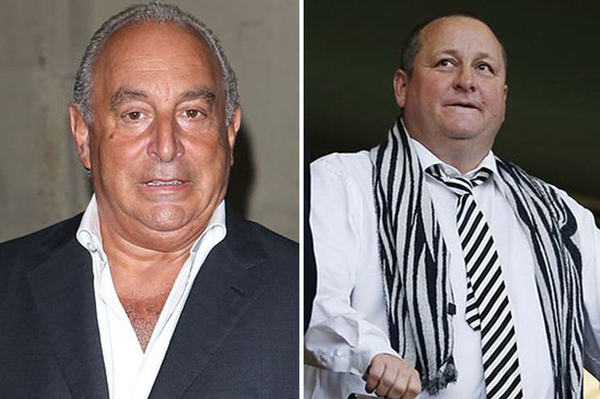

Today‘s news that despite a terrible financial performance in the last six months Mike Ashley has purchased a new £40 million company private jet, underscores the growing issue within retail corporate governance in the UK.

Many attribute the 2008 financial crash to corporate governance issues in the banking sector, and trust from the media, staff and the government has never fully recovered.

Now however, it seems that the issue is no longer contained to the financial sector. Retailers are increasingly making headlines over poor corporate governance practices.

BHS and Sports Direct have shifted the collective opinion around retail leaders and how they run their businesses, despite being the most publicised stories of the last year, they are far from the only ones.

Theresa May recently announced that she will launch a consultation into corporate governance, and last week released a Green Paper laying out proposals for change. She said: “This Green Paper focuses on ensuring that executive pay is properly aligned to long-term performance, giving greater voice to employees and consumers in the boardroom, and raising the bar for governance standards in the largest privately-held companies.”

“Few organisations have done enough to make sure their boards are transparent and honest.”

Bond Dickinson LLP head of retail sector Gavin Matthews stated that this is a sign of the government‘s “continued commitment to review the way UK retail businesses are run. It is also a clear statement that the Government wants to increase public trust in businesses, particularly in the wake of recent high profile cases such as BHS and Sports Direct.

“The Green Paper identifies some current issues and suggests some options for reform. There is no preferred option at this stage but the aim is to open a dialogue on the proposals.

“The Financial Reporting Council, the Investment Association and the Institute of Directors have all welcomed the publication of the Green Paper.”

The retail sector has already taken issue with some of May‘s proposed policies. After facing fierce opposition from retail leaders over the complications of appointing workers to the boardroom, May has diluted her original plan in order to initiate a truce.

READ MORE: Theresa May backtracks on measures to put employees in the boardroom

In return for a softer version of the plan, business leaders are agreeing to back the governments push for changes to executive pay. Shareholders will now have to hold a vote on company director‘s fees.

Matthews continues: “There is no suggestion that employees or other stakeholders would be directly appointed to company boards or that a dual board structure should be created echoing the comments of Theresa May at a recent CBI conference.

“This would appear to be a watering down of the Government’s original proposal to have employee and customer representatives on boards.”

Retail bosses have been slammed over the last year for everything from poor working conditions and sub-legal pay, to manipulating financial figures.

eShare chief executive Alister Esam comments that the problems may run deeper than first thought: “Boards are so formal and rigidly structured, few organisations have done enough to make sure their boards are transparent and honest.

“To really tighten up on governance, there has to be a true incentive for boards to be more accountable.”

“It‘s a cultural issue as much as anything – how many board executives are really in touch with what is going on in their organisation? At Marks & Spencers, executives spend time working in a store and this must help with being more open and transparent and encouraging trustworthiness both inside and outside the business.

“On the whole, boards are better behaved than they have ever been. But when they do fall short of the required standards, there is no hiding place so it‘s even more important to be honest, open and transparent.

“But I think that people are cynical about businesses and strong corporate governance. Because the few isolated cases are so high profile, other businesses are tarred with the same brush.”

Not only are these issues deep rooted in our business culture, but coming problems in the future could accentuate the issues.

Aon Global consultant David Molony comments: “Brexit represents a risk and governance issue for company boards who must acknowledge that their risk profile may change as a result.

“Possible outcomes need to be considered, including decreased capital mobility, loss of revenue, price increases, loss of competitive advantage and potentially an overall reduction in market share. For directors of larger businesses in particular, a failure to act could prove costly.”

READ MORE: John Lewis slams Theresa May’s corporate governance plans

The government has come under criticism for not effectively dealing with poor corporate governance, almost equal to that of the perpetrators. Esam explains that the government must take a harder stance in order to implement change.

“To really tighten up on governance, there has to be a true incentive for boards to be more accountable.

“Whether that‘s a fine big enough for a corporation to actually notice, or for individual board members to be held responsible when things do go wrong, punishment must be increased for bad behaviour. It will become self-perpetuating – the more organisations are encouraged to behave well and adhere to good governance, then other organisations will want to follow.”

“It‘s a little like disciplining a child. If you threaten to withhold a toy when they misbehave, but never follow through on that threat, then the child will continue to misbehave – it knows the threat is empty.

“Government needs to forget about the naughty step for corporates guilty of bad governance and deliver a punishment that they will stick to and one that is severe enough to deter other offenders.”

Click here to sign up to Retail Gazette’s free daily email newsletter