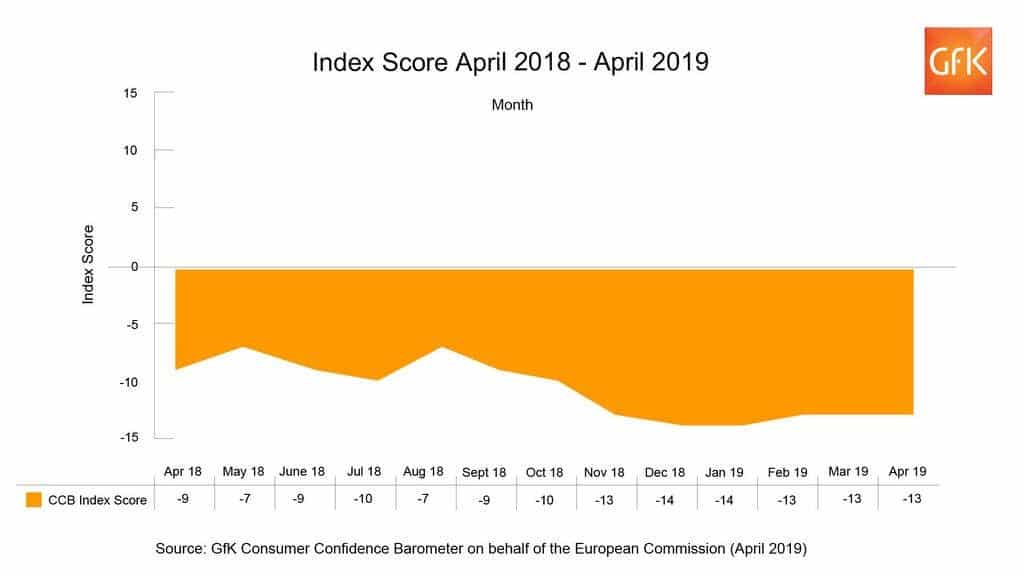

// GFK Consumer Confidence Index found that consumer confidence remained negative, but stable, during April

// The index found two measures increased and three decreased last month

// Overall confidence remained stable but negative at -13

Consumer confidence has remained negative but stable during April, according to the latest GFK Consumer Confidence Index.

READ MORE:

- March consumer confidence holds steady despite Brexit fears

- Subdued growth in March online retail sales

- March retail sales see strongest growth since August (ONS)

- High street footfall continues to battle wrath of “no splurge” culture

- Brexit uncertainty adversely affects March retail sales (BRC-Nielsen)

- March shop price inflation at its highest in over 5 years

The index records general economic and personal financial situations, and found two measures increased and three decreased in April.

Despite Brexit uncertainty, overall consumer confidence remained stable but negative at -13, the same level as February and March but four points less than April last year, when it stood at -8.

Meanwhile, the index found that consumers’ personal finance situation in the past year saw a dip to -1, one point lower than March but the same as April 2018.

Looking ahead for the next 12 months, the index around personal finance dropped by two points and now stands at zero – compared to the reading of four in April last year.

General economic uncertainty over the last 12 months had improved and was three points higher than March, but remained negative at -30 and almost on par with April 2018, when the index read -29.

Sentiments about the general economy over the next 12 months also improved, but only by two points and now stands at -34. This is still far off from the -24 reading in April 2018.

Finally, the major purchase index dropped by one point to -1, marking a steady decrease since February’s reading of five and the reading of three in April last year.

“Despite political carry-on in the Westminster bubble with the clock ticking on Britain’s eventual departure from the EU, consumers are holding firm and remain unshaken by the daily headlines of turmoil and intrigue, although we remain in negative territory.

“This month we are reporting a dip in the measures for our personal financial situation looking back a year and ahead to the coming year but this is balanced by a small increase in our perspective on the state of the UK economy.

“The further two-point drop in our measure on ‘major purchases’ suggests more challenges in the near future at least for the retail sector.

“The biggest change is a sudden drop in the motivation to save money – this is down by eight points – and represents the largest monthly drop in our savings measure since after the Brexit referendum in June 2016.”

Click here to sign up to Retail Gazette’s free daily email newsletter