It seems like every retailer is looking to launch a marketplace right now to expand their online reach and of course, boost sales.

However, B&Q was one of the first to lead the pack when it unveiled an expanded choice of over 300,000 products from more than 400 verified sellers on its website diy.com in 2022.

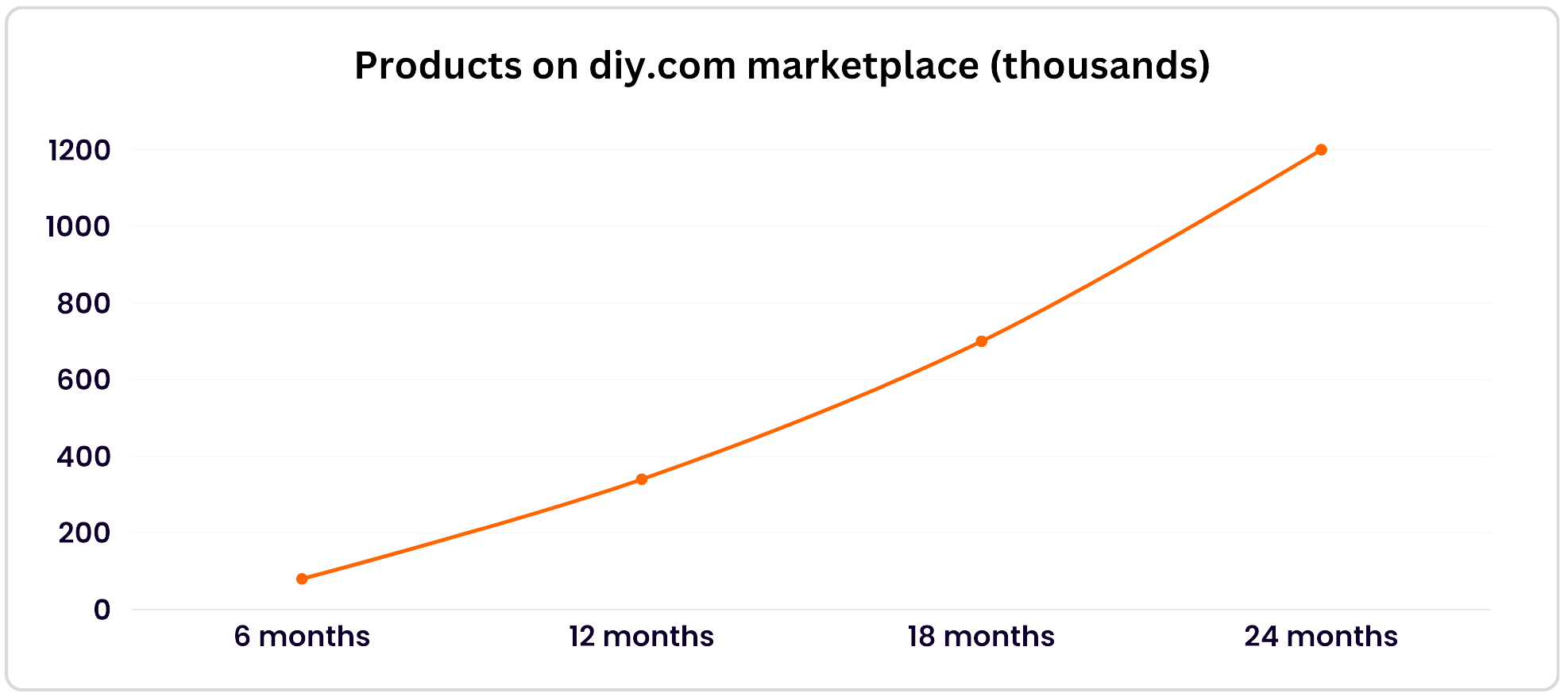

Now entering its third year, the marketplace has over 1.2m products from more than 1,000 sellers and represents 38% of the retailer’s total online sales – up from 13% in 2022. B&Q’s success has also served as a blueprint for the rest of the Kingfisher business, which has since launched marketplaces in France and Poland.

The scale and growth of the platform still comes as a shock to B&Q’s head of marketplace Tristan Commecy.

“We’ve been surprised by the amount of new customers we’ve been able to bring to our universe by extending our ranges this way,” he says, explaining that around 50% of its shoppers in 2023 had never previously bought something from the retailer.

“We knew that going into more depth into existing categories and opening adjacent categories would bring us new customers but we were a bit surprised by the quantity.”

Becoming a one-stop shop

Commecy explains the home improvement retailer chose to launch its marketplace after customers demanded more choice online and wanted to have the convenience of all the products required for their DIY projects in one place.

“We had a great range back then of 40,000 products, but we didn’t have everything,” he says.

“We didn’t have all the colours or the different products to suit the tastes of all our customers. One way to increase the product selection really fast was to launch a marketplace and to partner with best sellers across all categories to bring more products more choice to diy.com.”

B&Q’s marketplace, which took in £154m last year, now spans 23 product categories.

“We used the marketplace to start developing a range within categories for which we were not particularly known for,” he says, including cookware, tableware and small domestic appliances such as air fryers.

