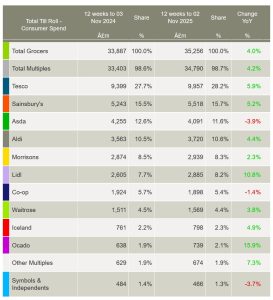

Grocery market share has shifted noticeably in the last 12 weeks, with Tesco, Lidl and Ocado emerging as the strongest performers while Asda and Co-op lost ground, according to new figures from Worldpanel by Numerator.

Tesco delivered one of the most robust performances among the major retailers, increasing sales by 5.9% and lifting its market share from 27.7% to 28.2%.

Meanwhile, Lidl continued to grow at pace, up 10.8%, taking its share to 8.2% and extending its long run of double-digit gains.

Online remained the fastest-growing channel, with spending on home delivery up 11%. That helped Ocado achieve its highest-ever market share at 2.1%, after posting 15.9% sales growth, its strongest rate in more than four years.

Sainsbury’s increased sales by 5.2% to reach 15.7% share, while Aldi edged up to 10.6% following 4.4% growth.

However, the picture was weaker for Asda, whose share fell to 11.6% after a 3.9% decline in sales. Co-op also slipped, down to 5.4%, while Morrisons eased to 8.3% despite a small 2.3% increase in sales. Waitrose held 4.4% share with sales up 3.8%.

Elsewhere, Iceland outperformed the total market, rising 4.9% to reach 2.3% share. M&S, assessed on FMCG only, saw growth of 8.8%, its strongest rate since June, although it is not included in the core share rankings.

Overall take-home sales rose 4% year on year in the period to 2 November, with inflation easing to 4.7% and shoppers directing close to 30% of their spending towards promoted lines.

Wordpanel head of retail and consumer insight Fraser McKevitt said: “Christmas ads are hitting our screens and the race to the big day is on in the supermarket sector.

“Retailers are very alive to the financial struggles that some households are facing, not least ahead of this year’s Budget. They’re eager to show how they’re offering shoppers value for money, putting the emphasis on price cuts rather than multibuy offers.

“It’s not just the Grinch who’s looking for savings with just shy of 30% of consumer spending at the grocers on promoted items in October, a figure that we expect to go even higher as we get closer to Christmas.”

Looking ahead, Worldpanel added it expected premium own label to play a larger role in December, forecasting sales of retailers’ top-tier ranges could exceed £1bn for the first time.

Click here to sign up to Retail Gazette‘s free daily email newsletter