Asda and Morrisons are going head-to-head on who can win back shoppers and boost profits amidst stiff competition from the rest of the sector.

The pair have seen their market shares – as well as sales and profit – sink over the last couple of years as consumers head elsewhere for their weekly grocery shops.

Morrisons narrowly avoided being overtaken in the grocery league tables for the second time in three years earlier this month, with rival Lidl following closely behind as it picks up the pace of its expansion plans and competitive value offer to become the UK’s fifth largest grocer.

Meanwhile, Asda chair Allan Leighton said earlier this year that the supermarket was utilising its “significant war chest” to defend its place as the UK’s third largest grocer.

Retail Gazette takes a look at what Asda and Morrisons are doing to win back shoppers, reverse sliding fortunes and win the race to recovery.

Where do Asda and Morrisons currently stand?

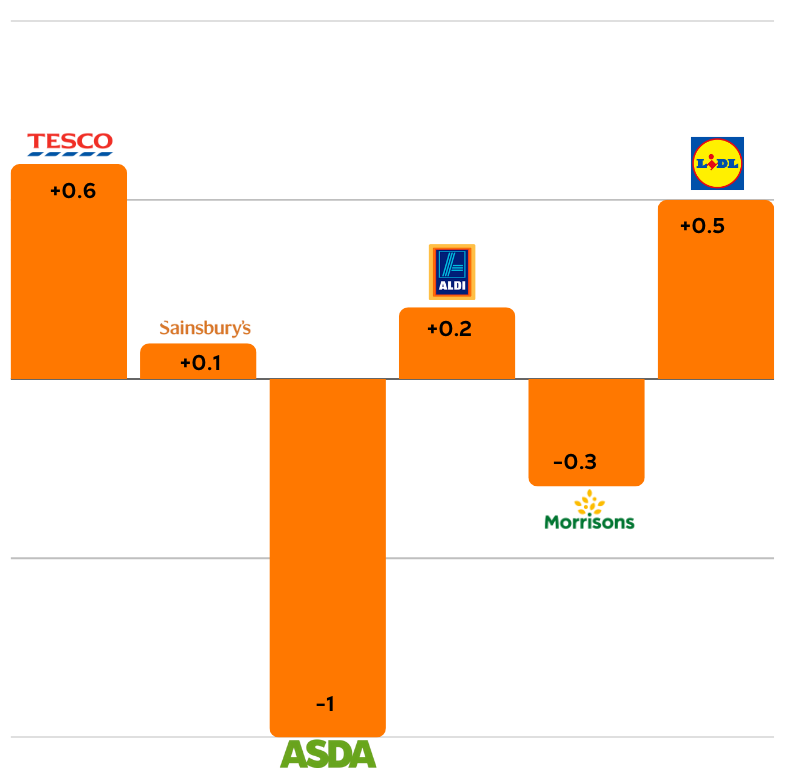

Both supermarkets saw their grocery market share fall again last month, as Worldpanel reported Asda’s hold on the market dropped a percentage point to 11.8% in the 12 weeks to 13 July while Morrisons’ slipped from 8.7% to 8.4%.

The two grocers lost out to Tesco, Sainsbury’s, Aldi, Lidl and Ocado, all of which saw an uptick in sales over the period driven by investments into their value and product offer.

Morrisons chief executive Rami Baitiéh, who is in his second year of spearheading a turnaround, reported last month the chain had “bounced back strongly” after its sales and profitability picked up in the half to 27 April.

In its most recent financial year, sales for the supermarket chain increased 4% in the 52 weeks to 27 October to £15.3bn and pre-tax losses more than halved to £538m.

Worldpanel reported that Asda’s grip on the market loosened once more last month as it became the only major supermarket to see a fall in sales (-3%) during the quarter.

Despite the weak performance, Leighton said in May that he was seeing “green shoots” in Asda’s recovery after its sales decline started to slow. Revenue, excluding fuel, fell 5.9% to £5bn in the four months to 31 March and was down 3.1% on a like-for-like basis – representing a 1.1% improvement on the same time last year.

Leighton, who returned to the grocer in November, has doubled-down on Asda’s value proposition by reintroducing its Rollback campaign at the start of the year and slashing prices on over 12,000 lines.

However, it seems progress has not come fast enough as Asda was usurped by Aldi to become the UK’s third largest grocer in terms of food and drink sales in May. The discount rival has also overtaken Asda in Scotland.

In response, Leighton said at the time: “Market share is something that comes [and goes]. It isn’t something that worries me on a day-to-day basis at all.”

Morrisons faced a fresh blow this week as new data revealed the retailer was overtaken by Lidl to become the fifth largest supermarket in the UK in terms of food and drink revenues. There is also 0.1 percentage point separating Morrisons and Lidl in the overall market share table.

Competing on value

Asda is banking on the return of its Rollback and Asda Price promise to restore its value credentials and drive sales. The supermarket chain has lowered the price on around 10,000 products since January, which it claims has established a price gap of between 3% and 6% compared to traditional full-service supermarkets.

The bet has paid off as consumer group Which? reported this week that Asda remained the cheapest supermarket in the UK for the big shop for the seventh month running.

However, former Lidl CEO Ronny Gottschlich argues the grocer has a long way to go if it’s to improve its value perception among shoppers.

“Historically, Asda was in a good position to defend themselves [from the likes of Aldi and Lidl] and had a very strong position on the pricing. Saying that, they’ve lost that a bit,” he says.

