Asda chief financial officer Michael Gleeson has dismissed reports that its owners are looking to sell the supermarket.

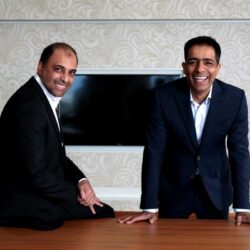

Gleeson told The Times that the grocer’s billionaire owners the Issa brothers and private equity firm TDR Capital had a track record “of growth and investing for the long run”.

He said: “They don’t tend to be in and out of companies — they hold their positions in companies for significant periods of time. So ‘no’ is the answer to that.”

Gleeson’s comments come following reports that co-owner Zuber Issa is close to offloading his 22.5% stake to TDR Capital, in a move that would give the private equity firm majority control.

Subscribe to Retail Gazette for free

Sign up here to get the latest news straight into your inbox each morning

Last month fellow co-owner Mohsin Issa said he was planning to step back from his role at Asda and would appoint a chief executive to support the daily management of the supermarket.

Gleeson said headhunters had been appointed and that the grocer was “actively looking” for a new boss. “We will make sure that we get the right person to fill that role”.

This week Asda saw its 2023 profits rise by a quarter to over £1bn, boosted by food and clothing sales that rose 7% to £21.9bn over the year.

The supermarket giant revealed it was looking to raise £2.6bn to refinance a portion of its debt load as it takes advantage of a rebound in corporate debt markets.

According to terms seen by the Financial Times, Asda has begun to market a £906m term loan to investors and looks to raise an additional £1.7bn of debt, with the new loan maturing in 2031.

Investors claim the £1.75bn figure will most likely take the form of a bond deal to be unveiled in the coming days.

Click here to sign up to Retail Gazette‘s free daily email newsletter