Consumer confidence in the UK rose slightly in August but household finances fell for the fifth month in a row, according to new data.

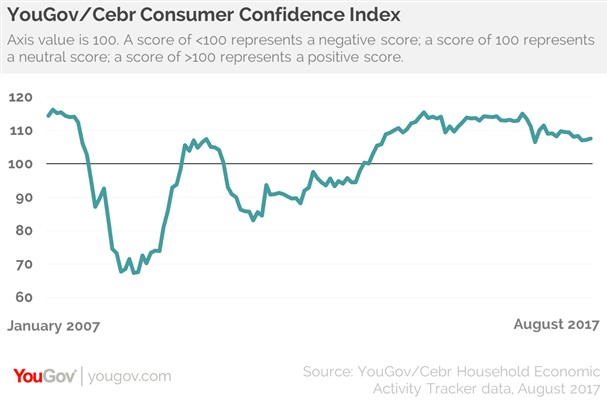

The latest analysis from the YouGov/Centre for Economics & Business Research (Cebr) Consumer Confidence Index stands at 107.6 this month – up from 107.2 in July.

Any score over 100 means more consumers are more confident than unconfident, and the August score is the highest the index has recorded since the General Election this year.

The news comes as various sources paint a lacklustre picture of UK retail. The Office for National Statistics last week reported that retail sales beat analysts‘ expectations in July despite consumer demand continuing to wane, while the Confederation of British Industry said UK retail experienced its worst month of growth since the the Brexit vote.

READ MORE: UK retail sales above expectations thanks to “extremely resilient” consumer

Data for the YouGov/Cebr index was compiled from a survey of 6000 respondents where they were asked about household finances, property prices, job security and business activity – both over the past 30 days and looking ahead to the next 12 months.

Five measures improved in August, while three declined.

The areas seeing the strongest increase are anticipated job security over the next 12 months and house values in the coming year. However, YouGov said both measures were still below the level they were at before the General Election.

The areas seeing the strongest increase are anticipated job security over the next 12 months and house values in the coming year. However, YouGov said both measures were still below the level they were at before the General Election.

The index also shows that household finances over the past 30 days continued to decline – falling for the fifth month in a row, something that has never happened before.

Both backward and forward-looking business activity measures also declined to their lowest levels in three-and-a-half and four-and-a-half years respectively.

READ MORE: UK retail endures worst month since Brexit vote

“Although this month‘s consumer confidence figures bring good news, they have to be placed in context – they have not yet returned to where they were ahead of the election,” YouGov boss Stephen Harmston said.

“This is demonstrated vividly when it comes to homeowners‘ expectations over the coming year.

“While there has been a notable improvement on this measure, it is still someway short of where it was in May and even further away from where it was ahead of last year‘s EU referendum.”

Cebr’s head of macroeconomics Nina Skero added: “At the moment the UK economy is treading water rather than making waves – the question being whether this is a relatively good or bad thing.

“Our latest consumer confidence figures are positive in certain respects, with the house price measures gaining ground and job security improving.

“However, people‘s household financial situations over the past 30 days have declined for the fifth successive month – something that has never happened since we started tracking it in 2009.”

Click here to sign up to Retail Gazette‘s free daily email newsletter