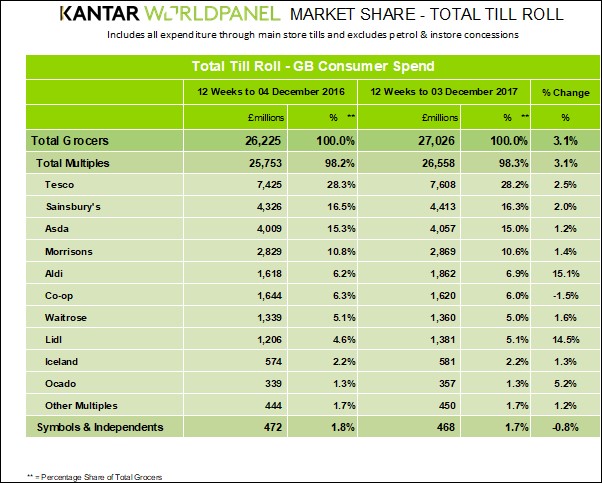

Aldi has reclaimed its crown as the UK’s fastest-growing grocer, with sales surging 15.1 per cent year-on-year in the latest quarter.

The news comes amid the latest grocery market share figures from Kantar Worldpanel, which show overall grocery sales in the UK increased in value by 3.1 per cent year-on-year for the 12 period ending December 3.

Hot on Aldi’s heels and the only other grocer to have double digit year-on-year growth is fellow German discount grocer Lidl, which had sales growth of 14.1 per cent.

The UK’s third-fastest growing grocer was online supermarket Ocado, with growth of 5.2 per cent year-on-year.

Meanwhile, the Big 4 grocers saw collective growth of 1.9 per cent during the past 12 weeks, making it the ninth consecutive period of increasing sales for the UK’s largest retailers.

Tesco – with sales up 2.5 per cent compared to this time last year – was the fastest growing of the four.

Asda had the slowest growth rate, with sales increasing 1.2 per cent year-on-year, while Morrisons increased 1.4 per cent and Sainsbury’s went up by two per cent.

Tesco’s market share slipped from 28.3 per cent to 28.2 per cent – although it was still the UK’s most-visited grocer and well ahead of main rival Sainsbury’s, which also slipped from 16.5 per cent to 16.3 per cent in market share.

Morrisons went from 10.8 per cent to 10.6 per cent of the market share, while Asda’s figures dipped from 15.3 per cent to 15 per cent.

Meanwhile, Aldi and Lidl’s market share grew from 6.2 per cent to 6.9 per cent and 4.6 per cent to 5.1 per cent respectively.

The Co-op also lost a bit of its market share, dropping from 6.3 per cent to six per cent, and it was the only grocery chain to have experienced a drop in sales, dipping 1.5 per cent year-on-year.

“With Christmas just around the corner, prices are still rising,” Kantar Worldpanel’s head of retail Fraser McKevitt said.

“Like-for-like grocery inflation now stands at 3.6 per cent – its highest level since 2013.

“Despite higher prices the British public is well into the swing of festive shopping. Alcohol sales are up by nearly £172 million compared to this time last year and while volume sales have increased, this impressive growth is mainly a result of consumers choosing more expensive festive tipples.”

McKevitt added: “Christmas day falls on a Monday this year – last time that happened, in 2006, the Friday before was the most popular day for grocery shopping that year.

“If we see a similar pattern in 2017, Friday 22 December is likely to win out as the grocers enjoy not only the biggest shopping day of 2017, but the most successful ever recorded.

“Over Friday 22 and Saturday 23 December, we expect shoppers to part with an eye-watering £1.5 billion as they fill their trollies ahead of Christmas day.”

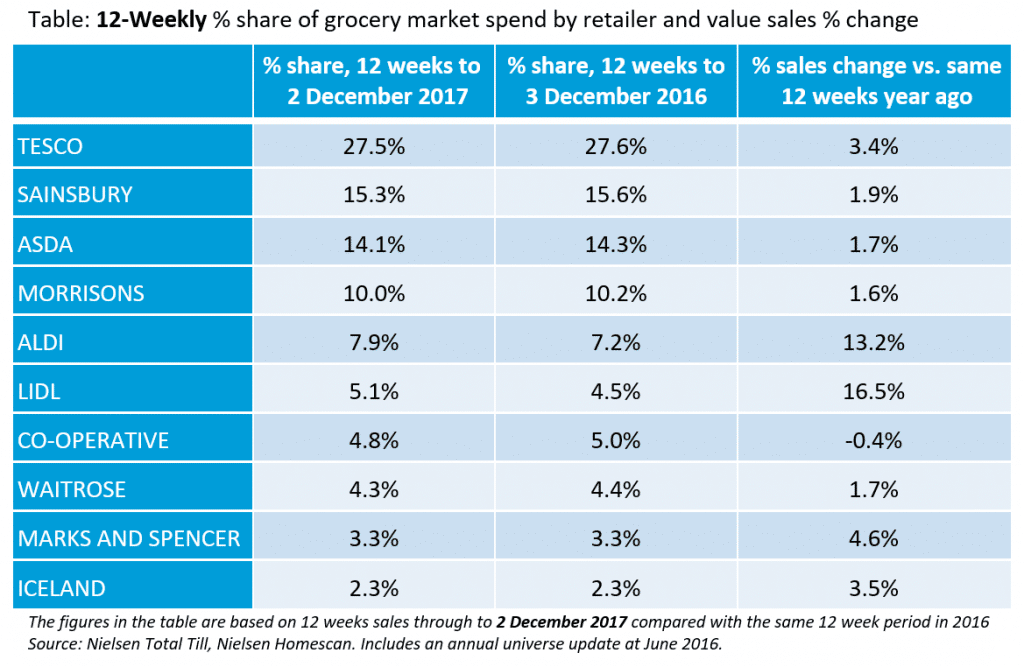

Grocery market share figures from Nielsen, which were also released today, indicated that sales at grocery retailers tills was 3.4 per cent higher versus the same period a year ago.

However, excluding the discounters it was only 1.3 per cent higher.

Among the Big 4, Tesco had the most improved performance over the last 12 weeks with sales up 3.4 per cent year-on-year, followed by Sainsbury’s at 1.9 per cent.

In contrast to Kantar’s data, Nielsen’s market share figures shows that Aldi dropped from 7.9 per cent to 7.2 per cent.

It also shows that Lidl’s sales growth made it the fastest-growing grocer in the UK, surging 16.5 per cent year-on-year compared to Aldi’s 13.2 per cent.

Outside of the discounters, Marks & Spencer had the best sales growth figures, up 4.6 per cent year-on-year.