The Hut Group has signed an agreement to supercharge its borrowing capacity as it prepares for more acquisitions.

According to Sky News, the retail company has struck a £515 million debt deal, up from £345 million, by adding Citibank, JP Morgan and Alberta Investment Management Corporation. Its existing creditors include HSBC, Barclays and Silicon Valley Bank.

This comes as The Hut Group continues its rapid expansion, having acquired four retail brands in less than three months.

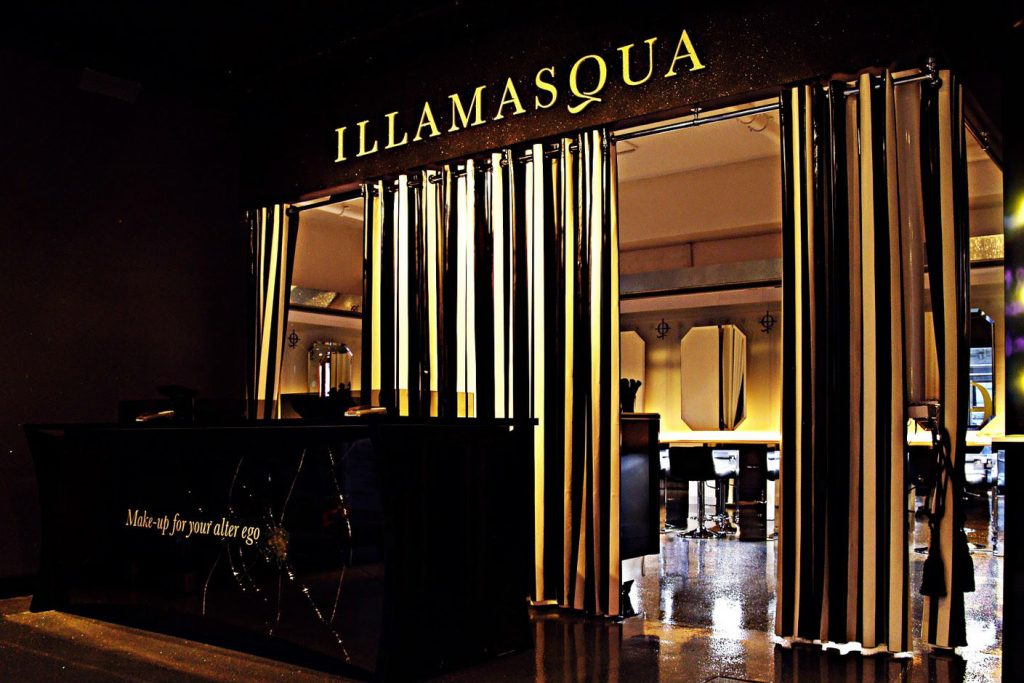

Earlier this month it purchased Illamasqua, co-owned by Agent Provocateur founder Joseph Corre, for an estimated £25 million.

In August it acquired cosmetics subscription business Glossybox before going on to purchase major Australian beauty retailer RY a week later.

In September it also purchased luxury skincare brand ESPA.

With its freshly-boosted buying power, The Hut Group says it expects to double in size by 2019.

It is also reportedly on track to see a sales rise of 50 per cent to £750 million this year, following a 67 per cent sales revenue boost last year.

“This year has seen a real acceleration in investment for THG, especially across beauty, infrastructure, technology and talent,” founder and chief executive Matthew Moulding said.

“This substantial new credit facility is another important step for the group and provides us with even more firepower to pursue our ambitions for further significant international growth.”

Click here to sign up to Retail Gazette‘s free daily email newsletter