// Aldo files for bankruptcy protection in Canada, where it is headquartered

// The footwear retailer is seeking a restructuring process under the Companies’ Creditors Arrangement Act

// This process has similarities with a CVA in the UK or Chapter 11 in the US

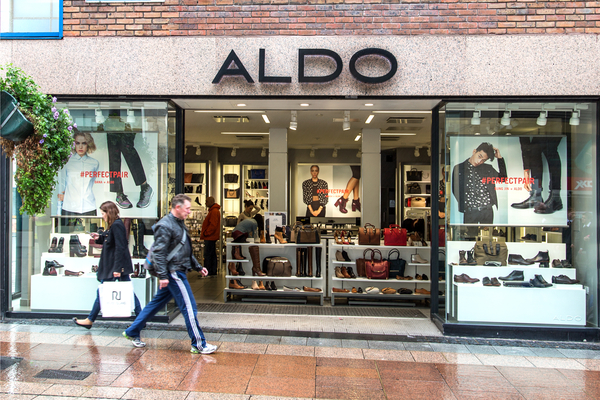

Aldo has filed for bankruptcy protection under the Companies’ Creditors Arrangement Act (CCAA) in Canada in a bid stabilise the business.

The Canadian footwear retailer said court restructuring process began last week and it was seeking similar protections in the US and in Switzerland.

Aldo said it was pursuing these measures to help it stabilise the business in response to the ongoing Covid-19 pandemic that has shut its stores outlets amid lockdowns.

READ MORE:

- J.Crew the first US retailer to file for Chapter 11 bankruptcy protection

- Brooks Brothers seeks buyer as Covid-19 takes its toll

- 1400 job cuts as Debenhams permanently shuts another 5 stores

Aldo said in a statement that EY had been appointed as the monitor in the Canadian proceedings.

The retailer also stated it would “carry on business” with its ecommerce websites to remain open and plans to re-open stores will be based on the guidelines set by local governments and health authorities.

The retailer added it would “work to complete its restructuring in a timely fashion and hopes to exit from the process as soon as possible and better positioned for long term growth”.

“It is no secret that the retail industry has experienced rapid and significant change over the last several years,” Aldo chief executive officer David Bensadoun said.

“We were making strong progress with the transformation of our business to tackle these challenges; however, the impact of the Covid-19 pandemic has put too much pressure on our business and our cash flows.

“After conducting an exhaustive review of strategic alternatives, we determined that filing under CCAA and related proceedings is in Aldo’s best interest to preserve the company for the long term and survive through this challenging period.”

Bensadoun added: “Throughout the process, Aldo expects to carry on business while it develops and implements a comprehensive restructuring plan across the organisation.

“With our deep fashion footwear heritage, experienced leadership team, extensive omnichannel capabilities and loyal customer base, we firmly believe that we will emerge from the restructuring process and from the challenges posed by the Covid-19 pandemic.

“We will come out stronger and well-positioned to continue leading the way in fashion retail.”

Click here to sign up to Retail Gazette’s free daily email newsletter