THG chief executive Matthew Moulding has clashed with New York-based hedge fund Quintessential Capital Management (QCM) online, as he criticised the UK’s public markets.

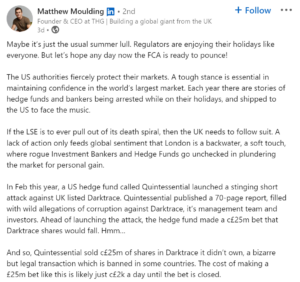

In a recent LinkedIn post, Moulding reiterated his disapproval of the London Stock Exchange and targeted hedge funds, media outlets and bank analysts, which he accused of being behind unfavourable coverage of publicly traded companies, including his own.

The boss of the online retail group cited Cambridge-based cybersecurity firm Darktrace as an example, which was accused by QCM of inflating its growth rates prior to its initial public offering in April 2021.

But an independent review from EY, which had been commissioned by Darktrace in response to the short seller’s allegations, found no evidence of fraud following a five-month investigation.

Subscribe to Retail Gazette for free

Sign up here to get the latest news straight into your inbox each morning

In response to Moulding’s post, QCM’s founder Gabriel Grego said: “We echo Mr Moulding’s concern for integrity in the market, but it’s essential to note that the EY report, despite our vocal requests, has not been made public.

“The conclusions shared were made by Darktrace insiders, thereby lacking the impartiality necessary for transparent evaluation.

“While we understand THG’s frustrations regarding short sellers, it is essential to recognize the vital role that short selling plays in market efficiency and price discovery.

“The short thesis on THG’s stock, validated by a significant drop in its value, might reflect underlying concerns that cannot simply be attributed to malicious intent.

Moulding responded: “Reads to me like sour grapes. I doubt anyone believes Darktrace have anything left to answer, reflected in the huge share price bounce since your attack. But that’s for you guys to debate.”

“Given the focus you have on transparency, maybe you could walk the talk, and provide details of your funders, so the public and markets can see who’s really behind these actions and who’s benefiting. After all, the public can see the real backers of LSE companies.

“Also, maybe share a full history of your short positions against Darktrace, and other companies on the LSE, so a clear picture of events can be seen.”

Click here to sign up to Retail Gazette‘s free daily email newsletter