The seemingly unstoppable march of Aldi and Lidl continued last year, and was driven by one major thing: new stores.

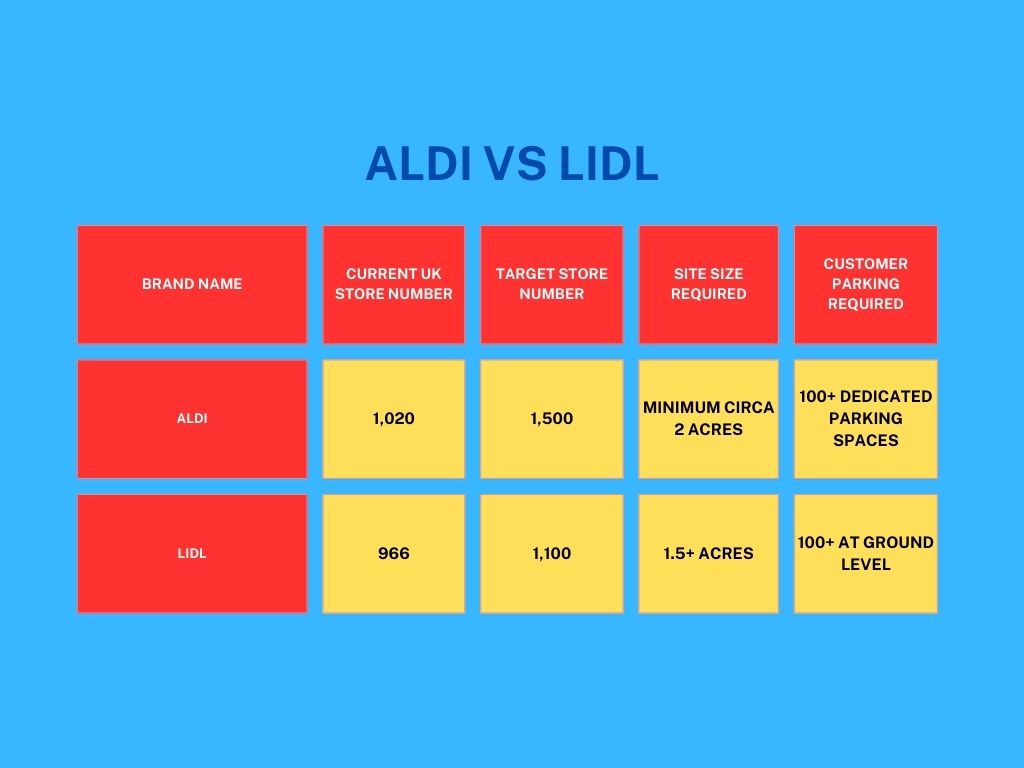

Last year, Aldi committed to a long-term target to open 500 new stores across the UK, taking its total number of sites to 1,500, with 35 new stores set to open this year alone.

Despite its grand expansion plans, last year Aldi UK boss Giles Hurley told The Telegraph he had been made to delay the grocer’s opening schedule as it faced a large number of planning objections from rival supermarkets.

Its competitors reportedly filed 77 objections to its planning applications from 2020 to late 2022 and launched 12 judicial reviews, with rival Lidl facing a similar challenge, according to the publication.

Lidl had set a target to open 1,100 stores by the end of 2025 in 2021. However, in February last year the discounter revealed it was scaling back its store opening programme, from 50 new stores during the year to just 25, to focus investment into expanding its warehouse capacity.

Retail Gazette looks at where discounters’ ambitious expansion plans stand now.

Is growth slowing for Aldi and Lidl?

On the surface it looks like the discounters are thriving, with Aldi overtaking Morrisons as the UK’s fourth-largest supermarket in 2022 and Lidl’s sales growth only usurped by Ocado’s last month according to the latest Kantar data.

However, the fact that neither Aldi or Lidl report like-for-like sales or profit guidance makes it difficult to decipher the true picture.

Shore Capital director Clive Black recently suggested that Aldi may have actually pulled in negative like-for-like sales volumes in the key December period. Meanwhile, the discounter’s share of supermarket sales fell from its 10.2% peak in September 2023 to 9.8% in March, according to Kantar data.

Additionally, in September Lidl plunged to a £76m pre-tax loss for the year to February 2023 despite sales soaring.

IGD retail futures senior partner Bryan Roberts points out that the discounters’ growth has been slower during the cost-of-living crisis than in the credit crunch, when the chains’ growth exploded.

