its findings from fundamental review into business rates in the autumn

// It delayed the findings because it expects there to be more economic certainty by that stage

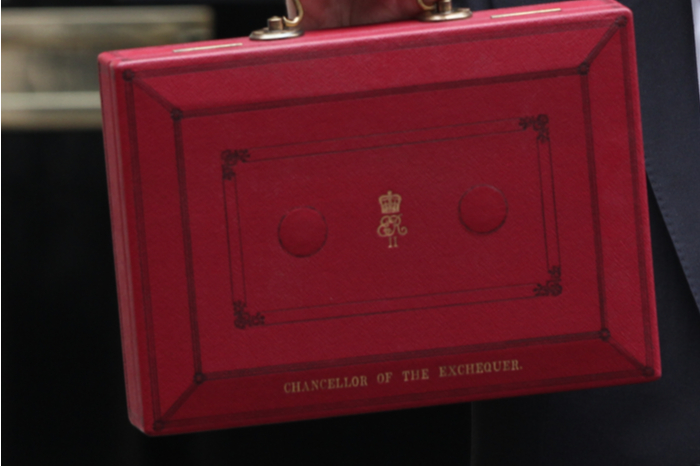

// The major review of the business rates system was called by Chancellor Rishi at last year’s Budget

The Treasury has confirmed it is delaying the final report on its review of business rates until later this year.

It confirmed that it will now publish its findings from its fundamental review into the property tax until autumn, when it expects there to be more economic certainty.

The major review of the business rates system was called by Chancellor Rishi at last year’s Budget, with a call for evidence launched in July.

READ MORE:

- Next CEO Lord Wolfson calls for reduction of business rates

- Scotland announces 12-month business rates holiday extension

Responses from the call are now “being considered” by the UK Government, with plans for an interim report to be released on March 23.

Retail, hospitality and leisure operators are currently benefiting from a business rates holiday for the current financial year, which will end on March 31.

However, bosses have called for the £11 billion tax break to be extended for another year after the industry was battered by enforced closures due to the Covid-19 pandemic.

Non-essential retail stores are currently shut due to the nationwide lockdown and are hoping to gain clarity over when they can reopen when Prime Minister Boris Johnson confirms the “roadmap to recovery” on Monday.

So far, only Northern Ireland and Wales have confirmed an extension of their respective lockdowns, until April 1 and for at least another three weeks, respectively.

Scotland is due to unveil its own roadmap lockdown exit plan in the coming days too.

Retail bosses have also called on the Chancellor for a major overhaul of the rates system in order to put store-based business on “a level-playing field” with online retailers, who have seen strong sales growth during the pandemic and pay significantly lower rates.

Last night, Next boss Lord Simon Wolfson said rates for retailers on the high street should be cut by 35 per cent with the commercial property tax increased for online rival warehouses instead.

with PA Wires

Click here to sign up to Retail Gazette‘s free daily email newsletter