Inflation shook consumer confidence over July as the UK economy shrunk for the second consecutive month, according to the British Retail Consortium (BRC).

Consumer expectations of the state of the economy over the next three months worsened to -33 in July, compared to -28 in June, the BRC-Opinium data revealed.

Consumer expectations of their personal financial situation over the period also deteriorated to -7 over the month, from -5 in June.

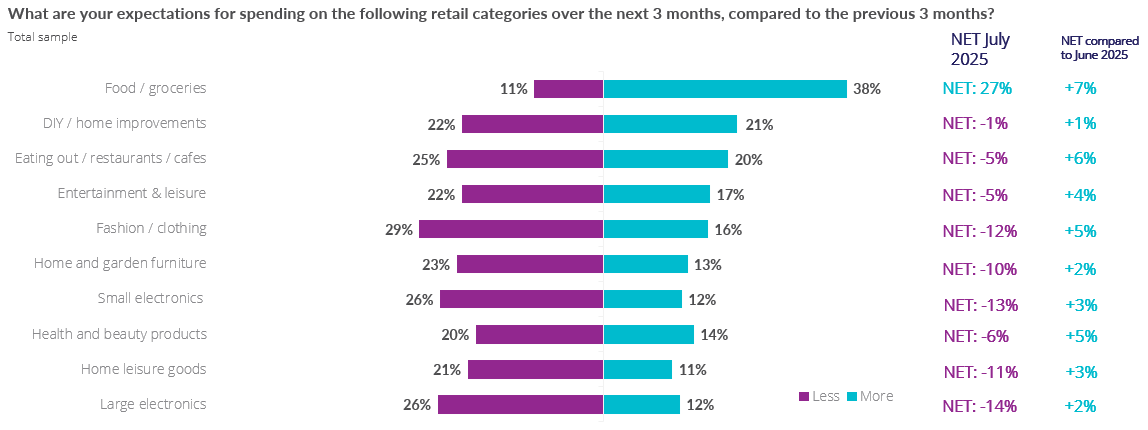

However, shoppers’ expectations over the coming three months of their personal spending on retail increased to +3 over the period, from +2 the month prior, while their overall spending expectations jumped to +16 from +12 in June.

Their expectations of their personal saving over the period also rose slightly to +3 in July, compared to -4 the month before.

The trade association’s CEO Helen Dickinson said: “With the UK economy shrinking for the second consecutive month, it is little surprise that consumer confidence fell in July.

“Rising inflation, particularly for food, has put more pressure on personal finances, increasing the cost of living.

“This has caused spending expectations to rise, particularly for groceries, as households anticipate higher prices at the till.”

She continued: “Despite fierce competition between retailers, retail inflation has risen steadily over the last nine months as a result of the Chancellor’s last Budget, which significantly increased employment costs.

“Further tax rises hitting the retail industry at the next Budget would likely fan the flames of inflation as retailers are forced to increase prices.

“The Chancellor has the opportunity to support households and high streets: the proposed business rates reforms could make the system fairer, provided government ensures that no store pays more as a result.”

The news come after it was recently reported that 40% of UK households saw their spending power growth decline in June, as inflation rose to 3.6%, according to the latest Asda income tracker.

The figures showed that the impact continued to be felt most by the UK’s lowest earning households, with their spending power growth dropping 8.1% year on year.

New data from Worldpanel by Numerator (formerly Kantar Worldpanel) also revealed yesterday (22 July) that UK grocery bills could rise by £275 as inflation hit its highest level since January.

Click here to sign up to Retail Gazette‘s free daily email newsletter