Toys R Us UK has come under fire from the Work and Pensions Committee which has raised concerns over actions that potentially led to an £18.4 million deficit in its pensions scheme.

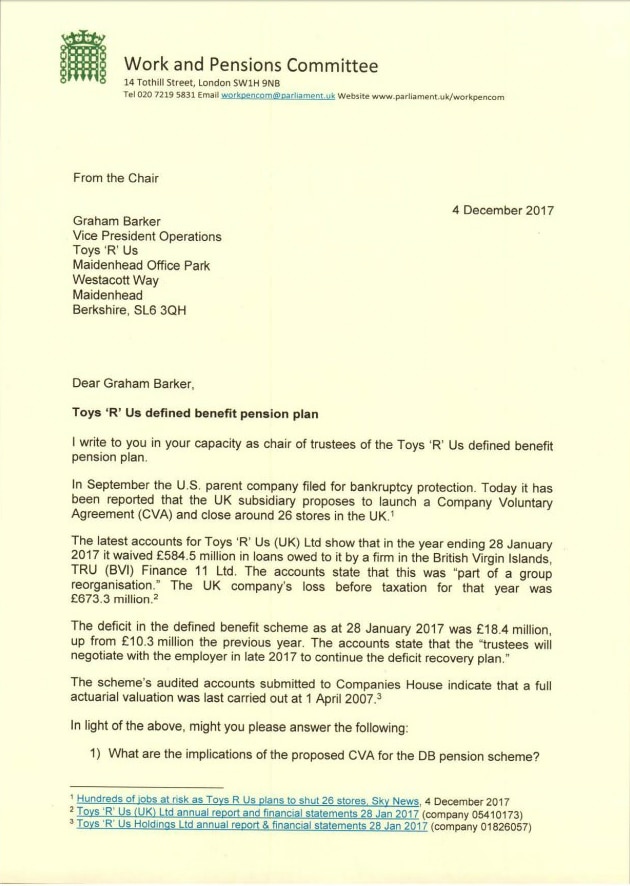

Work and Pensions Committee chairman Frank Field has penned a letter to the embattled toy retailer, which announced yesterday that it would apply for a Company Voluntary Agreement (CVA) and proposed the closure of 26 stores.

The letter highlights various potential missteps over the past decade which may have contributed to the retailer’s current financial trouble, and could yet spell trouble for employees’ pensions.

If the 26 stores closures are approved by the company’s creditors, an estimated 800 jobs would be axed.

Field, who was one of Sir Philip Green’s most critical opponents during the BHS pensions crisis, points out that in January this year, Toys R Us waived £584.5 million in loans it was owed, despite making a loss of £673.3 million that year.

The pensions deficit for this period also rose to £18.4 million, from £10.3 million a year prior.

Furthermore, the letter questions why the company had not carried out a full actuarial valuation, which is used to determine potential future liabilities, has not been carried out since 2007.

A similar letter was also sent to the collapsed grocery supplier Palmer & Harvey as the committee considers whether the Pension Protection Fund would need to take action to protect the 2500 employees who have been made redundant since it entered administration.