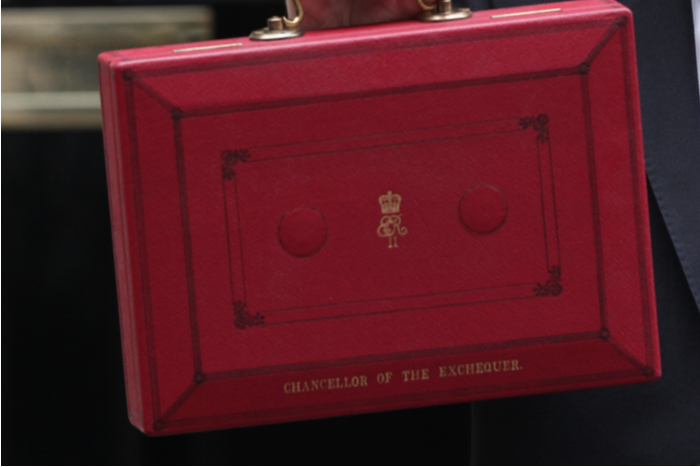

// Chancellor Rishi Sunak sets out a new financial support scheme for the self-employed

// Will benefit individuals in retail who run their own businesses, such as small shop owners or online stores

// Scheme includes a taxable grant worth 80% of average profits over the past three years, up to £2500 per month

Self-employed individuals in retail are part of the latest government support package aimed at helping them mitigate the impact of the coronavirus pandemic on their businesses.

Yesterday, Chancellor Rishi Sunak announced a taxable grant worth 80 per cent of average profits over the past three years, up to £2500 per month.

It will be open for at least three months across the UK, and will be extended if necessary.

READ MORE:

- Government orders all non-essential shops to close during coronavirus crisis

- Coronavirus: Retailers asked to delay imminent preliminary trading updates

- CMA sets up taskforce to crackdown on pandemic profiteers

The new scheme will benefit individuals in retail who run their own businesses, such as small shop owners or online stores.

However, the grant is only available for those with taxable profits of up to £50,000, and for those who make the majority of their income from self-employment.

In addition, only those already in self-employment and who have a tax return for 2019 can apply.

Sunak said 95 per cent of people who are majority self-employed will benefit from this scheme.

“We’re covering the same amount of income as we are for furloughed employees, who also get a grant worth 80 per cent,” he said yesterday.

“That’s unlike almost any other country, making our scheme one of the most generous in the world.”

Sunak added that the government will allow anyone who missed the tax return filing deadline in January to now have four weeks to submit their tax return.

National chairman of the Federation of Small Businesses Mike Cherry said the FSB “very much welcome the scheme” Sunak unveiled yesterday.

The news comes a week after the Chancellor announced a £350 billion emergency package for the economy last week.

This includes a state loan guarantees worth £330 billion along with a further £20 billion of handouts for struggling businesses.

Businesses can also take advantage of the Coronavirus Job Retention Scheme, whereby an employer applies to have 80 per cent of their staff’s wages covered by the government.

The government has also given most commercial properties – including retailers – a one-year business rates holiday and implemented a deferral of VAT and National Insurance payments from businesses.

Meanwhile, the Financial Conduct Authority has asked all stock market-listed companies due to produce preliminary trading updates in the next few days to delay them due to disruptions caused by the coronavirus.

Click here to sign up to Retail Gazette‘s free daily email newsletter