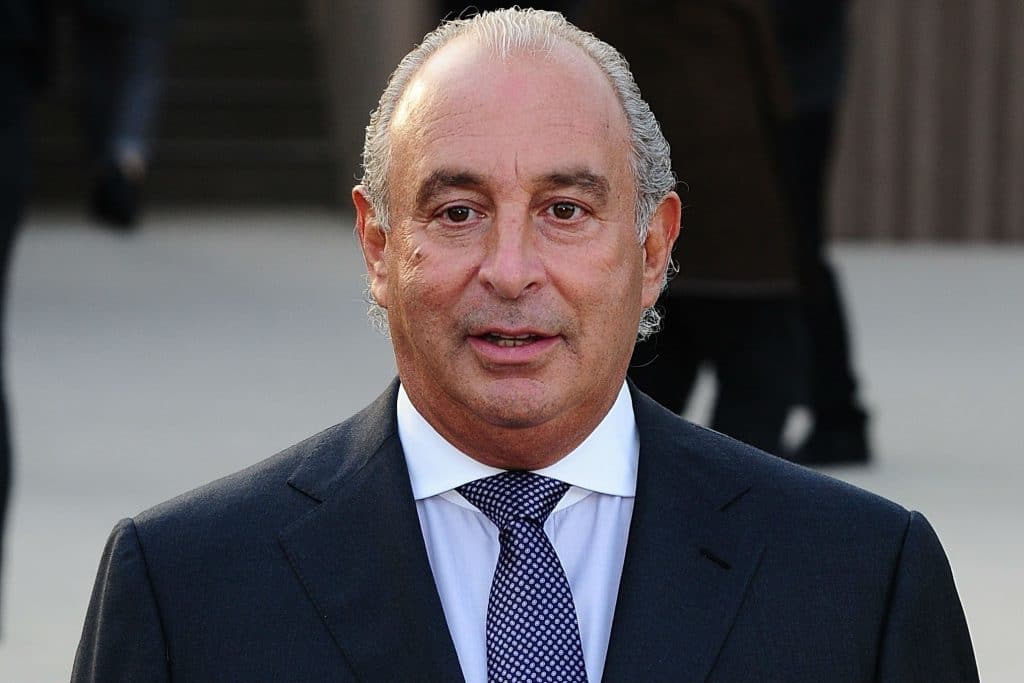

Sir Philip Green reportedly came close to taking over Marks & Spencer in 2004, according to a new book on the retail mogul.

The book, Damaged Goods, by The Sunday Times City editor Oliver Shah, alleges that Green had no idea he came close to winning his bid for M&S, which was once considered the star of the British high street.

It’s thought that Green’s offer for M&S per share reached 400p before it was withdrawn.

READ MORE:

- Sir Philip Green awaits high court ruling on FRC challenge

- BHS auditor Steve Denison spent just “two hours” on its file

- Frank Field asks what Sir Philip Green “has got to hide” in BHS report

- Dominic Chappell mulls legal action over PwC’s discredited BHS audit

- PwC fined £10m over handling of BHS audit

“Andrew Grant, the boss of Tulchan, M&S’s PR firm, was horrified to arrive halfway through a crunch board meeting… to find two different press releases waiting – one of them announcing M&S’s surrender,” Shah wrote.

“Some members of the board, including [Stuart] Rose’s right-hand man, Charles Wilson, felt it impossible to keep holding out at 400p.

“At that moment, Grant received a call from Kate Rankine, the Daily Telegraph’s deputy City editor. Rose instructed Grant to fob her off by saying there was no change in the board’s stance.

“Rankine, who was close to both Green and Rose, called Green and relayed the update. The M&S board continued to debate the position fiercely. At 8.30pm, Robert Swannell, one of M&S’s bankers, looked at his BlackBerry and announced: ‘It’s all academic now’ – Green had withdrawn.

“The message from Rankine seemed to have been the final ingredient that made [Green] lose his nerve.”

It came after Green first attempted to acquire M&S in 1999, but this failed after it emerged that his wife Tina had acquired shares in the retailer before news of the takeover was publicised.

Shah’s book also accuses Green of bullying employees, including female staff and Terry Green (no relation), the man he hired to turn around BHS.

The book also reveals how one of Green’s American private equity partners once expressed concerns over the accuracy of financial statements from Topshop.

Shah said a leaked email in 2012 revealed that John Danhakl, a managing partner of the Los Angeles buyout firm Leonard Green & Partners, told colleagues he was “particularly struck and troubled” by the consistency of Topshop’s financial results.

Shortly after, Leonard Green bought a 25 per cent stake for £350 million, to show that Danhakl’s concerns were assuaged.

Green said he has not seen Shah’s book and did not want to comment on it.

The book is released at a time when Green once again grabbed headlines in his involvement with the BHS audit, which has now been discredited by the Financial Reporting Council (FRC).

Earlier this month, the FRC handed BHS’s former accountancy firm PwC a £10 million fine for its audit of BHS, in which it gave it a clean bill of health for the year ending August 30, 2014.

PwC’s historic fine has been reduced to £6.5 million for early settlement.

PwC audit partner Steve Denison also signed off the BHS accounts as a “going concern” days before Green sold it to former bankrupt Dominic Chappell for just £1 in March 2015.

PwC stepped down as BHS’s auditor after the sale.

As a result, the FRC sanctioned Denison and fined him £325,000, while he also voluntarily gave an undertaking to remove his name from the register of statutory auditors.

Meanwhile, Green is now awaiting a High Court judge’s ruling over his attempt to restrict the publication the FRC’s report on the BHS audit.

Lawyers for his holding company, Taveta Investments, said they were not seeking a “blanket prohibition” but wants the FRC to redact parts of its report which “contain criticisms of the claimant, its directors and employees”.

The lawyers also argued that no injunction meant a judicial review of the FRC’s report sought by Taveta would be “pointless” as the “damage would be done”.

FRC’s lawyers argued it should be allowed to publish its findings and that Taveta had no right to challenge the report.

Green’s involvement in the collapse of BHS also led to MPs branding him as the “unacceptable face of capitalism”, and there were calls for him to be stripped of his knighthood.

Green had acquired the loss-making BHS for £200 million in 2000 and quickly the business around.

BHS was owned by Green for 15 years until he sold it to Chappell, and when the retailer collapsed in April 2016 it led to the loss of 11,000 jobs and a pension deficit of £571 million.

Green has since agreed to inject £363 million in to the BHS pension scheme.

Click here to sign up to Retail Gazette’s free daily email newsletter