The proposed Tesco-Booker merger has been met with fresh opposition after two major shareholders warned it would damage the grocery giant’s turnaround efforts.

Earlier this year, Daniel O‘Keefe, of hedge fund Artisan Partners, and City investment giant Schroders — both of which together hold around nine per cent of Tesco shares — wrote to chairman John Allan and urged him to scrap the proposed £3.7 billion takeover.

Speaking to The Telegraph, O’Keefe now said there was a general consensus of dislike and apathy for proposed deal among Tesco‘s other investors.

“I have spoken to shareholders, I would say I haven‘t spoken to anybody that likes the deal,” O’Keefe told The Telegraph.

READ MORE: Competition watchdog launches probe into Tesco-Booker merger

“My sense is that you have shareholders who are sort of wavering between indifference and outright distaste for the deal, yet most of whom are unwilling to speak up.”

The news comes a week after the Competition and Markets Authority (CMA) said it would start an investigation into the proposed takeover so that it could “assess whether the deal could reduce competition and choice for shoppers and other customers, such as stores currently supplied by Booker”.

The proposed deal would also need to be put to a vote to Tesco’s shareholders.

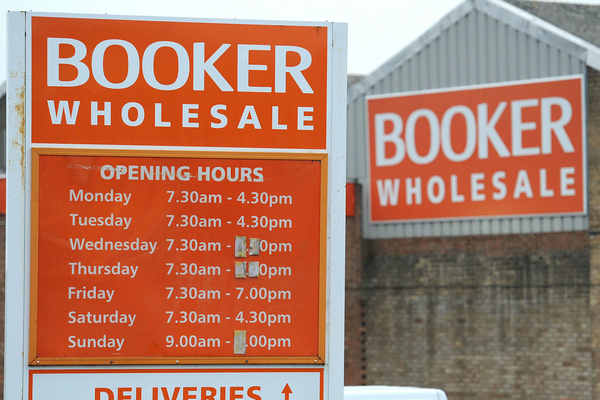

News of the proposed merger first emerged in January when Tesco agreed terms on a deal to acquire Booker, the UK‘s biggest wholesale supplier which also owns the Premier, Londis, Budgens and Happy Shopper convenience shop brands.

Click here to sign up to Retail Gazette‘s free daily email newsletter