// SKG Capital to invest £20m over the next 12 months for new retail acquisitions

// Follows successful turnaround of bedding retailer Julian Charles, which it acquired in June last year

// SKG Capital says its acquisition hunt could provide “a vital lifeline” for many retailers in the wake of the pandemic

The new owner of bedding retailer Julian Charles has pledged to invest £20 million over the next 12 months for new retail acquisitions.

Turnaround investment firm SKG Capital said it would target loss-making high street retailers, particularly those currently in private family ownership and with a known heritage brand.

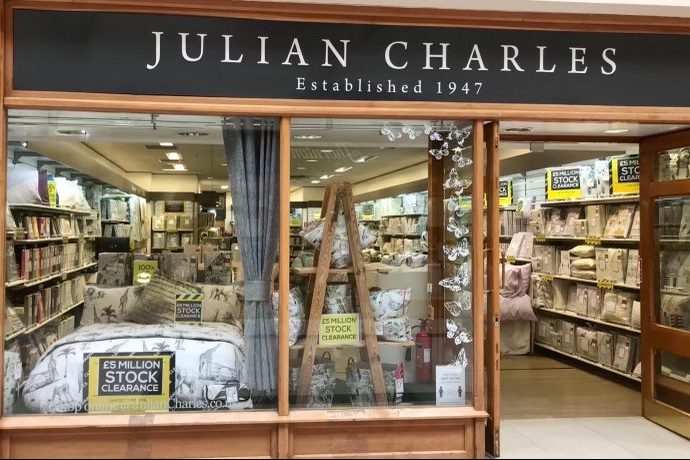

The news follows fast on the heels of the company’s successful turnaround of Julian Charles, which it acquired in June last year.

In less than a year, it has taken the bedding and textiles retailer from almost £1 million in the red pre-pandemic to £1.4 million in the black.

SKG Capital said its £20 million acquisition hunt could provide “a vital lifeline” for many retailers in the wake of the Covid-19 pandemic.

The buying spree is being led by SKG Capital founder and managing partner Chris Althorp-Gormlay.

“There are many reputable businesses that the downturn has adversely impacted over the last 12 months,” he said.

“Their balance sheet might have taken a hit, but their potential remains as strong as before, providing they receive the right support and investment.

“These are the businesses that we want to talk to. We have the in-house capability, expertise, and the capital to help them through the short-term storm, return them to long-term profitability, and ultimately rebuild a successful business with a bright future.

“One of our primary focuses throughout the process is to protect jobs and the supply chain.

“Turning around these businesses must be done in a way that preserves the wider impact they have on the local community and wider economy.”

The news comes as the day of reckoning for retailers fast approaches with the full reopening of non-essential retail in two weeks’ time in England and Wales.

As lockdown eases and government support schemes such as furlough and commercial rent moratoriums are tapered off, many retailers may be at risk of being forced to shut down should they not be able recover from the last 12 months.

Former HMV chief executive and SKG Capital equity partner Neil Taylor will also be leading the acquisition process and working closely with the investee companies on their journey.

“We’ve got our eye on consumer-facing retailers who had a challenging 12 months with either a national or regional high-street presence, such as those operating in the household and fashion retail segments, but we look wider than that too,” he told Retail Gazette.

“We’re looking for strong retail brands that have historically had a loyal consumer base, but have struggled over the last year or so.

“We know that a number of smaller privately-owned chains, perhaps with 100 fascias or less, are having had a torrid time on the high street, and many owners are understandably worried about the period ahead.

“We also know that a number of family-owned retailers may be looking for exits or even have their eyes on retirement.

“That said, we’re looking at retailers of all sizes. When we took over Julian Charles, it had 41 retail stores with another 34 concessions, and we’re looking to add to that over the coming period.

“We have the capital to purchase these chains and the expertise to see them through the coming period, ensuring that they continue to thrive on the high street.”

Click here to sign up to Retail Gazette‘s free daily email newsletter