“It was an immediate success without us having to take time to build the knowledge of the new range,” Commecy explains.

He lets slip that the retailer is in discussions with a couple of sellers that have performed well on the marketplace about selling some of their items in B&Q stores.

Commecy also attributes the marketplace’s success to “customers having a lot of trust in the B&Q brand”.

Attracting sellers onto the platform has become a much easier task since its initial launch thanks to its strong performance.

“The merchants and brands know how much traffic is going through diy.com on a daily basis so it gives us a very, very powerful selling point when we reach out to them,” says Commecy.

He points out there are much more sellers expressing an interest to join the platform now.

Don’t be the fashion police

Commecy says his team quickly learnt that in launching an online marketplace you shouldn’t try to be, what he termed, the “fashion police”.

“One of the first categories we launched was wallpapers and of course, as soon as we started to invite the sellers, we saw all types and tastes of wallpapers.

“Obviously not all of them met our own personal taste, so we were asking ourselves would we range this?

“We were very surprised to see products that we probably would not have ranged ourselves if we had to buy them for stores, still selling.”

Commecy believes that if his team had tried to “dictate the taste and to limit the customer choice” then consumers would have found elsewhere to shop.

He explains they now ask sellers to list their entire ranges – of all styles and sizes – “so that we can maximise customer satisfaction and make sure everybody’s finding the exact right products for their project”.

As B&Q looks to develop the marketplace capabilities, it has also opened up its promotional events to its third-party sellers, which Commecy says drives a surge in traffic and makes these sales better for customers and sellers alike.

He attributes the “very strong final quarter” it had to the Black Friday promotions that it ran.

“I think we had over 27,000 products on promotion during Black Friday,” he estimates.

The race to 2 million products

Commecy has some big targets for the marketplace, with his first focus on growing the product assortment to 2m in the next 12 months.

He says the retailer is “still very much in the high growth phase” of growing its range.

“In the categories we have, we still see there’s room for more. We still don’t have all of the products, all of the variations, to make sure the customers find exactly what they’re looking for.”

Commecy is looking to build out certain categories such as building supplies, flooring and tiling.

“These are the most complex categories and usually require large shipments, so we need to get the delivery and the delivery charges right so that it’s appealing for customers and makes sense from an economic point of view for the sellers.”

Adjacent categories, such as pets, is also another growth avenue the retailer is exploring, explains Commecy.

“We saw from the search data on diy.com that we already had people coming to our platform and searching for these kinds of products but we didn’t have the assortment.”

He explains that within 48 hours of his team spotting the opportunity to join the “pet care universe”, it had found sellers to join the marketplace and started to list the products.

Despite rapidly growing its range, Commecy says he’s not worried about the products losing their relevance.

He describes the platform as “self-sustained” in that the algorithm boosts products that perform well and those that don’t, are “gradually de-ranked” to lower down category pages.

“We don’t want to intervene too much and we really let the ranking work because we know it reflects the customer’s preference,” he says, but adds his team are looking closely at the quality of its data on product reviews and rate of returns.

Commecy’s growth ambitions come under B&Q’s strategy to have at least 40% of its online sales attributed to the marketplace. As of January, this sat at 38%.

B&Q marketplace 2.0

As part of his plans to develop B&Q’s marketplace, Commecy shares that he’s looking to introduce international sellers to the platform.

“It’s complex because we need to look at cross border shipping and the tax implications,” he explains, adding that customers are looking for even more selection.

As Commecy plots the next phase of the marketplace, a natural progression seems to be making some of the products from the third-party sellers available for click-and-collect.

“We’re looking at ways to leverage our fantastic store network because we know that the home delivery option doesn’t work for customers all of the time.

“We’re already offering click-and-collect for our own products in our store so naturally, we’ll be seeking to unlock the same capability for marketplace products.”

Commecy believes the move will help increase conversion even further and improve participation, but points out its not an easy task to complete.

“We can’t afford to have every single seller sending products to store at different times with a different courier so it’s a big and complex solution.”

He explains his team are still working out the eligible products for click-and-collect as well as different possible logistics solutions of cost-effectively transporting the goods from sellers to stores.

B&Q customers are used to having free in-store collection for all the B&Q products so they’ll be looking to recreate that for its marketplace items too, says Commecy who predicts the service will be rolled out at some point within the next 18 months.

The secret to success

B&Q has enjoyed remarkable growth with its marketplace which has helped to support the rest of the business amid softening demand and to achieve record market share.

Commecy says his biggest piece of advice is to give sellers the right tools to help them succeed.

“Initially, we were were much more restrictive in terms of shipping but then we realised that our rules didn’t apply to a number of sellers,” he says.

“For example, those who did custom made to orders, we were effectively blocking from selling on our platform. Once we enabled them to have more shipping options, they brought more products which has drawn more customers and increased their sales.”

The business also scrapped the content guidelines it first had in place for those listed on its marketplace.

“We’ve seen sellers doing things differently than B&Q, but still having a great conversion rate because they understand the importance of content, description images and even though they do things differently, it doesn’t mean it’s not going to work.”

He concludes that if by giving sellers “the right tools to improve their offering, you make your customers happier”.

Click here to sign up to Retail Gazette‘s free daily email newsletter