“If you were to bring back the price image of Asda, then this is something you need to continue doing for years, not months or weeks only.

“It’s a short lived exercise if you just do a promotion,” he says, explaining the supermarket will need to continue to communicate and speak louder on its new lower prices and Rollback campaign.

Leighton agrees, as the boss previously stated he was facing a turnaround that could take three to five years.

Morrisons is also trying to boost its value credentials. Baitiéh said in June that the business has a “rigorous focus on price, promotions and meaningful rewards for loyalty” since the start of the year.

The retailer has been busy price-matching hundreds more products to Lidl and Aldi, as well as expanding its More Card loyalty scheme.

Morrisons launched its exclusive member pricing on Deliveroo last month, a few weeks after it announced it had expanded its loyalty scheme to allow users to collect points at over 300 brand partners.

Grocery analyst Karen Green is sceptical of the Morrisons More Card push, suggesting the scheme has come “too little too late”.

“More loyalty card is not consistently delivering value and online consumer reviews are mixed at best,” she says, noting that the scheme’s technical challenges over Christmas would have likely sent many consumers elsewhere.

Changing the store experience

The two supermarkets have also introduced a series of changes to the shop floor this year.

Asda revealed this week that it is pumping £12m into store upgrades across Yorkshire and nearby regions over the next year as part of its wider strategy to modernise its estate and enhance the in-store experience.

It follows a £2m makeover at its Pilsworth store in Bury, Greater Manchester, in March. The 61,000 sq ft supermarket was given a fresh modern look with new feature lighting and updated signage.

The move is joined by a £10m investment programme to upgrade more than 180 of its in-store cafés, which will see the spaces given new interiors, the introduction of digital ordering screens and a table service offering.

At the start of May, the grocery giant rebranded one of its Asda Living stores and unveiled a new George at Asda concept. The format, which has been received positively, could be rolled out across the other Asda Living stores in the near future.

The mass store estate investment is a stark contrast to Morrisons, which is instead cautiously investing in its Market Street concept to provide shoppers with a more premium “farm shop feel” and higher quality products.

The changes – which include the axing of 2,500 SKUs and the launch of 500 new SKUs to its offering – were first introduced at the supermarket’s Warrington store in May and will be rolled out to the rest of the estate in the coming months.

Green notes that Market Street, which has long been an expensive point of difference for Morrisons, has been adapted in recent months to reduce costs. She warns that the supermarket risks “possibly losing customers in the process” if it fails to land well.

Boosting the bottom line

Baitiéh’s turnaround plan for Morrisons has focused heavily on stripping out costs to streamline operations, widen margins and reduce its debt burden.

The chief executive raised his savings target from £700m to £1bn in March, after reporting the business had made “exceptional progress” against its original objective.

One of his biggest moves was announced in March, which saw the closure of 52 cafés, all 18 of its Market Kitchens, 17 convenience stores, 13 florists, 35 meat counters, 35 fish counters, and four pharmacies as part of a major operational shake-up.

So far this year, the supermarket has delivered £114m in cost savings, surpassing its initial £700m target set out in 2023. Baitiéh said the savings “will help us offset cost headwinds, invest for customers and remain competitive in a fast-changing market”.

Morrisons has also resorted to sale and leaseback deals, raising £331m in September last year through the sale of ground leases on 76 supermarkets to pay off its debts.

Asda is also no stranger to making property deals, with the supermarket chain understood to be close to securing £400m through the sale of 20 of its supermarkets.

The grocery giant has kept a very close tab on costs under Leighton’s management. Asda ditched its plans to introduce new uniforms for its store staff in June, instead investing the money into “lowering prices and delivering the excellent service our customers expect”, the retailer said at the time.

Gottschlich says there has been a lot of “cost cutting and slicing” at Asda under Leighton, arguing that “apart from price cutting exercises, what is Asda going to stand for and what is going to be the big reason [for consumers] to go back shopping there”.

Asda v Morrisons: Who will win?

Both supermarkets have seen a lot of leadership changes in recent months, and many familiar faces have returned to Asda to work alongside Leighton including former chief commercial officer Darren Blackhurst.

However, whether getting the old gang back together is enough to restore the supermarket chain to its former glory is another question – especially with Aldi and Lidl rapidly closing in.

“Both Asda and Morrisons are under pressure from two sides, one is the increasing footprint of Aldi and Lidl and the other one is the improving game of Tesco and Sainsbury’s,” says Gottschlich

“[Asda and Morrisons are] still losing volume, but they’ve slowed that down. I don’t think that they’ll find it easy to start seeing an increase in customer numbers, like-for-like in their existing stores,” .

When it comes to stabilising the business from its steep losses, Gottschlich notes that Morrisons is starting to reap the benefits of a more sharpened food proposition.

While Green feels a little more positive about the state of play in the grocery sector and is placing bets that Leighton – and his new leadership team – carries the winning formula in the battle of the turnaround.

“I think the new Asda team with the addition of Darren Blackhurst will probably win the day by offering a clear proposition to its customer base underpinned with the non-food strengths making more of a destination shop.”

Morrisons may be making strides in cutting costs and boosting profitability, but the supermarket has a long way to go to win back shoppers and stop it from tumbling further down the grocery league tables.

Meanwhile, Asda may have a longer road ahead in its turnaround but it has much more breathing room if it’s to defend its position as the UK’s third largest grocer.

Click here to sign up to Retail Gazette‘s free daily email newsletter