Consumer confidence has gone up despite predictions of a pre-election and post-Brexit slump.

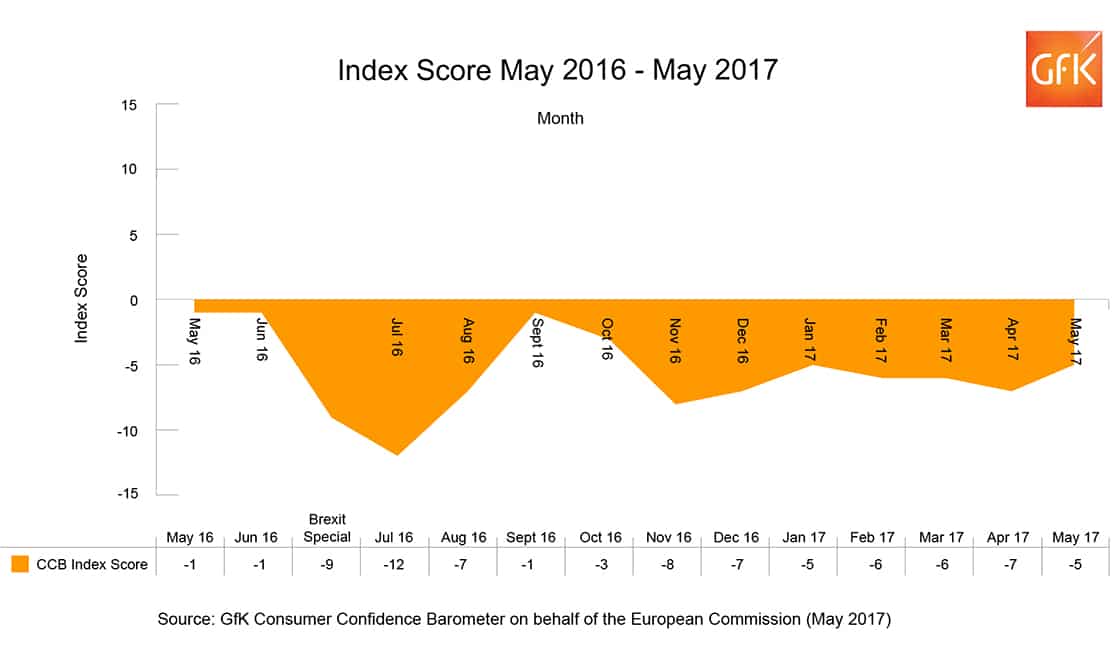

According to the long-running and closely-watched GfK Consumer Confidence Index, consumers’ confidence in May stood at -5, two points up compared to -7 in April.

The uptick comes in defiance of inflation adversely impacting household spending, and with wages rising at a slower pace than inflation for the first time in two-and-a-half years.

“We have an unexpected uptick in the barometer this month as consumers report increased confidence in their personal financial situation, the wider economy, and future plans for shopping and saving,” GfK head of market dynamics Joe Staton said.

“Despite life becoming more expensive with inflation hitting its highest level in four years and wages dropping in real terms for the first time in three years, stagnant living standards haven’t yet significantly dented consumers’ spirits — when it comes to retail therapy we remain happy to splash the cash as sales jump ahead of expectations.”

Meanwhile, the measure for the general economic situation of the country during the last 12 months has increased three points to -20, which is seven points lower than May 2016.

Shoppers also felt the general economic situation over the last 12 months was slightly better, up three points to -20, while the major purchase index increased two points to positive nine — the same as this time last year and an indication of consumer confidence in buying big ticket items.

READ MORE: Consumer confidence “surprisingly stable” ahead of General Elections & Brexit

“Although the overall index score is bumping along in negative territory, we haven’t seen any significant fall of the kind we might expect during such periods of pre-election and pre-Brexit uncertainty,” Staton said.

“Perhaps the real squeeze in living standards is yet to hit home. After years of people paying off debts post-downturn, unsecured borrowing has steadily increased since 2014 reaching record highs this month.

“When will we get our comeuppance and realise we have to pay the piper?”

The GfK’s consumer confidence index follows the Office for National Statistics’ (ONS) recent retail sales figures that showed sales defying expectations to rise by 2.3 per cent in April compared with the month before.

The ONS also said sales were up by four per cent compared with April last year, exceeding forecasts of one per cent monthly growth and two per cent year-on-year growth.

Click here to sign up to Retail Gazette‘s free daily email newsletter