Wish was once the big new disruptor on the retail scene, offering pretty much everything, from the latest fashion trends and pet accessories to household gadgets you weren’t aware existed but you now can’t live without.

The US website shot to fame in 2018 for its cheap prices – and incredibly long delivery times – and quickly became the most downloaded shopping app worldwide, doubling its revenue that year alone to £1.5bn ($1.9bn).

That was until rivals like Shein and – more recently – Temu started to gain traction, with a similar offering but more competitive delivery times.

Where does that leave Wish? Retail Gazette caught up with chief product officer Mauricio Monico on how it plans to compete with its rivals.

Wish now sits in a highly saturated market – not forgetting about the biggest Chinese giant Alibaba – but its not looking to do “same thing, just a little bit better”, explains Monico.

“What we’re continuing to do is innovate in the same way we did when we started,” he says.

When it launched in 2010, Wish.com was the only manufacturer-direct discount shopping app on the market.

The San Francisco-based platform shipped its vast array of discounted products straight from their factories.

“[The site] really introduced this model of discovery-based shopping,” explains Monico. “Most of the time you don’t even know the products exist.”

“You’re not intentionally looking for anything but based on your interests, behaviour and all the information we can collect, we’re going to be able to show you the products you are more likely to be interested in.”

Flying on a high off the pandemic online shopping trend, Wish debuted on the Nasdaq stock exchange in December 2020 providing it with an initial valuation of £11.4bn ($14bn).

However, its high was short lived when Shein, which launched in 2008, started to pick up momentum.

The Chinese fashion giant hit the $30bn turnover mark in 2022, but was quickly knocked off the top spot when rival Temu debuted last September.

Meanwhile, Wish fell behind ever further. As of August 2023, the value of its stock has fallen more than 99% from its initial £14bn valuation, meanwhile, the 13 year old business is still racking up substantial net losses.

However, Monico says that Wish is taking a much more sustainable approach to growth.

“What you’re seeing right now is the Temu’s of the world, spending a tremendous amount of getting to the market,” he says.

“We have been a lot more focused on retention of our users [and] ensuring that the products actually meet the expectations of our user.”

Becoming a reputable marketplace

Last year, then chief executive Vijay Talwar set out Wish’s comeback plan as he looked to turnaround the business.

This included launching an invite-only merchant programme, adjusting its supply chain to make its famously slow delivery faster, and boosting the customer shopping experience.

“In the past, Wish used to be a completely open marketplace – like completely unmanaged, meaning that we let the demand and supply figure itself out,” explains Monico.

“Right now, we are a little bit more of a managed marketplace. We’re putting merchants that we want on the platform, which also helps with quality and trust”.

The move – introduced in January last year – has helped to make “tremendous amounts of improvement” on the product listings, Monico says, adding that its also helped to reduce return rates.

Wish is also looking at providing a more curated feed for shoppers, with teams looking at finding further opportunities to develop the platform’s current categories.

“We’re going into H2 with a very deep focus on some new categories, as well as trying to improve the [current ones] and making them a lot more visible, more discoverable, and a better experience,” says Monico.

For example, the platform “dramatically expanded” its range of sexual wellness products last month after the line was proving increasingly popular among shoppers. It joins investments in its refurbished, health and home and garden ranges.

“We’re managing those categories very strongly and ensuring that those products actually meet the expectations of our user,” Monico adds.

Speeding up delivery

Delivery is a “key compenent” of Wish’s turnaround plan, says Monico, especially as its long waiting times, is one of the factors that saw it drop behind the marketplace newcomers.

One of the ways it is shortening lead times is through setting up distribution centres in key regions, allowing for selected products to be shipped directly.

Monico admits that “less than 2% of our products are stocked in the warehouses”.

Wish has also introduced “incentives for users to build a basket” through providing flat rate shipping, where the price is calculated on the size of the packaging instead of weight.

“We used to have delivery dates of upwards of four weeks, and now for the vast majority of our markets it’s less than 15 days and is some regions, it’s anywhere between six to 10 days.”

Building a community

As part of Wish’s turnaround plan, the business has been investing in building a community among users and has taken influences from social media platforms.

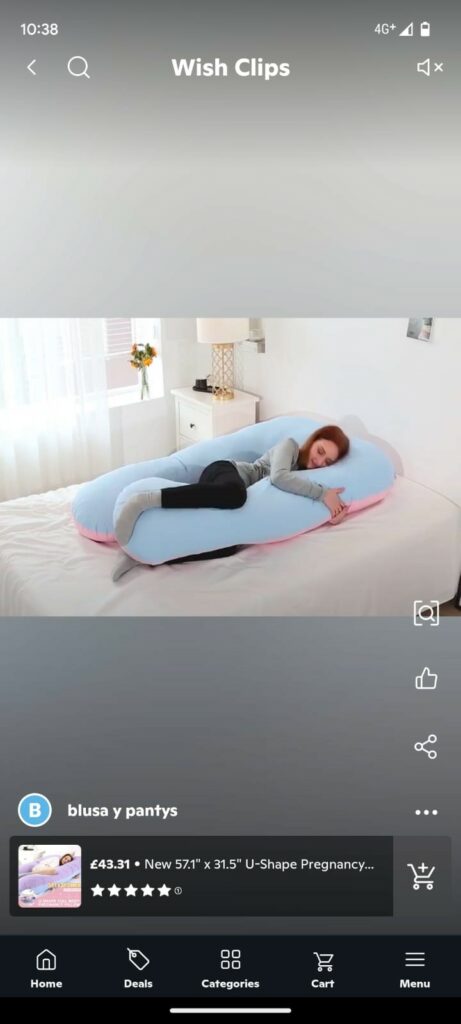

It introduced Wish Clips – a scrollable video section on its app – back in January last year allowing users “to see the product and understand how to use it”, Monico explains.

The video function has proven to be a “very good match”, helping to increase engagement among users on the platform, he says.

There are plans to invest further in building the feature’s capabilities, including its social components and user generated content.

The business launched Wish Creators last month, where influencers can earn commission when followers buy from their recommendations.

“We have created a variety of different functionalities to make the discovery experience more entertaining,” says Monico.

These initiatives form part of the company’s strategy to build trust with customers.

It has also worked on its product reviews, which are instrumental to online marketplaces with vast ranges.

However, some ecommerce platforms have seen an influx of fake reviews promoting poor quality goods.

“We only allow verified purchase reviews,” Monico says, explaining that it doesn’t even allow merchants to upload reviews received from other platforms.

It also has other checks in place to ensure all reviews are genuine.

“We have AI tools in place that allow us to identify suspicious buyer/merchant signals – from IP addresses to delivery addresses,” he says.

Wish has some way to go to catch up with Shein and Temu.

Total sales for the business dropped 46% to £174m in the six months to June 30 2023, a stark contrast to £1bn its biggest rival Shein raked in across the last 16 months for its UK business alone.

However, it seems that Wish is not letting the fierce competition in its market deter it and is focused on improving its core services over targeting mass growth.

“We’re continuing to innovate in the same way we did when we started,” Monico concludes.

Catching up with its rivals may seem like wishful thinking, however, the desire to create a more sustainable business model brings a welcome dose of realism.

Click here to sign up to Retail Gazette‘s free daily email newsletter