Wilko has formally collapsed into administration, appointing PwC to lead the process, as 12,000 jobs are put at risk.

The retailer had been trying to broker a solvent rescue deal since it filed a notice of its intention to appoint an administrator last Thursday.

The chain said it had “a significant level of interest, including indicative offers”, however it was unable to complete the deal within the necessary timeframe.

“Given the cash position, we’ve been left with no choice but to take this unfortunate action,” said Wilko CEO Mark Jackson.

It was in talks with private equity firms Laura Ashley-owner Gordon Brothers, Bensons for Beds-owner Alteri, and OpCapita, as well as a rival retailer.

Jackson said: “Over the past six months Wilko has been very open that we’ve been considering options to accelerate a turnaround plan given that we needed to make significant changes to the way we operate to restore confidence and stabilise our business.

“We left no stone unturned when it came to preserving this incredible business but must concede that with regret, we’ve no choice but to take the difficult decision to enter into administration.”

Wilko will continue to trade all stores without any immediate redundancies as discussions with interested parties continue.

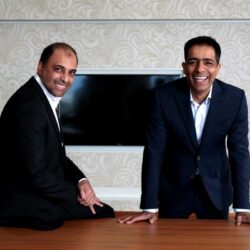

PwC partner and joint administrator Zelf Hussain said: “We know that the appointment of administrators, which comes during an already challenging time for many, will be an unsettling development for everyone involved with the business – particularly its committed team members – and the communities it serves.

“As administrators we will continue to engage with parties who may be interested in acquiring all or part of the business. Stores will continue to trade as normal for the time being and staff will continue to be paid.”

Wilko, which was founded in the 1930s in Leicester and grew to 400 stores, has been struggling for some time.

Its cash flow issues became evident last year when it deferred supplier payments and asked landlords to move to monthly rents.

It was dealt a major blow when credit insurers Allianz Trade and Atradius pulled cover in October.

This has made life difficult for Wilko ever since with many suppliers demanding payment for goods upfront, which led to poor availability across its stores for the past year.

It was given a lifeline when it secured £40m in funding from restructuring specialist Hilco late last year, and new CEO Jackson, who took the helm late last year, sought to cut costs and rebuild funds by axing more than 400 jobs and selling its Worksop distribution centres.

Jackson said: “Since January and with the help of retail advisers and experts, we’ve been facing into problems and have seen real progress against many areas of our plan.

“We’ve made significant savings across our cost base and have been considering various options based on advice given regarding our store costs.”

“We’ve all fought hard to keep this incredible business intact but must concede that time has run out and now, we must do what’s best to preserve as many jobs as possible, for as long as is possible, by working with our appointed administrators.”

Subscribe to Retail Gazette for free

Sign up here to get the latest news straight into your inbox each morning

Wilko fell behind the value competition

Wilko had filled the gap left by the collapse of Woolworths in 2008, but has since faced increasing competition from other value retailers, such as B&M, Poundland and Home Bargains, which have all been in expansion mode and have stolen market share from the retailer.

GlobalData retail research director Patrick O’Brien said that its rivals “really eroded its competitive position and undercut Wilko on price”, which has created long-term damage to the business.

Since 2015, B&M, Home Bargains and The Range have all overtaken Wilko for non-food market share with Wilko the only one of these retailers not to gain share over this period, according to GlobalData.

Wilko recorded sales declines in its last four financial years, with revenue falling by 18.6% between 2017/18 and 2021/22.

Meanwhile, the £35.9m loss it made in its last financial year, was more than its operating profit from the previous four years.

GlobalData senior data analyst Matt Walton said that the retailer has been “caught in a pincer movement” on both price and design.

“It has been outflanked on price by the likes of B&M, Home Bargains and The Range while it is unable to compete on design with the likes of Dunelm or Ikea.”

Click here to sign up to Retail Gazette‘s free daily email newsletter