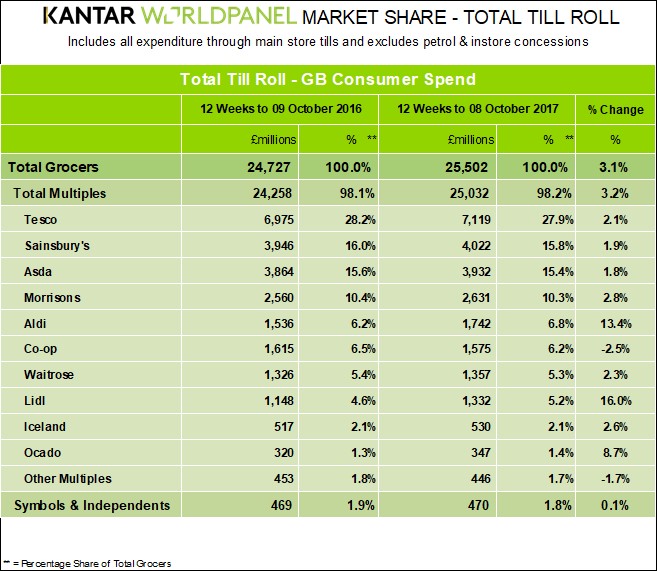

The UK’s grocers have seen their 17th consecutive period of growth, with value increasing 3.1 per cent year-on-year, as inflation and early Christmas shopping boosts margins.

According to Kantar Worldpanel’s latest grocery market share figures, inflation remained at 3.2 per cent for the 12 weeks to October 8 but this is predicted to drop to two per cent in early 2018.

The Big 4 grocers all enjoyed rising sales during the period, yet their market share continued to be chipped away by the discounters.

Morrisons topped the list of fastest growing in the Big 4, seeing a sales increase of 2.8 per cent. A 29 per cent rise in online sales, particularly in London and the South, bolstered its sales growth, despite it seeing a 0.1 per cent drop in market share to 10.3 per cent.

The UK’s largest supermarket Tesco came close behind in terms of growth rising 2.1 per cent, yet it saw a more significant decline in market share dipping 0.3 per cent to 27.9 per cent.

Despite a turbulent few years, Asda has continued its recovery with sales up 1.8 per cent, pushed by the popularity of its own branded Farm Store and Extra Special ranges now accounting for 45 per cent of sales. This marks a significant change as Asda traditionally sells a greater portion of branded items than its rivals.

Meanwhile, German discounters Aldi and Lidl saw their market share rise 0.6 per cent each to 6.8 per cent and 5.2 per cent respectively. They both eclipsed larger rivals in terms of sales growth with Lidl seeing a sales boost of 16 per cent while Aldi jumped 13.4 per cent, collectively accounting for half the markets overall growth.

Waitrose edged ahead of Lidl in terms of market share, dipping 0.1 per cent to 5.3 per cent. Sales jumped 2.3 per cent helped by a traditionally strong Christmas period.

READ MORE:

Co-op was the only retailer to see a drop in sales, dropping 2.5 per cent alongside a market share drop of 0.3 per cent to 6.2 per cent.

Conversely, Iceland was the only grocer aside from Aldi and Lidl not to see market share drop, while sales rose 2.6 per cent.

Ocado continued to win a share of the online grocery market, which currently includes around 18 per cent of the UK population. It also saw sales rise 8.7 per cent.

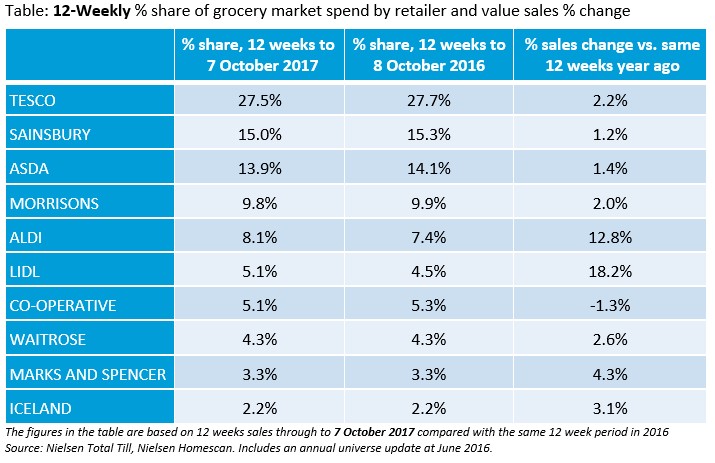

Nielsen, which also released supermarket sales figures this morning, reported that inflation was at its highest point in nearly four years.

“Retailers have done a great job of cushioning shoppers from the rising food chain costs they’re experiencing, exacerbated by the weakening pound, but this can’t last forever,” Nielsen’s head of retailer and business insight Mike Watkins said.

“Inflation is helping supermarkets’ growth and the good news for them is that shoppers are still spending. Meanwhile, the good news for shoppers is that grocery inflation is still below that in other parts of the economy – such as travel and fuel – and should peak later in the year.

“Furthermore, retailers are likely to up their use of price-saving promotions at Christmas, offsetting some of the inflation.”

Click here to sign up to Retail Gazette‘s free daily email newsletter