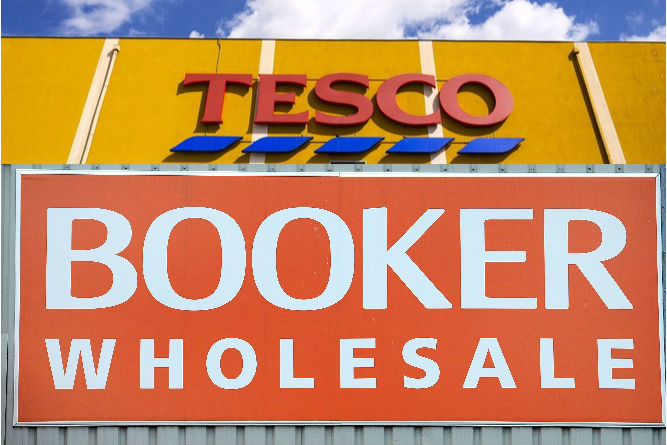

Another prominent investment advisory firm has muscled in on the Tesco-Booker merger, recommending Booker shareholders reject the deal.

Glass Lewis issued a note to investors today warning against Tesco’s proposed £3.7 billion takeover, ahead of the shareholder vote a week today.

In order for the deal to go ahead, Booker must secure 75 per cent shareholder approval.

The group said it saw “little cause for Booker investors to support what appears to be a less than compelling control transaction”.

This marks the second principal proxy advisory firm to recommend opposition to the deal, with the Institutional Shareholder Services (ISS) last week stating the deal offered “limited potential benefit” for Booker.

A week before that, activist shareholder Sandell Asset Management, which owns a 1.75 per cent stake in Booker, branded the deal “cheap”.

It said that the share price offered for Booker should represent 255p to 265p per share, far above the agreed 205.3p per share agreed when the deal was first announced last year.

Other shareholders, including Shroder’s and Artisan, who own a combined eight per cent in the company, also announced their opposition to the deal.

Despite thism the Competition Markets Authority (CMA) gave the takeover, which has already caused significant ramifications in the grocery sector, the green light in December.

Click here to sign up to Retail Gazette‘s free daily email newsletter