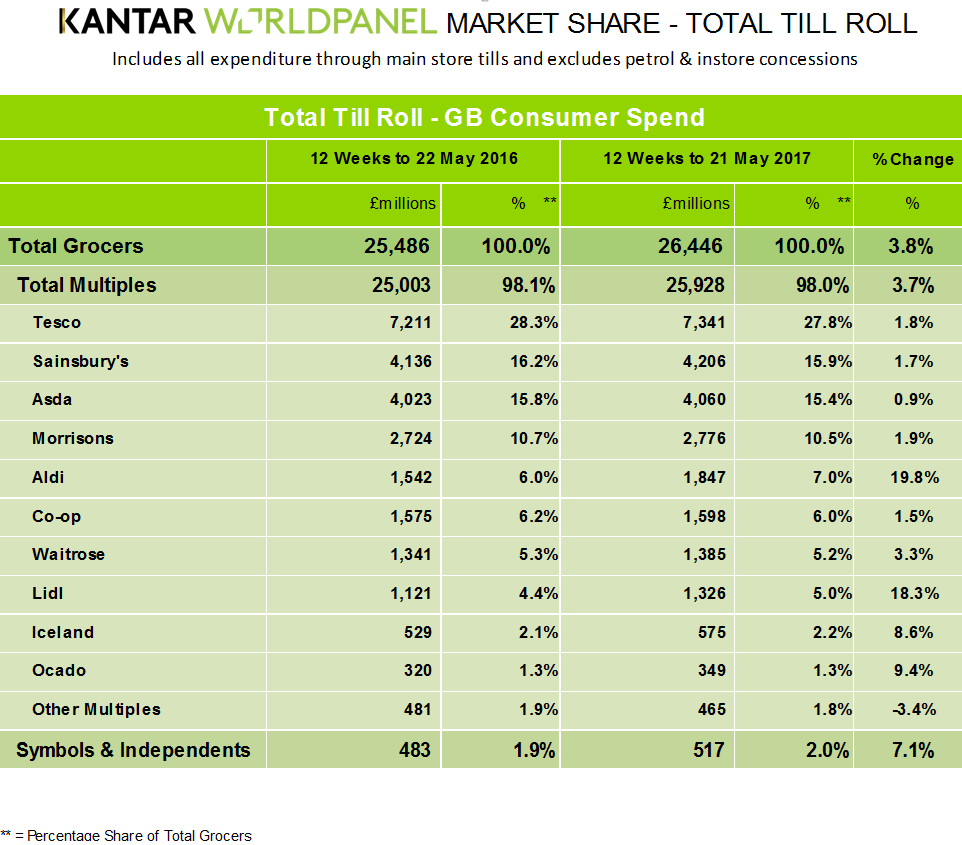

The latest grocery market share figures show that while the Big 4 collectively grew by 1.6 per cent, Aldi and Lidl together grew at their fastest rate since January 2015.

The two German discount grocery chains experiences a combined sales increase of 19.2 per cent year-on-year, and achieved a record market share of 12.0 per cent combined.

The figures from Kantar Worldpanel – published today for the 12-week period ending May 21 – shows that while the overall grocery sector had its best performance since September 2013, with sales up 3.8 per cent year-on-year, 62 per cent of the UK population still shopped at Aldi or Lidl in the past 12 weeks compared to just 58 per cent this time last year.

READ MORE: Grocery sector enjoys all-round growth for the first time since 2013

This equates to 1.1 million households visiting either of the German supermarkets in the last quarter.

Kantar Worldpanel’s latest figures also indicates that inflation continues to rise – up 2.9 per cent during the past 12 weeks – contributing to another period of growth for the grocery market.

“That may not seem like much, but if inflation continues at its current rate over the course of a year that would mean an extra £119 spent on groceries per household.”

He added: “Once again all 10 grocers have seen sales increase, no doubt boosted by higher prices as inflation continues.

“Own-label is also a major source of growth for all of the retailers, with sales up an impressive six per cent year-on-year in contrast to branded products which grew by just 0.6 per cent during the same period.”

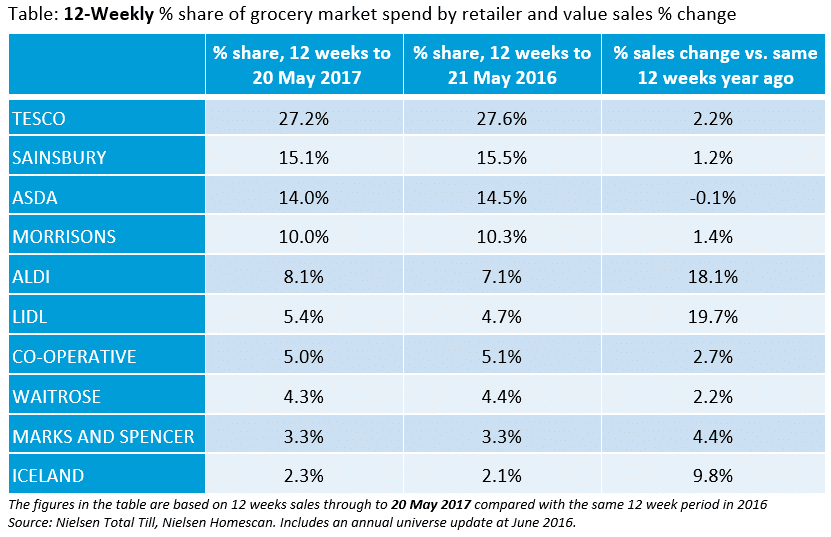

Separate grocery market share figures from Nielsen, also published today, show that Tesco recorded the fastest growing sales out of the Big 4 grocers for the second consecutive month for the 12-week period ending May 20.

Nielsen said Tesco increased sales by 2.2 per cent, ahead of the 1.4 per cent for Morrisons, 1.2 per cent for Sainsbury‘s and a -0.1 per cent decline for Asda.