// Grocery sales up 1.7% according to Kantar Worldpanel or 3.3% according to Nielsen

// Sales boosted by increasing demand for fresh produce and Veganuary

// January market share: Big 4 and Waitrose decline; Aldi & Lidl increase

Grocery retailers hailed a growth in post-Christmas sales during January, which experts said was boosted in part by the strong performance of fresh produce for Veganuary.

READ MORE:

- BRC cautiously welcomes January retail sales uptick (BRC-KPMG)

- Brits’ “wait & see” attitude keeps January consumer confidence low (GfK)

- January shop price inflation edges up to highest rate since 2013 (BRC-Nielsen)

- December retail sales up 3.7% despite month-on-month dip (ONS)

- Footfall dwindles for 13th straight month in December (BRC-Springboard)

- Online retail sales growth in December hits all-time low

- December inflation drops to lowest level in two years (ONS)

The latest data from Kantar Worldpanel for the 12 weeks ending January 27 indicated overall market growth of 1.7 per cent, while data from Nielsen showed that grocery sales increased by 3.3 per cent in January.

However, Kantar said that despite the overall growth, total till roll sales fell by £1.5 billion compared with the month of December.

Nonetheless, the insights firm said consumers ate a total of 4.4 billion meat-free dinners in 2018, an increase of 150 million meals on the year before, and Dry January failed to stop alcohol sales growing by 10 per cent throughout the month.

On the other hand, Nielsen said volume growth in fresh produce was up 1.5 per cent during January, with shoppers spending over £900 million on fresh fruit and vegetables – an increase of £27 million compared to this time last year.

“Looking back on 2018 as a whole, one of the most notable consumer trends is the shift to a more plant-based diet,” Kantar Worldpanel head of retail insight Fraser McKevitt said.

“Today, one per cent of all households include a vegan, five per cent have a vegetarian and 10 per cent have flexitarians in their ranks.”

He added: “Following an indulgent Christmas period, health-conscious shoppers and Veganuary participants helped sales of fruit, vegetables and salad surge by £46 million compared with January last year.”

Nielsen head of retailer insight Mike Watkins said the increase in fresh grocery spend was a testament to evolving shopping trends.

“In the new year, consumers are focusing on positive diet changes which are not just healthy, but convenient, cheap and are less wasteful overall,” he said.

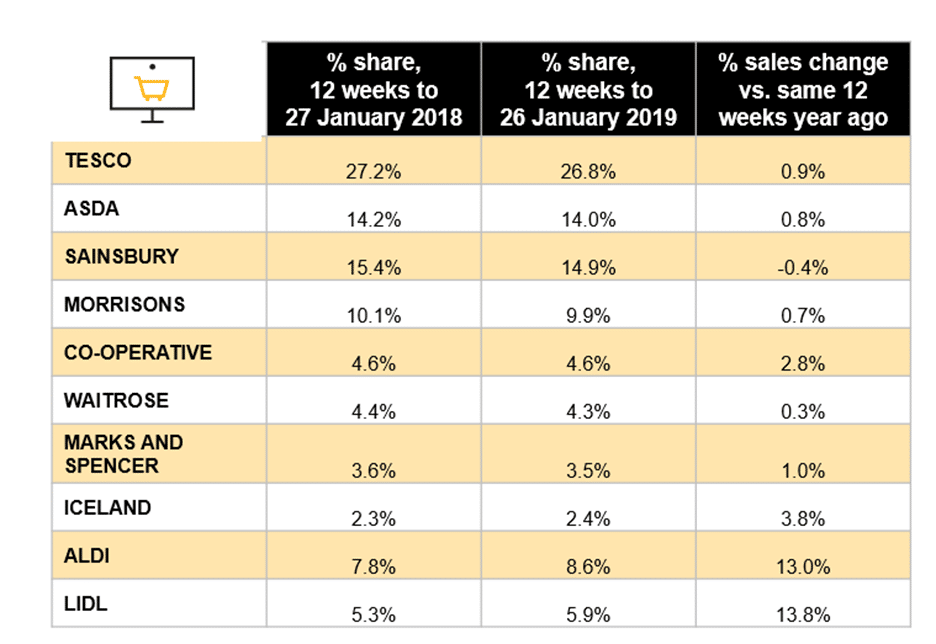

In terms of market share, both Kantar and Nielsen indicated that the Big 4 retailers, along with Waitrose, lost a bit of their market share while Aldi and Lidl had increased once again.

Kantar added that Aldi and Lidl continued to lead the field with 18.3 million households shopping in at least one of the German discounters over the past 12 weeks.

Meanwhile, Kantar said the Co-op’s market share had increased while Nielsen indicated it held steady, and Iceland’s market share had grown according to Nielsen but remained steady according to Kantar.

Kantar Worldpanel’s market share data:

Nielsen’s market share data: