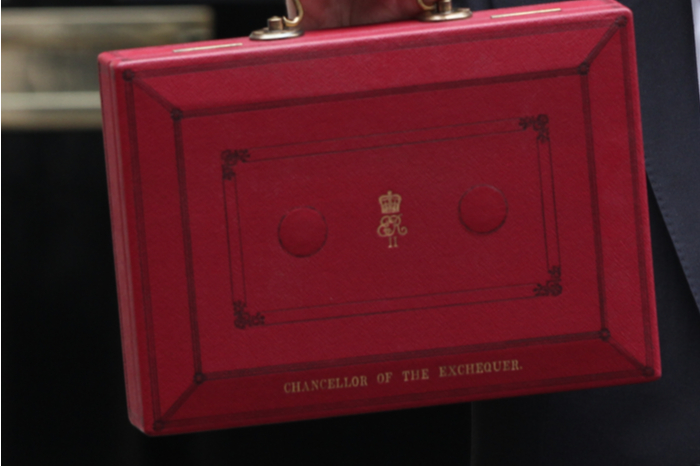

// Chancellor Rishi Sunak extends business rates holiday to all retailers amid coronavirus crisis

// In last week’s Budget, the 1-year holiday only applied to commercial premises with a rateable value under £51,000

// Government also providing £330bn of loans and guarantees for UK businesses

The one year business rates holiday has been extended to all retailers as part of the government’s updated economic support for UK businesses and amid the coronavirus crisis.

When Chancellor Rishi Sunak first revealed the one-year business rates holiday in the Budget last week, it only applied to commercial premises with a rateable value under £51,000.

This meant only small and independent retailers benefited, and the larger chains missed out.

READ MORE:

- PM urged to suspend all business rates bills amid coronavirus crisis

- Budget 2020: Business rates for small retailers abolished for 1 year

Sunak has now extended the business rates holiday to all retailers starting in the next government financial year.

The government also revealed it would provide £330 billion of government-backed loans and guarantees for UK businesses.

”Any business who needs access to cash to pay rent, salaries, suppliers or buy stock will be able to access a government-backed loan on attractive terms,” Sunak said.

This will be offered through two schemes, with the first being a new lending facility agreed with the Bank of England for larger businesses.

The second scheme, for small and medium-sized businesses, is a business interruption loan that is extended to £5 million with no interest due for the first six months.

Meanwhile, cash grants for the UK’s smallest businesses have been increased from £3000 to £10,000.

Sunak also confirmed that for businesses with insurance policies that cover pandemics, the government’s advice will allow them to make an insurance claim.

For those without insurance, Sunak said there would be an additional cash grant of up to £25,000 per business to help them mitigate the economic impact of the coronavirus pandemic.

The Covid Bill also allowed Sunak to bring about any further financial support he deems necessary in the future.

”The coronavirus is a public health emergency but it is also an economic emergency we have never in peacetime faced an economic fight like this one,” Sunak said.

”This struggling will not be overcome by a single package of measures but a collective national effort.”

Sunak revealed the updated economic support just a few hours after some of the UK’s biggest retailers came together in a rare moment of unity to urge Prime Minister Boris Johnson to suspend all business rates bills during the coronavirus pandemic.

In a letter – sent by Moss Bros this afternoon and signed by the Retailers Rates Action Group – the PM was urged to introduce a new package of temporary measures to help retailers survive the economic impact of Covid-19 as it moves to its most serious stage.

On Monday, Johnson told the UK to avoid all unnecessary public interaction including visiting retail destinations.

Click here to sign up to Retail Gazette’s free daily email newsletter