// Sir Philip Green offers £185m in additional funds to reduce Arcadia Group’s pension deficit

// The offer is part of a bid to win approval from creditors for a CVA proposal

// Arcadia launched its CVA proposals last week, and features 23 store closures and 520 job cuts

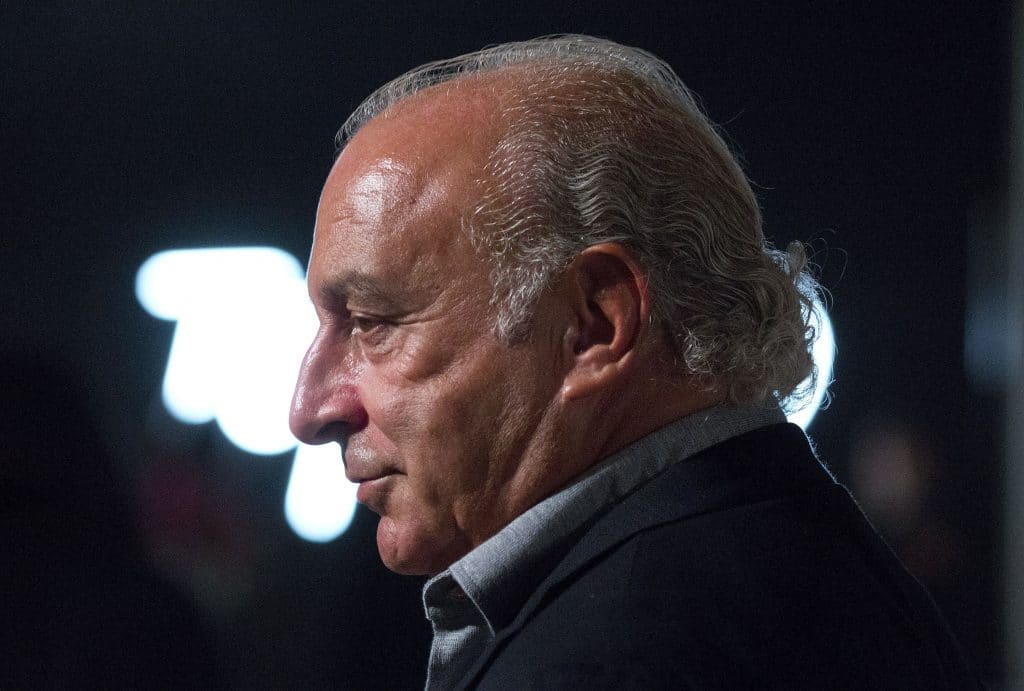

Sir Philip Green has offered to provide £185 million in additional funds from property assets to help reduce Arcadia Group’s pension deficit as part of a bid to win approval for its CVA.

It comes after Green’s longtime critic Frank Field MP wrote a letter in which he asked for a commitment from the retail tycoon to make a personal payment in the event that a deficit reduction plan proves insufficient.

READ MORE:

Field’s letter came shortly after Arcadia Group unveiled its CVA proposals last week, which features 23 store closures and 520 job cuts, and rent reductions on 194 additional stores across its UK and Irish operations.

It has since emerged that another 25 stores under the Evans and Miss Selfridge fascias will shut down as part of separate insolvency proceedings, including the flagship Miss Selfridge store on Oxford Street.

Arcadia’s pension debt is reportedly around £565 million.

Field, who is chairman of parliament’s Work and Pensions Committee, said it was “disappointing” to see Arcadia’s CVA proposals include a reduction of contributions to the pension deficit – from £50 million to £25 million.

It is not known if Green is responding directly to Field’s letter, but the additional £185 million he is now offering will me made up of property assets.

This includes security over Arcadia’s flagship Topshop Oxford Street store, which would allow the property to be sold to shore up the pension deficit if a CVA is not enough to replenish Arcadia’s coffers.

Lady Tina Green – wife of Sir Philip and a major shareholder of Arcadia – is already set to inject £50 million of equity into the business, on top of £50 million she has already loaned, if the CVA is approved.

The latest news comes after Arcadia last week sent a 312-page document to landlords that laid bare its dire financial state, according to The Telegraph.

The document reveals that Arcadia’s earnings have plunged from £215 million to £30 million in the last five years, while like-for-like sales dropped by nine per cent last year.

The company attributed the performance to “increasing switch from in-store to online shopping”, aggressive discounting by competitors, rising business rates, and the new living wage.

Arcadia also said its £170 million annual rent bill is 30 per cent higher than it should to be, based on market rates, and that the most of its credit insurance cover had been withdrawn.

Arcadia directors will meet creditors – which includes The Pensions Regulator, the Pension Protection Fund and landlords – on June 5 to seek approval for its CVA proposals.

The CVA will only go ahead if at least 75 per cent of creditors vote in favour of it.

Green recently lost his billionaire status due to the pension debt that plagues Arcadia, which was valued as “worthless” in this year’s Sunday Times Rich List.

Green and his wife’s stake in Arcadia was last year valued at £750 million, but compilers for the rich list removed £300 million from their worth to allow the shoring up of the deficit.

Green’s reputation also was left damaged by the 2016 collapse of BHS – once part of Arcadia for 15 years until he sold it off for £1 in 2015 – which resulted in the loss of 11,000 jobs and a £571 million pension black hole.

The retail tycoon was eventually forced to plug up to £363 million into the scheme of thousands of former BHS employees.

Click here to sign up to Retail Gazette‘s free daily email newsletter