// Moonpig sees “temporary increase in average order values”

// It now expects revenue for the financial year ending April 30, 2021 to be approximately double the £173 million revenue for the previous year

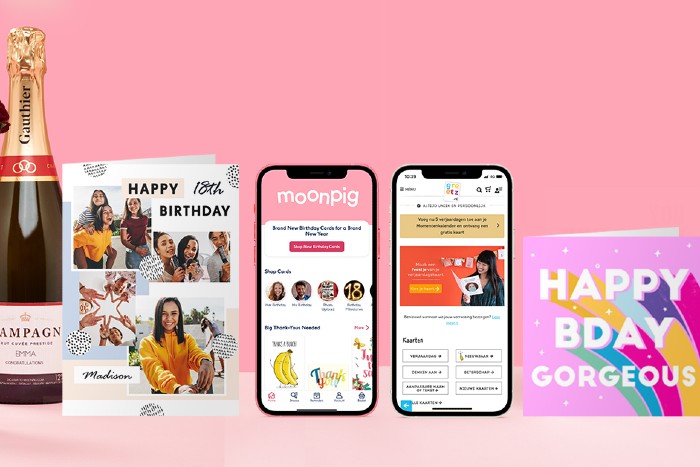

Moonpig has witnessed an increase in its trading performance during the first half of the year.

Last week was “the strongest ever trading week” in the group’s history ahead of Valentine’s Day.

The gifting and cards retailer has seen a “temporary increase in average order values” as more customers attach gifts to their orders.

READ MORE: Moonpig begins £1.2bn stock market float

“In line with our strategy in the first half of the year we have further increased marketing activity to accelerate customer acquisition,” Moonpig said.

It now expects revenue for the financial year ending April 30, 2021 to be approximately double the £173 million revenue for the previous year.

On top of higher marketing spend, Moonpig has incurred incremental costs and capital expenditure due to higher temporary staffing levels throughout its supply chain, and also by the partial shifting of its production mix to the UK following the Guernsey lockdown.

The higher levels of customer purchase frequency and elevated gift attach rates are both expected to moderate as lockdown restrictions ease.

Earlier this month, Moonpig debuted on the London Stock Exchange with a market capitalisation of £1.2 billion. It said the offer price of its IPO will be 350p per share.

The flotation comprises 5.7 million new shares to raise gross proceeds of £20 million and 134.6 million existing shares being sold by certain existing shareholders – equating to a total offer size of £491.2 million.

Click here to sign up to Retail Gazette‘s free daily email newsletter