The first signs of what happened in retail over the all-important Christmas period were unveiled yesterday when giants Next and B&M shared their Christmas results.

The pair, which both lifted their profit guidance for the year following impressive sales growth, may turn out to be outperformers, however, they reveal vital trends of how consumers were shopping this Christmas.

Retail Gazette unpicks some of the big findings.

Shoppers returned to stores in droves

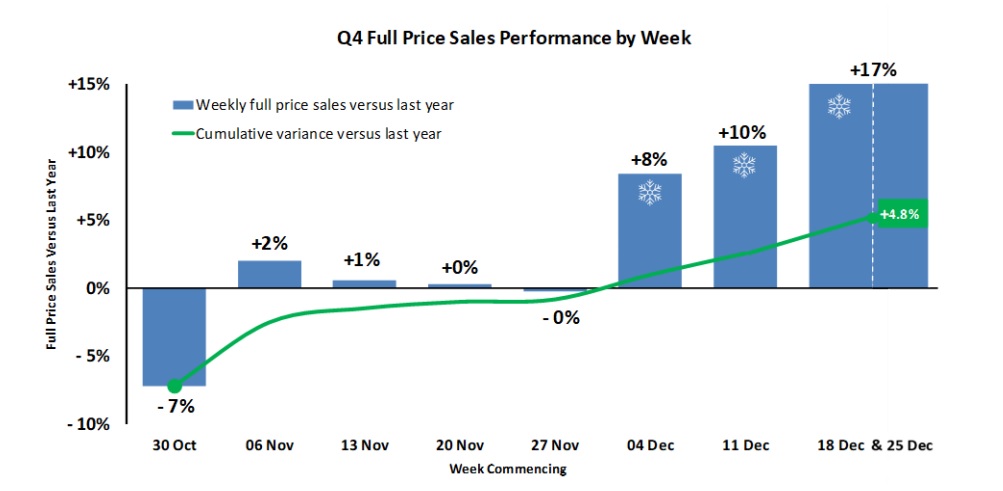

With total full price sales up 4.8% over the golden quarter, substantially higher than the -2% guidance given for the period, Next had a great Christmas. However, it was its retail stores that really drove this performance.

Sales jumped 12.5% in its retail stores, compared to the 0.2% rise in online.

Shoppers also flooded into discount store B&M, which saw revenues grew by 12.3% in the three months to December 24, hitting £1.57 billion.

Next believes it might have underestimated the negative effect the Covid pandemic had on store sales last year, however, it also shows how rather than sticking with online, shoppers have been eager to rush back to stores.

Shoppers seek out bargains

Amid soaring inflation and damp consumer demand, shoppers have continued to flock to value in a bid to make their budgets stretch.

Value giant B&M reaped the benefits as its like-for-like sales grew 6.4% in the key Christmas quarter with the retailer’s boss Alex Russo pointing out that relentlessly focusing on price, product and excellence in retail execution has helped it soar.

“Despite the challenging macroeconomic environment, we will continue to work hard to help both existing and new customers manage the cost-of-living crisis,” he said.

B&M also owns discount supermarket Heron Foods, which enjoyed revenue growth of 22.5% in its third financial quarter, compared to the previous year.

Meanwhile, Next said that its famous end-of-season Sale was performing ahead of expectations as shoppers snap up bargains post-Christmas.

Last-minute Christmas rush

There was lots of talk of consumers shopping earlier ahead of Christmas in order to manage budgets, however, Next sales had what it termed a “dramatic boost” when December started.

Sales peaked the week before Christmas, when revenue jumped 17%. This momentum was maintained the week after Christmas, when it kicked off its Sale.

The retailer said that the cold weather in December was the big driver for this as it unleashed the pent-up demand for winter products from an unsually warm October.

This is a trend that many fashion retailers should have benefited from.

Supply chain disruption subsides…but some retailers are overstocked

The supply chain issues that hampered availability last Christmas have subsided, according to Next.

The retailer said this improved stock availability helped to boost sales over peak and show that it might have underestimated the impact this had on performance last Christmas.

B&M said the supply chains across its businesses also “executed well” across the business.

However, Next – like many retailers – is now sitting on a big stock pile, thought to be a hangover of last year’s supply chain issues. The retailer had 60% more Sale stock this year than last year’s low levels. This was up 31% on the pre-pandemic levels of 2020.

The retailer will not be alone.

It emerged before Christmas that fashion retailers were sitting on piles of unsold clothing due to a combination of a pile up of products in warehouses as supply chain disruption has eased and lacklustre demand.

Asos, for example, is sitting on £1.08 billion of unsold stock, up a third on the year before.

Unlike Next, many retailers resorted to discounting before Christmas to clear this overstock, with the BRC reporting that inflation in non-food dipped in December as retailers slashed prices.

Caution about the year ahead

Despite posting positive results, Next struck a note of caution in the year ahead.

The retailer forecasts that full-price sales will be down 1.5%, or £69 million, in 2023/24 with profits to be down an estimated £65 million, when taking into account cost rises.

Although the retailer acknowledged that some might think this forecast is “overly cautious” in light of its postive performance, it warned that higher energy bills and mortgage rates would dampen demand from shoppers throughout 2023 and beyond.

Prices will rise

Next also flagged that rising costs and supply chain issues mean that its prices for spring and summer clothes and home goods would rise by 8%.

Shoppers will also see prices rise in the autumn and winter, the retailer said, but the increase will not be as sharp at 6% as the price of key commodities such as cotton and polyester had fallen and a slowdown in global demand had increased capacity at factories.

Click here to sign up to Retail Gazette‘s free daily email newsletter