With consumer confidence subdued, concerns over rising costs and new technology redefining customer expectations, 2025 was a rollercoaster for all aspects of the retail sector.

But will 2026 be any different?

In the first of a two-part series, Retail Gazette hears from seven industry experts with predictions for the 12 months ahead.

The importance of blended retail

Carina Hummel, UK managing director for Optics at Specsavers, says one trend that will be key in 2026, is that “customers expect a truly blended retail experience”.

“We’ve long believed that people should be able to engage with us in whatever way suits them best.

“Whether that’s starting their journey online, seeking the expertise and friendly face that comes with an in-store environment, or moving seamlessly between the two, and that principle will only grow in importance.

“But a blended experience doesn’t diminish the significance of physical retail. If anything, it reinforces it. Customers may start their journey online, but they still value the reassurance, expertise and human connection that only the high street can provide.

“Retailers with deep community roots – and who stay closely attuned to the people they serve _ will ultimately come out on top.”

Brand loyalty cannot be taken for granted

Jacqui Baker, head of retail at auditing and consultancy firm RSM UK, says while the November Budget “didn’t deliver a killer blow to consumer confidence”, it “didn’t provide much of an incentive to get spending”.

“In fact, following the budget, nearly 60% of consumers said they plan to save more or continue saving at the same rate over the next three months, suggesting caution remains king.

“With most tax rises backloaded to the end of the decade, it’s likely consumers will be muddling through the continued cycle of uncertainty next year which doesn’t bode well for the sector.

“Household saving rates remain extremely high, but with more interest rate cuts on the horizon and inflation coming down, this should help consumers feel like they have a bit more money in their pockets and hopefully prompt them to spend rather than save.”

She added: “With an abundance of product variety in the retail space, loyalty is no longer guaranteed, so brands are having to fight harder than before to win over consumers. When looking at Gen Z shoppers, only 28% consider themselves loyal to brands, with 33% preferring to mix familiar brands with new or trendy ones and 25% actively seeking out new brands.

“Budget loyalists tend to be younger and the most financially constrained; given their price sensitivity they tend to stick to trusted brands. Experimentation also tends to accelerate with online shopping. Retailers must focus on continually re-winning loyalty through relevance, authenticity and innovation. The use of artificial intelligence will be key here to flex their approach depending on the consumer and their needs.”

The high street revival

Martin Smethurst, CCO at retail communications firm VoCoVo, believes 2026 will “mark the comeback of the high street as bustling, vibrant community hubs”.

“Despite a backdrop of closures, regeneration is a work in progress and gaining momentum in towns up and down the country,” he says.

“The Government’s recent Pride in Place initiative, for example, allows local people to have a greater say in the future of their beloved high streets.

“Our high streets are vital to the UK’s economic and social fabric, providing a space for people to meet, shop and connect with each other.”

He added: “But, it’s going to take a collective effort to breathe new life into our precious community centres, with government and council initiatives needing to drive regeneration from the top.

“Thoughtful planning must combine with accessible parking and affordable rates to keep retail centres attractive next year.”

“Going into 2026, turning the tide on retail crime will require a collective effort. The passing of the Crime and Policing Bill into law will result in more arrests and tougher action against retail criminals, with the assault of a shopworker becoming a standalone criminal offence.

“This alone, however, is not enough to fully protect shopworkers, particularly from non-criminal acts such as verbal abuse.

“Charities and industry bodies, such as the Retail Trust, must continue to get behind and support retailers, with the startling reality that 77% of retail team members have faced intimidating behaviour in the last year.”

Opportunities for indies

Martin Swadling, customer director at logistics firm Co-op Wholesale, says the independent sector has a “real opportunity” to “lead the next phase of growth in grocery” in 2026.

Martin Swadling, customer director at logistics firm Co-op Wholesale, says the independent sector has a “real opportunity” to “lead the next phase of growth in grocery” in 2026.

“The fundamentals are clear: value will remain the primary driver of choice, but value in its broadest sense and not simply the lowest price,” he says.

“We expect strong, well-executed in-store promotions to be absolutely critical, giving shoppers clear reasons to visit and to spend more when they do.

“Own label will continue to play a central role in this value equation. By 2026, the most successful independents will be those that have invested in own-label ranges that deliver both affordability and quality.

“Independents are uniquely placed to win by offering credible dine-in and tonight’s-tea solutions, supported by premium own-label ranges that allow shoppers to enjoy small luxuries, either through restaurant-quality meals at home or as a trade-up treat.

