The sector has had its fair share of collapses this year, which has resulted in some of the industry’s biggest acquisitions.

As the year draws to a close, Retail Gazette takes a look back at the retailers that went bust over the past 12 months

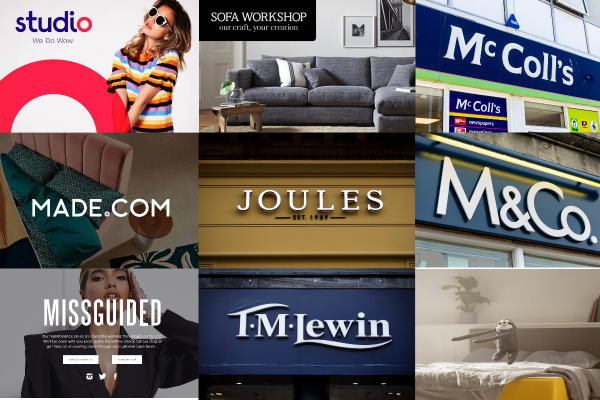

Studio Retail

Collapsed: February

Studio Retail collapsed at the beginning of the year after attempts to secure emergency funding failed.

Despite being a high-flyer of the pandemic,iStudio was one of the many retailers that were hit hard by last year’s supply chain delays which resulted in it struggling to shift excess stock.

This resulted in Studio needing to apply for additional funding in the interim but its request for a £25 million short-term loan from its bank was denied.

Shortly after falling into administration in February, it was picked up by Mike Ashley’s Frasers Group, which had been its biggest shareholder with a 28.9% stake in Studio before its collapse, for £26.8 million.

TM Lewin

Collapsed: March

TM Lewin struggled to recover from the pandemic, when the demand for formalwear waned, and fell into administration in March for the second time in two years.

The men’s formalwear retailer first collapsed in 2020 after Covid-19 restrictions dampened in store sales and its newly established online presence failed to compete with rivals.

However, the retailer was rescued by its main lender The Petra Group, which has since relaunched the retailer’s website with plans to open flagships.

Sofa Workshop

Collapsed: April

Sofa Workshop closed its doors for the last time in April after it failed to be rescued from administration.

The retailer cited supply chain challenges and rising costs had led to consistent trading losses.

Administrators said increasing costs to import goods from Asia and leftover Covid-related supply disruption meant the business was unable to meet its payments.

McColl’s

Collapsed: May

McColl’s collapsed into administration in May after talks with lenders for an emergency cash injection or a potential sale failed.

The convenience store chain reported “softer trading” in March as a result of reduced consumer spending and continued supply chain disruption across the industry.

The group had accumulated debts of around £170 million.

Following its collapse in May, McColl’s was the subject of a bidding war between Asda and Morrisons, with the latter emerging victorious. It snapped up the convenience chain in a £190 million deal which saw all its staff, UK stores and pension schemes saved.

Morrisons, which had partnered with the chain in 2021, is in the midst of converting the remaining McColl’s stores into its Daily format.

Missguided

Collapsed: May

Missguided collapsed in May after experiencing ongoing financial troubles since 2021.

The retailer had sold 50% of the business to distress specialists Alteri Investors in late 2021 as it sought emergency funding.

The final straw for the etailer was when clothing suppliers owed millions from the brand filed a winding-up petition.

The retailer attracted interest from businesses including Boohoo, JD Sports, and Shein, however, Frasers Group ended up buying the etailer out of administration in June.

Eve Sleep

Collapsed: October

Eve Sleep collapsed in October after efforts to secure additional funding or a sale failed.

In September, the brand reported sales for the year had plummeted 18% in what bosses described as a “truly unprecedentedly appalling market conditions”.

The retailer was forced to focus on its most profitable lines and slashed annual overheads by £2.5 million.

Eve Sleep’s brand and intellectual property were purchased by Bensons for Beds in October for £600,000.

Joules

Collapsed: November

Early signs of Joules’ collapse began last December when the yellow raincoat favourite warned supply chain challenges would hit trading.

Faced with higher costs from stock delays, the brand began discounting products to shift excess out of season stock.

The retailer struggled to bounce back from the hit to its trading and recover profit margins.

It collapsed in November and was bought out by Next and founder Tom Joule in a £34 million deal earlier this month.

Made.com

Collapsed: November

Made.com was a big winner of the pandemic, however, it fell victim to the cost-of-living crisis and a move away from online shopping.

In September, the furniture retailer posted a £35.3 million loss before tax for the six months to 30 June as homeware demand waned/

It then put itself up for sale following an unsuccessful fundraising round but potential buyers failed to meet the retailer’s end of October deadline.

The online retailer then plunged into administration at the start of November.

Shortly after, Next swooped in to buy the brand, domain names and intellectual property in a £3.4 million deal.

Last week, Made.com board members begun the process to formerly liquidate the business.

M&Co

Collapsed: December

M&Co collapsed once again in December, just two years after its previous administration, after “increased pressure on cash flows and trading losses” pushed it to over the edge.

The retailer, which has around 180 stores across the UK, appointed Teneo as administrators. It is vying to sell the value fashion chain.

Around 35 staff members at the retailer’s Scottish head office, working in its marketing and IT department and production studios have been made redundant.

M&Co first collapsed back in 2020 but was bought out by its existing owners the McGeoch family in a pre-package deal.

Click here to sign up to Retail Gazette‘s free daily email newsletter