UK retail sales in April smashed all expectations growing at more than twice the rate of analyst predictions.

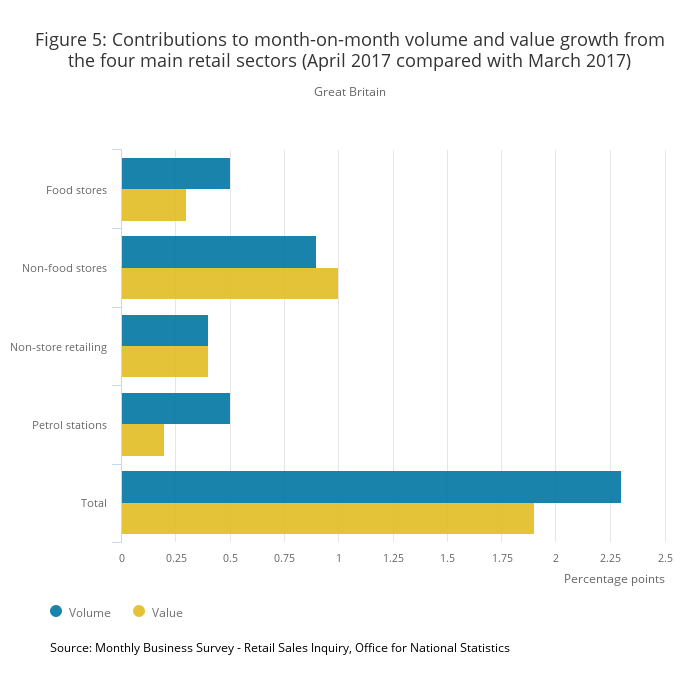

Sales shot up 2.3 per cent last month, following a decline of 1.8 per cent in March and racing past City of London analysts‘ expectations of one per cent growth.

Figures from the Office for National statistics show that sales were also up four per cent year on year, growing from just 1.7 per cent yearly growth in March.

On a three-month basis growth was offset by March‘s decline, climbing just 0.3 per cent. However, compared to the first quarter in which retail sales declined at their fastest rate in seven years, the figure still shows promise.

Soon after the figures were released, the sterling jumped 0.5 per cent past to $1.336, the highest level since last September.

All sectors contributed to the skyrocketing growth throughout the month, aside from department stores and clothing and footwear stores which saw a small decline in sales volumes.

According to the ONS: “This coincides with monthly falls in average store prices across all retailers except food stores and textile, clothing and footwear stores.”

READ MORE: Inflation hits highest level in over three years

These results are largely attributed through “anecdotal” evidence to good weather conditions, and suggest the UK consumer may be more resilient than thought after March‘s decline.

Retail service company eCommera’s head of insight Alex Hamilton stated: “Following a Christmas-driven credit binge, which raised eyebrows at the Bank of England and led to a tightening of credit conditions, this data raises may suggest the economy‘s consumption engine is starting to fire again.

“Despite this optimism, we need to strike a note of caution here. Today‘s news follows data released earlier this week showing consumer inflation hitting a three-and-a-half year high. We also saw real wages, the gap between inflation and wage growth, falling at the fastest rate in three years.

“With real wage growth expected to remain below inflation throughout most of 2017, the income squeeze on households is only set to continue.

“Against a backdrop of cost rises for retailers, emanating from national living wage and an unravelling of hedging linked to a weakness in sterling, the screw is being tightened on retail margins.

“Looking ahead, surveys of households are already showing signs of financial worries deepening, with May‘s Markit Household Finance Index indicating one of the sharpest falls in cash available to spend for two-and-a-half years in response to higher living costs.”

Click here to sign up to Retail Gazette‘s free daily email newsletter