// Business rates for small retailers will be abolished for the next financial year, as unveiled in today’s Budget

// Chancellor Rishi Sunak said this applies to retailers with a rateable value of less than £51,000

// However, Sunak failed to mention any reform of the controversial regime of business rates as a whole

Thousands of small and independent retailers are set to enjoy some financial respite after the government revealed it would abolish business rates for them in the next financial year.

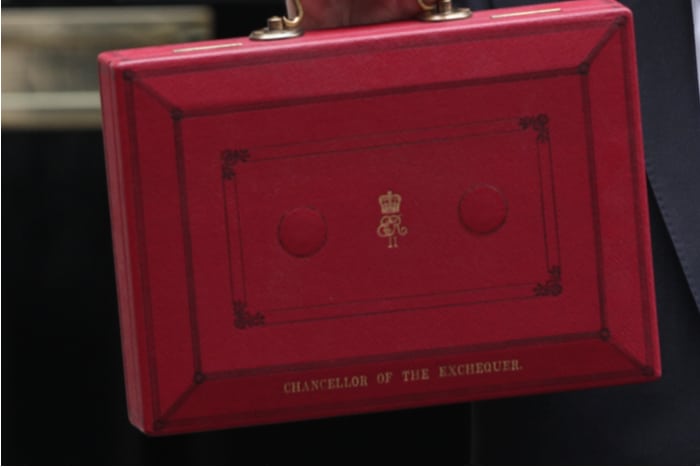

Chancellor Rishi Sunak announced the move today as he rose to present his first Budget to the House of Commons.

He said that for the coming year, he would take the “exceptional step” of abolishing business rates for small businesses with a rateable value below £51,000.

The tax cut is estimated to be worth around £1 billion and would benefit thousands of small and independent retailers around the UK.

READ MORE:

- Retail leaders urge Chancellor Rishi Sunak for business rates reform

- Calls to fix “broken” business rates system “fallen on deaf ears,” BRC says

- 50+ retailers write to Chancellor demanding business rates overhaul

Retailers eligible for small business rates relief may also be eligible for a £3000 cash grant – which equates to a £2 billion injection for 700,000 small businesses.

“Our manifesto promised that for shops, cinemas, restaurants, and music venues with a rateable value of less than £51,000 we would increase their business rates retail discount to 50 per cent,” Sunak told MPs today.

“Today I can go further, and take the exceptional step, for this coming year, of abolishing their business rates altogether.”

Despite these measures for small businesses, Sunak failed to roll out any tangible reform of the controversial regime of business rates as a whole – despite numerous calls to do so from a growing list of retail leaders and business groups in recent years.

Meanwhile, Altus Group estimated that only 10 per cent of all retail properties in England are over £51,000 in rateable value – but they account for 69 per cent of the overall business rates burden for the retail sector.

The real estate advisory firm said that not only are those properties exempt from the retail discount, they also help fund the small business rates relief through the 1.3p supplement on the standard rate of tax.

Altus Group added that last September’s 1.7 per cent CPI inflation rate would see business rates bills rise by £94.45 million on April 1 for those retail properties in England with a rateable value over £51,000 – and these businesses are excluded from the retail relief.

On the other hand, Sunak offered £2 billion of statutory sick pay rebates for two million small businesses with fewer than 250 employees in the wake of the coronavirus outbreak.

He said the sick pay would also be offered for “all those who are advised to self-isolate”, even if they have not displayed symptoms of Covid-19.

In addition, by 2024 the National Living Wage would increase to £10.50 per hour and in the next three weeks, the National Insurance threshold will rise from £8632 to £9500.

The retail elements of Sunak’s Budget formed part of a wider £30 billion fiscal stimulus – effectively ending austerity and supporting the country as it grapples with the coronavirus outbreak.

Responding to the Budget, GlobalData UK retail research director Patrick O’Brien said a restructure of business rates to reduce the disproportionate burden on retail chains “looks further away than ever”.

“Despite a concerted effort by retail bosses in the weeks leading up to the budget to put pressure on the government to help, they were left disappointed by Chancellor Rishi Sunak, who only reiterated the previous promised ‘fundamental’ review,” he said.

“While the government is abolishing business rates for small retailers, having already cut it by 50 per cent, this is only for firms with a rateable value of less than £51,000.

“For larger retail chains already struggling with increased labour costs, as well as crippling rent and rates bills – not to mention the prospect of the short term impact on consumer demand, there was little reason to agree with Sunak that his budget ‘gets it done’.

“Retailers will have to keep the pressure up as the rates review gets underway, and is scheduled to report in the autumn.

“But retail has been through such reviews before, and no government as yet has been prepared to alleviate the tax burden on traditional retail, due to the need to significantly increase the tax bills of other businesses, or increase other taxes.”

Chris Turner, chief executive of the network of British Business Improvement Districts, welcomed the move to temporarily abolish business rates for small shops but said the government needed to go further.

“We now need to build on this and have a comprehensive review of the four major business taxes together – rates as well as VAT, corporation tax, and National Insurance,” he said.

“These taxes were made many years ago and need to evolve to accommodate the growing number of online companies forming part of our economy, many of these companies are less exposed to business rates as a tax, making for a very uneven and unfair operating environment.

“We believe there is a bright future for our high streets. As we begin a new life outside the European Union, it is retailers and businesses up and down the country who will create the jobs and help the nation prosper.”

Ed Cooke, chief executive of retail property lobby group Revo, said today’s budget initiatives “provides a much needed safety-net which will keep many retailers trading”.

“However, the Chancellor has once again neglected to support larger retailers, who are major employers are drivers of economic activity in towns and cities across the UK, particularly in those communities that lent their votes to the Conservative Party last December,” he said.

“Attention will now turn to the business rates review, with the Chancellor seeming to have broken its fiscal neutrality rule in favour of ‘reducing the burden on business’ – if this is the case, it could be excellent news but must apply to retail and leisure occupiers of all sizes.

“We also welcome moves to review the transitional rate relief scheme, as we have long argued it is time to end a system where retailers in Middlesbrough are subsidising those in Mayfair.

“After a decade of calls for change, we hope this government will be the one to get it done.”

New West End Company chief executive Jace Tyrrell said: “While we welcome the Chancellor’s support for the wider retail community, the temporary rates relief announced today will not help the West End’s retailers bounce back from the challenges of Covid-19.

“These businesses are the heart of retail in the UK, and their health is directly linked to the state of our economy.

“We would urge the Chancellor to widen his scope for rate relief and help the UK’s most significant shopping district survive and thrive in such a difficult time.

“We would also urge the government to go further and add international centres, such as London’s West End, to the list of areas exempted from the Sunday Trading Act.

“A quarter of shoppers are international travellers, often on short breaks, and allowing them to shop after 18:00 on Sundays would generate up to £260 million in extra sales each year for UK retailers.

“In the longer term, we also believe there is a strong case to permanently rebalance business taxes to reflect an increasingly digital economy.”

Click here to sign up to Retail Gazette‘s free daily email newsletter