// Moonpig announces intention to publish a registration document today

// The retailer targeted a value above £1bn in London stock market listing

// Citi and JP Morgan are leading the listing

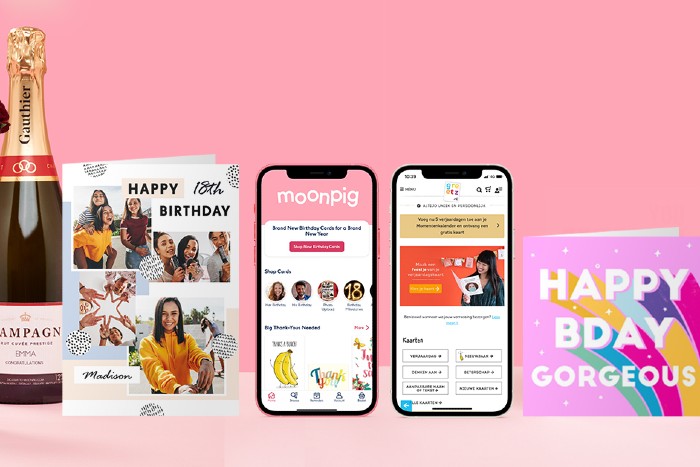

Moonpig has confirmed its intention to seek a stock market flotation in London after revealing plans to publish a registration document on Tuesday.

The online greeting cards retailer revealed that its private equity owners were targeting a free float of at least 25 per cent.

Citi and JP Morgan are leading the listing, which will value the company at more than £1 billion.

READ MORE: Moonpig plans £1bn flotation

The retailer said it was considering the float to “further raise the profile of the company”, as well as “provide it with a platform for continued growth”.

During the first two months of the UK-wide lockdown, Moonpig said it added one million customers to its platform.

It also trades in the Netherlands under the Greetz brand.

The company said it has an 86 per cent brand awareness in the UK in the year ended April 30, 2020.

Moonpig generated revenues of £173 million in the year to April 2020 and £156 million in the following half-year to October 2020.

It also delivered revenue growth of 135 per cent in the six months ended October 31, 2020, compared to 2019.

The total orders on its app increased from 16 per cent in the month of October 2019 to 33 per cent in the month of October 2020.

Moonpig said it is led by a dynamic leadership team. The establishment of a new leadership team over the last three years, including Nickyl Raithatha as chief executive in June 2018, Andy MacKinnon as chief financial officer in January 2019 and Kate Swann as chair in August 2019, has “accelerated Moonpig Group’s growth and sharpened its focus on becoming the gifting companion”.

“Moonpig Group’s mission is to create moments that matter, helping people to connect by sharing meaningful cards and gifts,” Raithatha said.

“This is more important now than perhaps ever before.

“We have built a technology platform that harnesses data science and AI at every point of our customers’ journey, making it as effortless as possible for them to be as thoughtful as possible.

“The combination of our extensive range of personalised cards, curated gifts, high-speed logistics and unique predictive insights into gifting intent helps our 12 million loyal customers to remember, choose and create the perfect card and gift for every occasion.

“We are confident that Moonpig Group will continue to make gifting even more effortless for millions of people across the UK and internationally, and, as the leaders of the accelerating shift to online, now is the perfect time for us to bring the company to the public market.”

Swann added: “Moonpig Group combines strong and sustained growth with excellent cash generation, in a market which is underpenetrated and moving online.

“I have been impressed by the management team, their innovation, and by the customer insight provided by Moonpig Group’s data.

“The board is confident that Moonpig Group is well positioned to capitalise on its first mover advantage in the online card market and continue its strong momentum in the gifting segment, benefit from the continued human need for connections, and cycle-resilient customer spend on gifts and cards.”

Click here to sign up to Retail Gazette‘s free daily email newsletter