“Shopping behaviour will continue to evolve as we’re seeing fewer trips but larger baskets. Great in-store standards will be non-negotiable: visually appealing stores, outstanding fresh food offers, and clearly communicated promotions will be essential to converting footfall into basket spend.”

Hybrid models become the new normal

Jack Tomson, chief growth officer at retail, fulfilment and refurbishment partner Trojan Group, argues that 2026 is shaping up to be “a year of major shifts” for the retail sector.

“More brands will move to a hybrid Amazon model, balancing Amazon 1P with Amazon 3P, while continuing to invest in their own direct-to-consumer channels,” he says.

“This approach gives brands greater control over pricing/margins and reduces risk when Amazon scales back 1P buying.

“It’s fast becoming the smartest way to stay visible, profitable, and resilient on the platform.

“How shoppers find products will change, too. With more people turning to AI-led, conversational searches, brands will start rewriting product pages, FAQs and wider content so they appear when someone asks a question rather than types in a short keyword.”

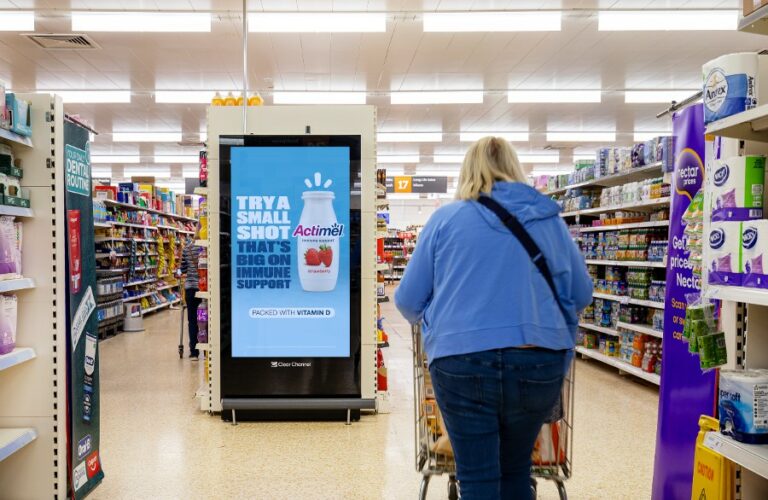

“And then there’s retail media. With Amazon, Tesco, Sainsbury’s and TikTok continuing to build out their digital ad networks, brands are starting to divert more trade spend towards these digital placements.

“If that trajectory continues, retail media may well move ahead of traditional trade spend and become one of the main performance levers for brands.”

The further rise of retail media…

Tom Ridges, CEO of consultancy Herdify, highlights the growing importance that retail media will have in 2026.

“This year we have seen retail media really come into its own,” he says.

“Off-site buying powered by retailer data has accelerated rapidly, giving brands the ability to reach people long before they reach the store.

“The latest forecasts suggest retail media will overtake the combined investment in linear and streaming TV globally by 2026, a shift that would have been unthinkable a few years ago.

“But growth alone isn’t the real headline. What matters is trust. Retail media works because it’s based on what people actually buy.

“And when you pair that with an understanding of how behaviours spread through local communities, how a recommendation in one neighbourhood can ripple into another, the opportunity becomes far bigger than a product slot on a webpage.”

“As standards for measurement are being formalised, brands should expect proof of incrementality. That means clear definitions of what counts as on-site versus off-site, and evidence of true ‘extra sales,’ not just re-labelled last-click wins.

“In 2026, the most successful retail media strategies will combine rich retailer data, rigorous measurement, and an understanding of how influence travels through communities.”

… as long as the content remains relevant

Selen Ozkan, marketing platform Uber Advertising’s head of CPG EMEA, agrees retail media is “entering a new phase in 2026”.

“No longer the shiny new toy, it has matured into a commercially dynamic channel, offering high-intent audiences and environments that closely mirror how people shop today,” she says.

“The biggest opportunities will come from engaging consumers in the micro-moments where choices are being made, not weeks or days beforehand, and aligning messaging, creative, and commerce to those moments.”

“Incrementality, transparent outcomes, and closer integration of media, commerce, and brand-building strategies will be critical.

“In this environment, the platforms and networks that provide signal-rich, contextually relevant opportunities will be best positioned to help brands drive immediate results and build lasting connections with consumers.”

Click here to sign up to Retail Gazette‘s free daily email newsletter