// Shein is understood to have hired Bank of America, Goldman Sachs and JP Morgan to lead a $50bn IPO in New York

// Founder Chris Xu is thought to be contemplating changing his citizenship to Singaporean to bypass China’s rules on overseas listings

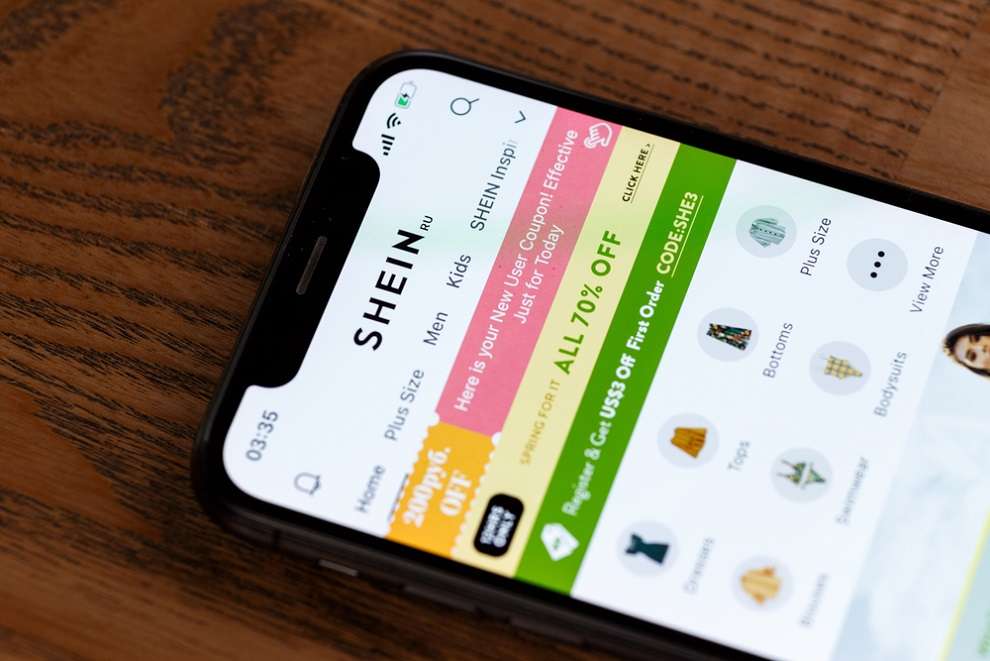

Chinese fast fashion retail Shein has revived its plan to IPO as it opts to float on the New York Stock Exchange.

Shein has hired Bank of America, Goldman Sachs and JP Morgan as bookmakers, according to Reuters.

Shein had planned to float in New York two years ago but is understood to have u-turned in the face of rising tensions between the US and China.

The Shein IPO would be the first significant equity deal by a Chinese company in the US since regulators clamped down on overseas listings last July.

Founder of Shein, Chris Xu, is understood to be contemplating changing his citizenship to Singaporean to bypass China’s stern rules on overseas listings.

READ MORE: Shein becomes the largest online-only retailer in the world

Shein, which is a rival to Boohoo and Asos, has become an international fast fashion success. It delivers to 150 countries and the US is its largest market. Last year, it overtook Amazon to become the most downloaded shopping app in the US.

The company, whose investors include Sequoia Capital China, IDG Capital, and Tiger Global, made $15.7 billion in sales in 2021 as it capitalised on the rise of online shopping stimulated by the pandemic.

Shein, which was in the running to buy Topshop last year, is thought to be valued at around $50 billion.

Click here to sign up to Retail Gazette‘s free daily email newsletter