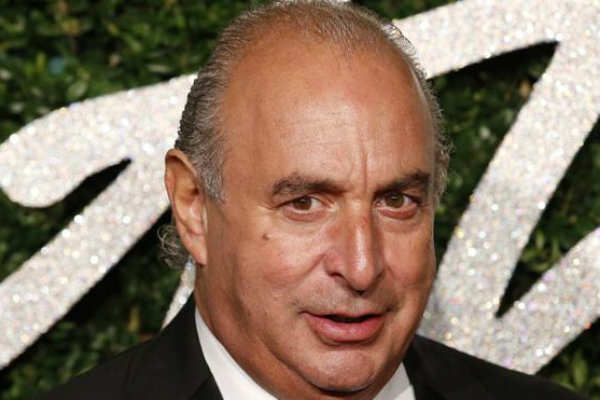

Sir Philip Green and Arcadia were aware of Dominic Chappell‘s speckled business history before finalising the sale of BHS.

It emerged on Monday that Green and his business associates were well aware that Dominic Chappell, the boss of Retail Acquisitions which purchased BHS in 2015, had been bankrupt and lacked strong experience in the retail industry.

Finance Director for Arcadia Paul Budge admitted that they had been aware of this and were “cautious” about the sale, but defended the decision to sell BHS to Chappell nonetheless.

“We seriously believed there was a credible business plan and seriously believed he was surrounded by credible people,” said Budge.

When BHS was sold to Chappell, Green famously asked: “If I give you my plane…and you tell me you‘re a great driver and you crash it into the first mountain, is that my fault?”

Green sold BHS for £1, but left the company with a pension deficit of £571m. Budge reminded MPs in the House of Commons Business Committee that Arcadia left £94.5m in cash and debt facilities in BHS for Chappell‘s use, along with £200m in property and £110m of guarantees on loans. He ultimately blamed Chappell for BHS‘s fall, for not successfully instigating a turnaround plan “quickly enough.”

Prior to Budge and other Arcadia executives giving evidence on Monday, a Goldman Sachs representative informed MPs that they had warned Budge of Chappell‘s background. Co-Head of Investment Banking in Europe for GS Anthony Gutman said Chappell‘s proposal was “very light on detail” and included “no business plan.”

“We provided a view that there were risks attached to the proposal,” said Gutman, though GS‘s role was strictly informal, involving no remuneration.