He comments: “It’s hard to pick apart the numbers, but a reasonable conclusion would be that the full-range grocers have become more adept at retaining shoppers than they were in 2008-09 and that the discounters have been seeing more muted like-for-like growth as a consequence.”

Ben Green, principal at investment platform Atrato Group, believes loyalty member price schemes from traditional supermarkets such as Tesco and Sainsbury’s have meant the price differential between them and the discounters have narrowed.

He says: “Aldi and Lidl are probably still cheaper across the board, but by much less when you take into account Clubcard Prices, and of course the trade off is range.

“Although more and more people are interested in shopping at Aldi and Lidl for the prices, for a lot of people time is a valuable commodity and they’d rather shop the full range and the price differential is narrowing so much.”

Expansion on ice?

Is this slower growth the reason behind Lidl scaling back on its opening programme last year?

Although Roberts says the discounters have “patient stakeholders who have a very long-term horizon and slightly different expectations to competitors’ stakeholders”, Lidl specifically has been hit with some financial challenges of late.

It emerged late last year that interest on Lidl UK’s debts had almost trebled to £108m, which has reportedly put its expansion plans were under threat

It emerged late last year that interest on Lidl UK’s debts had almost trebled to £108m, which has reportedly put its expansion plans were under threat

However, the discounter has turned to a unique way to fund some new stores. In February, it emerged that Lidl was looking for investors to plough £91.1m into building a dozen new supermarkets, which it will then rent from them.

Although the retailer has since ploughed ahead with building some of those sites by itself, according to The Grocer, this was the first time Lidl’s UK business had sought such investment as it usually prefers to own its own property, with only about 20% of its roughly 960 UK stores leasehold.

Aldi, which tripled profits in the UK in 2022 – its last reported financial year – is not suffering the same financing issues and has pledged to invest £1.4bn in its expansion over the next two years.

However, store opening has become more challenging for the discounter because of its already-expansive estate.

Former Aldi UK and Ireland CEO Paul Foley points out: “When you’ve already put 1,000 stores on the map, the next 500 have to be very carefully positioned because they can’t be too close to the existing 1,000.

“I don’t see any lack of ambition. It just becomes a little harder because the locations are kind of thinning out to what’s left missing from the dots on the map.”

The pair have very similar property criteria. JDM Retail founder and CEO Jonathan De Mello says: “The only difference is that Aldi has been a bit more successful at expanding than Lidl. The two are looking at the same size sites and the same sorts of locations.”

In terms of where the discounters have room to grow, De Mello says that they are competing with each other for sites in the South of England, having initially opened most of their stores in the North and the Midlands.

“The issue is the cost of property is more expensive in the South East, especially London. You already have a lot of incumbents here in relation to all the different metro and local offers from the big four grocers.”

He adds: “And there’s an overlap with Aldi and Lidl in that they tend to like serving residential neighbourhoods in a purpose-built store, but the stores are relatively small so they’re going to compete more with the c-stores we’re seeing in conurbations in the London area.

“So it’s going to be harder for them to see that expansion successfully, or at least profitably in London in the South East, in particular.”

Roberts points out that Aldi seems to have “more of an explicit interest in smaller-format urban convenience while Lidl is sticking largely to bigger boxes”.

Aldi opened its first “local” store in 2019 in Balham under a trial, with a spokeswoman for the supermarket noting at the time this was “not a move into convenience retailing”.

Backing this up, Foley does not think Aldi will break further into different types of format such as convenience in the future.

He comments: “It will vary it a little bit because the traditional standalone store with 100 car parking spaces is not available in the middle of big cities. So they have to work with either no car parking, car parking somewhere in the area or grabbing people by foot.

“But I do not see a big change in the format since you see Aldi or Lidl across the world and the variation is rather small.”

“The supply of perfect new build rectangles is somewhat limited, and both have proven able and willing to take over properties both larger and smaller than their historic archetypes,” he says.

How big could they become?

Growth may have been slower for the discounters during this financial crisis compared to the last one, however, there is still much to go for in the UK for the pair.

When asked how big the duo could be, experts agree that a quarter of the market could be theirs for the taking.

Foley says: “If you look everywhere else, a typical market share for the discount format is somewhere around 25%. If you put Aldi and Lidl together at the moment they’re about 17% or 18%.

“So I think that 25% marker for me is a forgone conclusion in the coming ten years when they will mature and maximise the number of locations.”

Likewise, Roberts says a “reasonable forecast” for the discounters would be “a combined 3,000 stores with market share north of 25%”.

Despite the recent slowdown in openings, there is still much to go for. The march of the discounters has not petered out just yet.