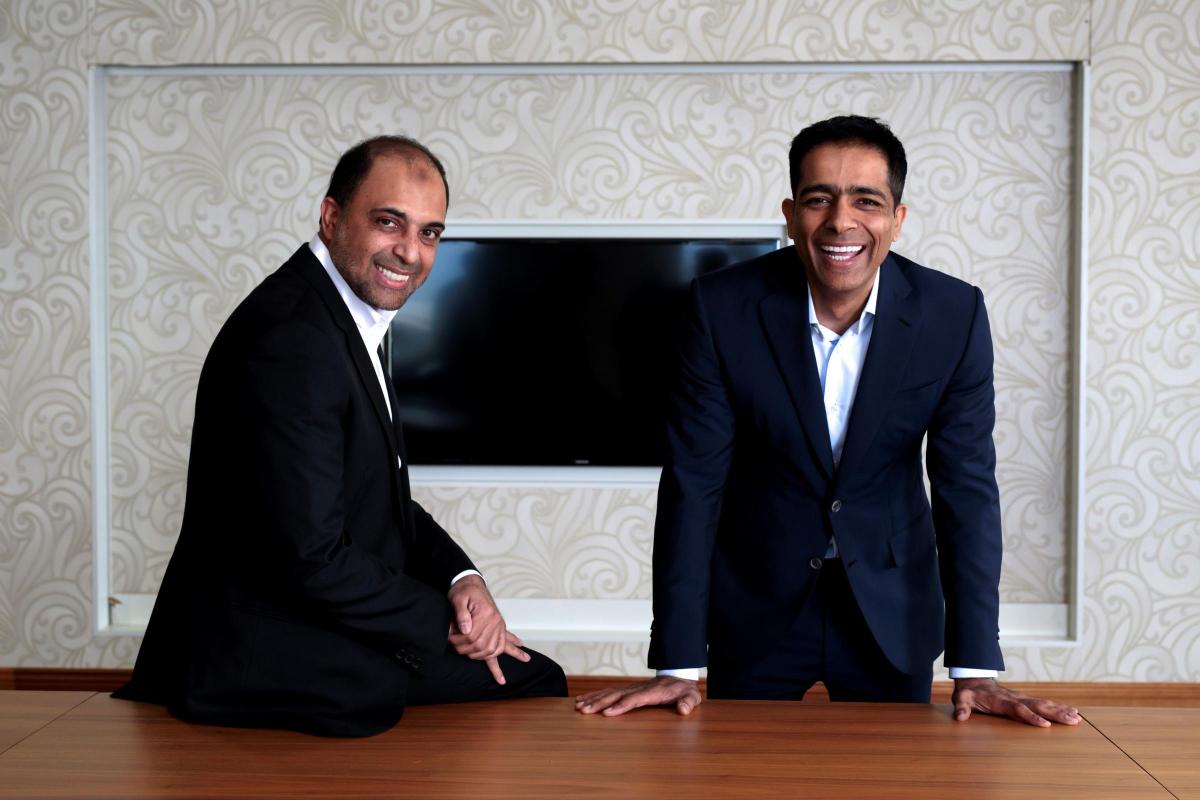

Billionaire brothers Mohsin and Zuber Issa are preparing to take their petrol station empire, EG Group, public with a New York stock market listing potentially as early as this year.

The IPO could value the firm at around $13bn (£10.7bn), equating to around 13 times its underlying earnings of $1.1bn last year and according to the Financial Times, would allow the brothers’ private equity partner TDR Capital to reduce its stake in the business over a decade after initially investing.

Zuber Issa told The Sunday Times that “the road map is starting now” on an IPO, which is expected to take place either this year or next.

It is understood that the petrol giant would float under the name of Cumberland Farms, an American c-store operator that it purchased six years ago.

The US is EG Group’s single largest market, with the group having acquired 800 convenience stores from US retailer Kroger back in 2018 for £1.7bn. The Issa’s have also built up their EG empire across the pond to operate across 30 states.

The forecourt giant sold the bulk of its British facilities to in 2023 for £2bn to Asda, the supermarket chain the brothers owned alongside TDR.

Zuber Issa sold his 22.5% stake in Asda last June and used the proceeds to buy out EG’s remaining UK locations and launch a rival business, EG on The Move. He retains his shareholding in EG Group.

Click here to sign up to Retail Gazette‘s free daily email newsletter