// Mytheresa has raised £297m in a US IPO

// The online fashion retailer first announced plans for a Wall Street IPO in December

// The shares are expected to begin trading on the New York Stock Exchange on January 21

Mytheresa has raised $407m (£297m) in a US IPO after parent company MYT Netherlands Parent sold around 15.65 million depositary shares for $26 (£18.98) each on Wednesday.

The shares are expected to begin trading on the New York Stock Exchange on January 21, and the offering is expected to close on January 25.

The listing will be underwritten by Morgan Stanley, JP Morgan, Credit Suisse, UBS, Jefferies and Cowen.

READ MORE: Mytheresa eyes Wall Street IPO after sales reach £399m

Mytheresa first announced plans for a Wall Street IPO in December, which could value it at as much as £1 billion.

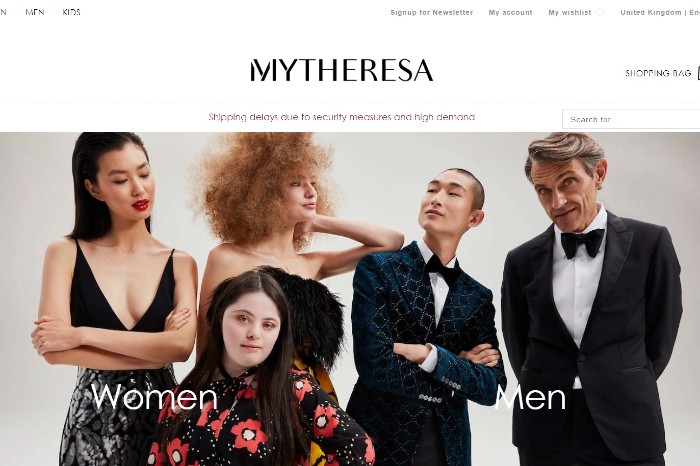

The retailer sells luxury fashion brands including Prada, Gucci and Burberry, and was originally founded as a bricks-and-mortar store in Munich, Germany.

Mytheresa launched its online business in 2006 and has since grown to trade in approximately 140 countries including the UK.

The online fashion retailer reported a 27.5 per cent rise in net sales year on year to €126.4 million (£115 million) in the three months to September 30.

Click here to sign up to Retail Gazette‘s free daily email newsletter