It’s been almost three years since outbreak of the Covid19 pandemic, when the world of retail was upended.

Enforced lockdowns meant the doors of ‘non-essential’ shops were closed, and fear of the virus meant many people were either shielding or too afraid to go to supermarkets.

Businesses pivoted to find ways to meet consumer demand so the rise of ecommerce and home delivery was inevitable.

So, the question is, now that the world has not only reopened for business, but simultaneously fallen into an economic climate of high inflation, increased production prices, supply chain issues and a cost-of-living crisis, has ecommerce taken a hit?

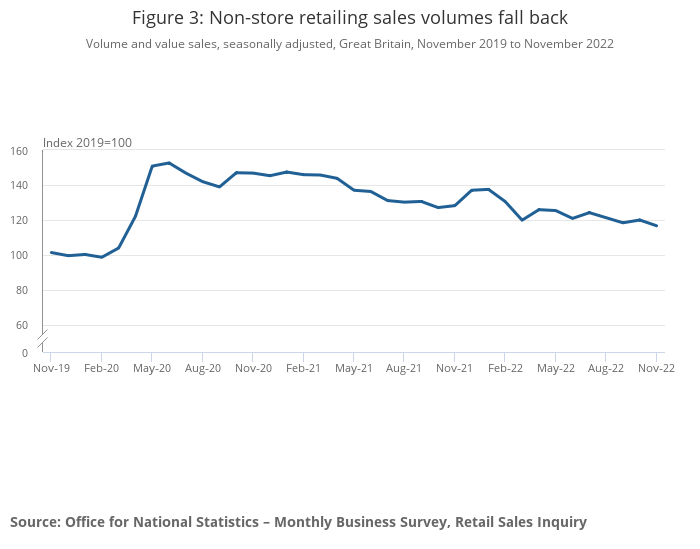

Recent data from ONS (Office for National Statistics) shows that online sales fell by 2.8% in November 2022, with overall retail sales dropping by 0.4% from October’s figures.

However, it is worth noting that ecommerce sales were still 18.2% higher than pre-pandemic February 2020 levels.

ONS director of economic statistics Darren Morgan notes that Black Friday offers in 2022 failed to provide their usual lift in this sector.

But I would argue any turbulence to online is temporary, and there are a number of reasons why online is here to stay:

1. Work from home = buy from home

Even now we’re still finding our feet with the ‘new normal’ of life in a post-pandemic world.

This is, in large part, driven by the massive cultural shift of working from home, with Time Magazine calling hybrid working it’s trend for the year last year – and in 2023 too.

The publication wrote that that working from home accounted for only 5% of all workdays before the pandemic, but as of December 2022, almost 30% of paid workdays happened at home.

As a result, working from home is also changing our online shopping habits.

It is estimated that almost half (49.7%) of total non-food retail sales will be made via ecommerce by 2025 because more shoppers work from home, a new report from Metapack and Retail Economics suggests.

An extra £19.6bn of online sales are predicted to be delivered to homes as a result.

Subscribe to Retail Gazette for free

Sign up here to get the latest news straight into your inbox each morning

2. Culinary convenience is king

Being at home means being able to more easily take deliveries, and also less of a desire to leave the house to go shopping – especially for food.

The rise of convenient grocery delivery has led to new and innovative ways to get your shopping done.

Deliveroo and Just Eat have partnered with many big grocers including Sainsbury’s, Asda, Morrisons, Co-op and Waitrose.

Just last month, Co-op struck a deal with Just Eat to increase its online delivery reach to more communities nationwide.

The convenience retailer will be trialling Just Eat across 50 stores early next year, with the service expected to expand to over 1,000 Co-op stores by spring.

3. High street stores are closing

Scores of major retailers went out of business in 2022, including Sofa Workshop and household retailer Made.com.

Fashion chain Joules also went into administration, before the business was bought by Next.

It is estimated that 15,000 high street stores are expected to close in 2023. Meanwhile, according to the Metapack and Retail Economics report, 35.8% of people in UK say they will visit physical stores less in the future.

New research from personal lender Abound, which analysed the transactions of its users through Open Banking software, found that vast amounts of consumers flocked online this Christmas and for the first time ever, Londoners (where WFH is high) have spent more online than on the high street.

4. One-click culture

Social is undoubtedly having an impact too.

According to a recent piece by Forbes, an increasing number of consumers are discovering new products via digital experiences rather than in physical stores.

In fact, Forrester recently estimated that 61% of all US sales are now influenced by digital experiences, and projects that 70% of all sales will be digitally influenced by 2027.

So, what’s next?

The world of online shopping and home delivery aren’t going anywhere. As always, they’ll just continue to evolve and shift to meet the consumer demand and behaviour.

As the ties between social and digital grow stronger, our one-click buying culture and the rise of the metaverse mean a move to a more integrated, “phygital”, experience is going to be a must-meet challenge for big name brands in the future.

Or they may not survive.

Click here to sign up to Retail Gazette‘s free daily email newsletter