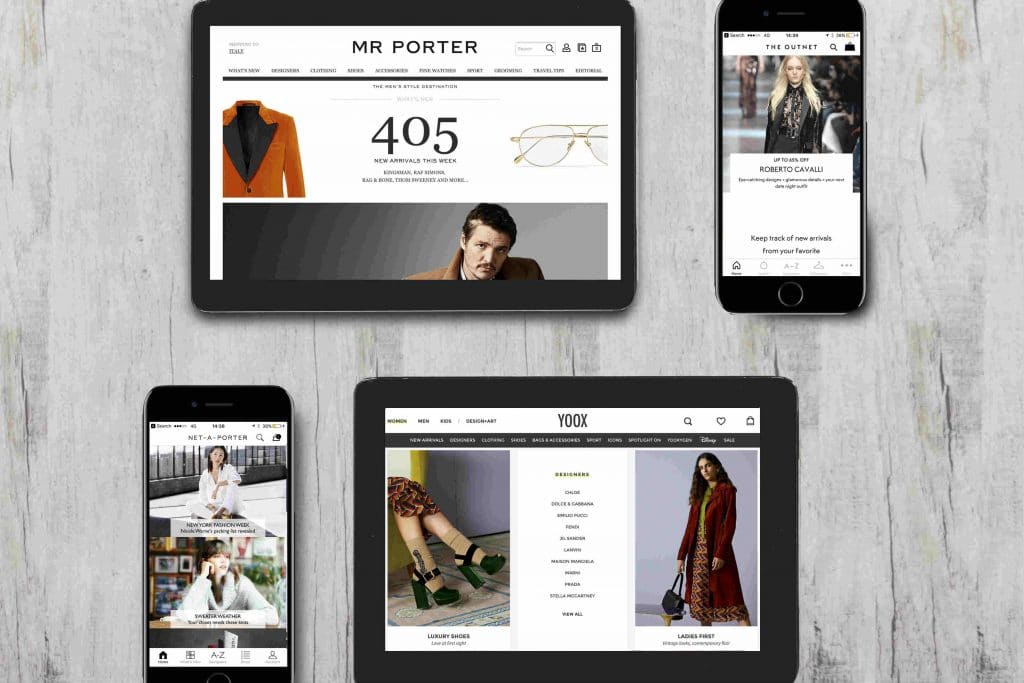

Richemont is considering spinning off its Yoox Net-a-Porter (YNAP) brand, despite investing millions into the online fashion retailer.

The Swiss-based luxury group which bought control of YNAP in 2018, has decided that the ecommerce platform has lost appeal to rival Farfetch.

Richemont’s priority is to remove YNAP from its brands, either by selling all or part of the business.

READ MORE: Richemont shares rise after rejecting merger with Kering

Richemont has hinted to analysts that it no longer regards YNAP as a strategic asset.

In March, Richemont shares rose after it was approached by French luxury goods group Kering for a potential merger in January.

Richemont had rejected the informal offer back in January.

A cash-and-shares proposal to merge had been made directly by Kering chief executive François-Henri Pinault to Richemont chairman and controlling shareholder, Johann Rupert.

Click here to sign up to Retail Gazette‘s free daily email newsletter