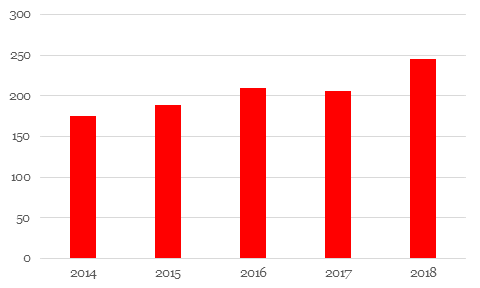

// The number of online-only retailers going bust surges 19% in 2018

// 246 pureplay retailers folded in 2018, compared to 206 in 2017

// 2018’s figure is more than double of what was recorded in 2010, when 120 went bust

The number of online-only retailers going bust has more than doubled since 2010, with new research highlighting that the challenges facing high street retailers are also felt increasingly online.

According to data obtained by accountancy firm Price Bailey, 246 online-only retailers became insolvent in 2018, a 19 per cent increase on 2017 when 206 pureplays went into insolvency.

The data also showed that the number of online-only retailer insolvencies more than doubled since 2010, when 120 went under.

Online-only retailers have mostly been immune from the problems afflicting bricks-and-mortar or multichannel retailers in recent years.

Online sales growth has generally been strong while many high street retailers struggled with declining footfall and rising costs associated with business rates and the national living wage.

However, Price Bailey said that declining consumer confidence, coupled with aggressive discounting, has placed many online fashion retailers under growing financial pressure.

It said that this was what prompted pureplay giant Asos to issue a profits warning before Christmas.

READ MORE:

Another issue facing online retailers is the high percentage of product returns, which is often at around 40-50 per cent, as they pile on significant costs and can have a detrimental impact on margins.

“While the problems on the high street have been widely documented, pressure has been quietly building for online-only retailers,” Price Bailey partner Matt Howard said.

“Many online clothing retailers are facing the same difficulties experienced by their bricks and mortar counterparts.

“Declining consumer demand, coupled with aggressive discounting, are driving a growing number of online fashion retailers to the wall.

“The shock profit warning issued by Asos just before Christmas shows how tough trading conditions are in the online-only fashion retail space.”

He added: “Over saturation in the online retail space is leading to a decline in web traffic for many of the leading online fashion brands.

“Competition from general merchandisers, such as Amazon, is also a factor driving aggressive discounting.

“The problem for many market entrants is raising brand awareness without a High Street presence during a period of sustained economic weakness.”

Click here to sign up to Retail Gazette‘s free daily email newsletter