UK grocery sales have grown at their fastest rate this year thanks to a combination of World Cup fever and the prolonged hot weather, new figures show.

According to the latest grocery market share figures from Kantar Worldpanel, sales were up 3.6 per cent over the 12 weeks to July 15, with customers visiting supermarkets an extra 13 million times over the last month to stock up on viewing essentials for World Cup matches.

Separate figures from Nielsen also show that total grocery volume sales accelerated to 2.2 per cent over the four-week period to July 14, the best volume growth outside of Christmas and Easter since July 2013.

Nielsen added that shoppers spent 4.5 per cent more on groceries during the same four-week period, in response to the heatwave and England’s strong performance in the World Cup.

READ MORE:

- June retail sales decline but still best quarterly growth since 2015 (ONS)

- June footfall dips despite World Cup spending boost

- World Cup fever boosts June retail sales (BRC-KPMG)

- Online retail growth stays strong in June amid World Cup fever

- Food inflation holds steady as overall shop prices dip (BRC-Nielsen)

- No signs of consumer confidence improving ahead of Brexit

- June’s flat inflation dashes hopes of interest rate hike

Kantar Worldpanel said that during the week that the English team played both Colombia and Sweden, sales of alcohol surged to £287 million, a record outside of Christmas and Easter.

It also said that over the past month, sales of firelighters and fresh burgers rocketed by 47 per cent and 30 per cent as customers turned to barbecues and al fresco dining thanks to the prolonged sunny and warm spell.

Sales of sun creams also surged 38 per cent, while nearly a third of all households bought pain-killing tablets over the past month.

“England may not have won the World Cup – but its journey to the semi-finals not only helped to kickstart the summer, but supermarket sales to boot,” Kantar Worldpanel head of retail insight Fraser McKevitt said.

Nielsen head of retailer insight Mike Watkins added: “It’s also good news that the hot summer weather looks set to continue for the next few weeks, with the hottest days of the year expected later this week.

“With the summer holiday season now truly under way, retailers will be planning inspiring media campaigns supported by compelling in-store promotions, to encourage shoppers to keep spending.”

Kantar Worldpanel’s data indicated that Aldi was the fastest-growing supermarket during the quarter, recording a sales surge of 10.9 per cent and marking a return to double-digit growth.

Its main rival Lidl was hot on its heels with sales growth of 9.7 per cent – boosted by its title as the official supermarket of the England football team – followed by online-only grocer Ocado which enjoyed sales growth of 8.5 per cent.

The Co-op recorded growth of 6.4 per cent over the quarter, its highest recorded since October 2011, while Asda saw sales jump by 3.7 per cent to make it the best performer of the Big 4 for the first time since December 2014.

Morrisons posted strong growth of 2.9 per cent and Tesco’s overall sales growth came in at 2.3 per cent, but Sainsbury’s sales grew marginally by 0.8 per cent.

Sales at Waitrose and Iceland grew 2.8 per cent and 4.5 per cent respectively.

In terms of market share, Kantar Worldpanel indicated that the only grocers to have grown were Aldi, Co-op, Lidl and Ocado.

Aldi’s market share grew from seven per cent to 7.5 per cent, Co-op grew from 6.2 per cent to 6.4 per cent, Lidl grew from 5.1 per cent to 5.4 per cent, while Ocado’s grew marginally from 1.1 per cent to 1.2 per cent.

“Aldi and Lidl are now on the verge of hitting a combined market share of 13 per cent for the first time, though the speculation over new entrants to the discount market could mean new pressures on the two retailers,” McKevitt said.

Asda, Morrisons and Iceland held their market share, at 15.1 per cent, 10.5 per cent and 2.1 per cent respectively.

Meanwhile, Tesco, Sainsbury’s, and Waitrose all lost a bit of their market share during the quarter.

Tesco went from 27.9 per cent to 27.6 per cent of market share, Sainsbury’s dropped from 16 per cent to 15.6 per cent, and Waitrose dipped from 5.1 per cent to five per cent.

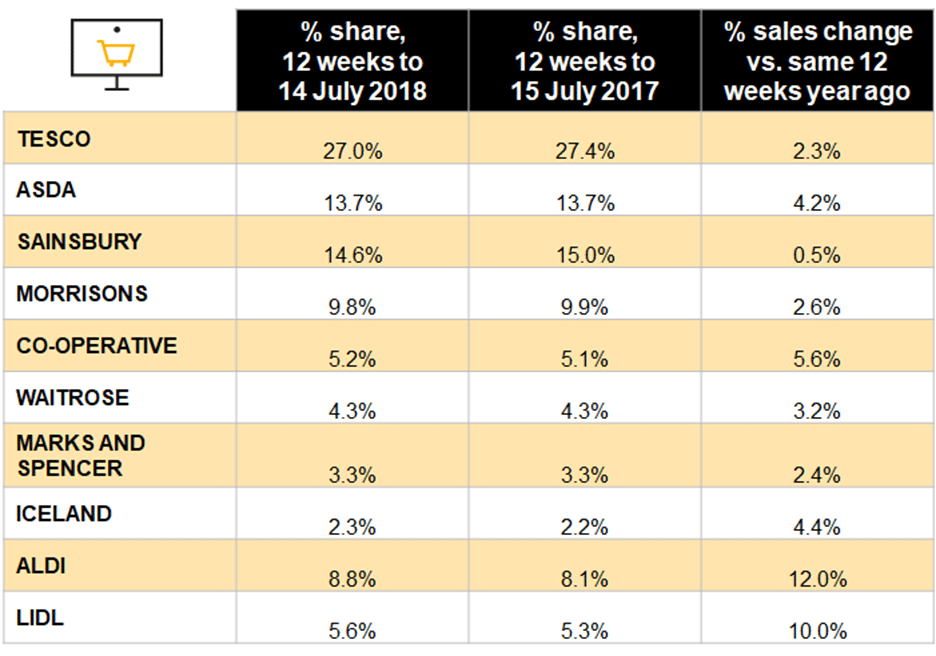

Nielsen’s market share data painted a slightly different picture.

It found that Tesco’s market share grew from 27 per cent to 27.4 per cent, Sainsbury’s grew from 14.6 per cent to 15 per cent, and Morrisons grew marginally from 9.8 per cent to 9.9 per cent.

Meanwhile, Asda held its share at 13.7 per cent, as did Waitrose and M&S, at 4.3 per cent and 3.3 per cent respectively.

The Co-op and Iceland’s market share dipped by just 0.1 percentage point to 5.1 per cent and 2.2 per cent respectively.

Despite being the only grocers with double-digit sales growth in Nielsen’s data, Aldi and Lidl’s market share dropped from 8.8 per cent to 8.1 per cent and 5.6 per cent to 5.3 per cent respectively.