The grocery sector has grown at the slowest rate in nine months despite retailers and shoppers getting into the Christmas spirit, according to new market share figures.

According to Kantar Worldpanel, for the 12-week period ending December 2, the UK grocery sector grew two per cent – the slowest growth rate since March this year.

READ MORE:

- UK retail suffers worst November footfall decline in 9 years (BRC-Springboard)

- Bricks-and-mortar retail endured “worst November in 3 years” (BDO)

- Retailers face “nerve-wracking run-up to Christmas” (BRC-KMPG)

- November consumer confidence drops to lowest point for the year (GfK)

- Consumer confidence slumps in November (YouGov/Cebr)

- Mild inflation returns in November amid rising food prices (BRC-Nielson)

Separate figures from Nielsen also indicated that sales momentum remained weak across the grocery industry, with headline growth of 2.3 per cent for the four-week period ending December 1.

Despite this, Kantar head of retail insight Fraser McKevitt said consumers continued to benefit from falling inflation, which now stands at 1.6 per cent and is less than half the 3.6 per cent inflation rate in December last year – which led to slower sales growth at the time.

“Over the summer shoppers upped their weekly trips to the grocers as they took advantage of the hot weather, but with the mercury dropping the number of trips has tailed off – again contributing to waning market growth (for this period),” McKevitt said.

However, both Nielsen and Kantar predicted record sales for the peak Christmas trading season, which it attributed to the way Christmas Day falls on a Tuesday.

“The last time Christmas Day fell on a Tuesday was in 2012 and the Saturday before was the busiest shopping day of the year,” Kantar head of retail insight Fraser McKevitt said.

“We expect the same trend to hold true this year, with Saturday 22 December pulling in the last-minute Christmas crowds.

“Because of the way Christmas falls, grocers have an extra trading day this year meaning overall sales in December – up to and including Christmas Eve – could reach £10 billion.”

Meanwhile, Nielsen predicted grocery shoppers will spend £7 billion in the crucial two-week period ending December 29.

“It’s been a slow start to Christmas in 2018, and in particular for the grocery multiples,” Nielsen head of retailer insight Mike Watkins said.

“The good news is that we still expect shoppers to spend on seasonal treats and indulgences as well as premium food and drink when shopping and to enjoy the festive season with family and friends.

“This will provide some much-needed sales momentum in particular for the big supermarkets.”

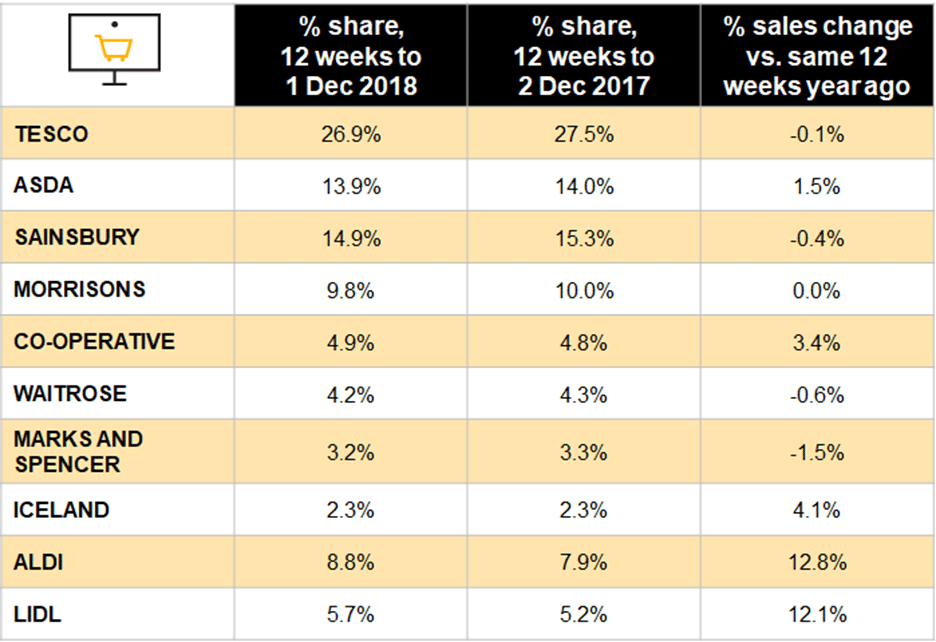

Nielsen found that all of the Big 4 retailers lost a bit of their market share when compared to figures this time last year, while Kantar found Asda was the only one to have kept its market share steady.

Both analyst firms also found that the Co-op had won back some of its market share, Iceland remained steady, while Waitrose’s market share slid by one percentage point.

Click here to sign up to Retail Gazette‘s free daily email newsletter